At the end of each year, it’s probably natural for you to reflect on the past—celebrations, milestones, lessons, challenges—because what you experienced and learned will inform your plans for the future. Thinking back can give you the right information to create a road map for what’s ahead and make it easier to budget for that dream vacation, forecast for upcoming needs, and correct shortfalls in your savings.

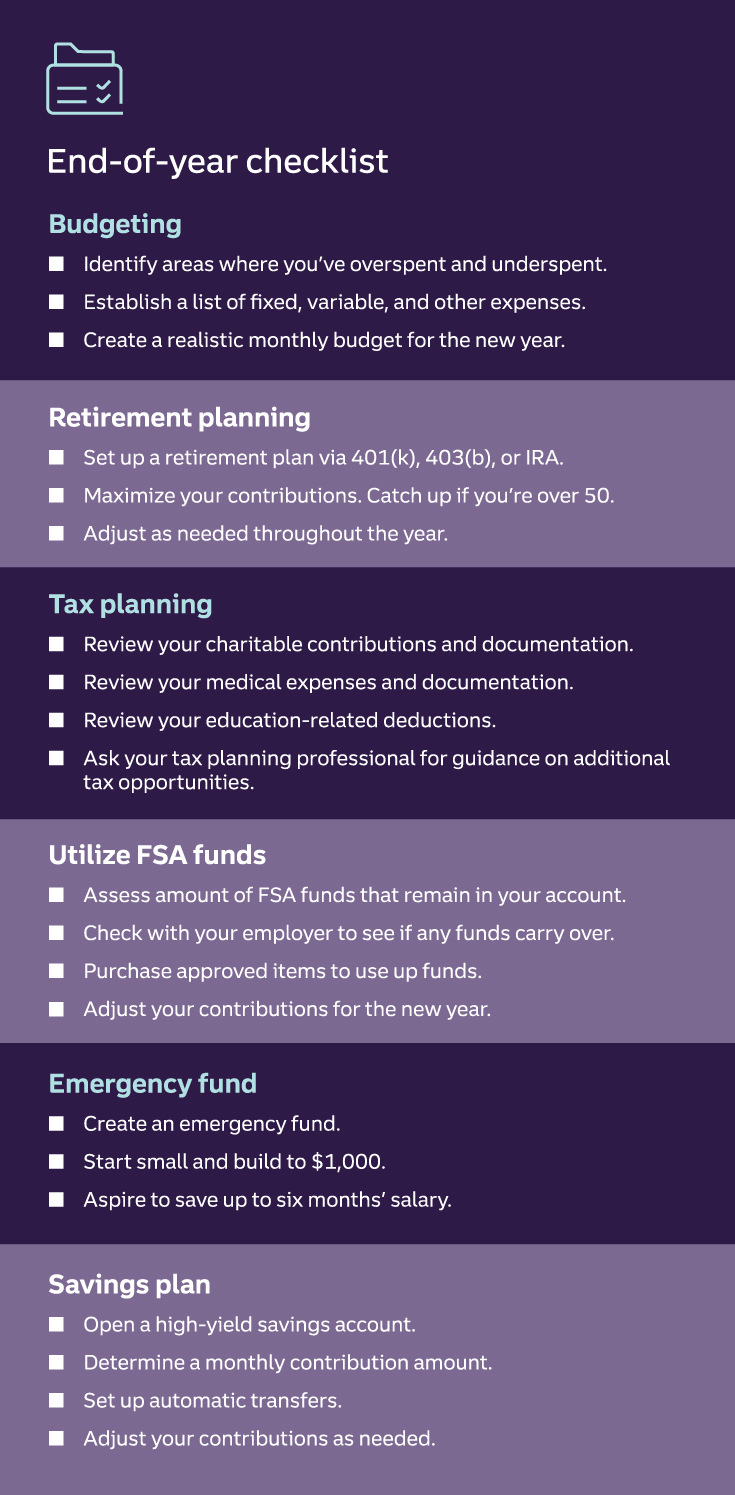

By analyzing your year-end situation, you can create an actionable financial plan and budget for the next 12 months. This checklist can help you position yourself for financial success in 2025 and beyond.

Review your budget

Budgeting is a critical part of financial planning. If you’ve already created a budget, has your spending been on track? And if you don’t have a budget yet, now’s the time to make one.

Track your spending

The first step in reviewing or creating a budget is to track your spending. Looking at your expenses from the past three to six months can help paint a clear picture of your spending habits.

- Fixed expenses are the same month after month. Examples include your rent or mortgage payment, insurance premiums, streaming services, and costs for child care.

- Variable expenses change from month to month. These include things like groceries, clothing, and utilities.

- One-time expenses can be planned or unplanned, but they aren’t regularly occurring. These would include things like replacing a broken cell phone, the cost of a vacation, or a planned home repair.

By listing your expenses, you can see your numbers as they really are. These numbers provide a baseline that can help you better understand your spending habits, identify overspending, and illuminate ways to establish or enhance your savings.

Assess your debt

Since you’ve tracked your spending, have you identified areas you want to cut back? Doing this can also free up funds you can use to pay down existing debt. Including your debt pay-off plan in your budget can be key to being successful.

When it comes to paying off debt, there are two main schools of thought:

- Prioritize the highest rate: Pay off the credit card or loan with the highest interest rate first, and then focus on the debt with the second-highest rate. This strategy is known as the “avalanche method,” and the goal is to help you reduce the amount you’re spending on interest rates.

- Prioritize the smallest balance: Pay off the debt with the smallest balance first and then move to the next smallest balance. This strategy is known as the “snowball method,” and the goal is to help reduce your debt-to-income ratio.

You can also make a substantial dent in longer-term debt like a car loan or mortgage if you can make an extra payment or pay down extra principal on your mortgage. For example, paying off $100 extra a month in principal can reduce your mortgage term by four years.Disclosure 1

Adjust or create your budget

First, download our Super Budget Worksheet to help you keep track of your planned income and expenses.

If you already have a budget, compare what you spent to what you budgeted. This is the perfect opportunity to think about if you’re spending mindfully. This can also help you identify overspending and underspending patterns, such as:

- Dining: Did you overspend on restaurants and food delivery services?

- Shopping: Could you cut back on your online shopping habits?

- Entertainment: Did you go to fewer movies and events than you thought you would? If so, would it be possible to move money out of your entertainment budget and put it into savings?

- Debt: Could you reallocate funds to pay down debt faster?

Once you identify those patterns, you can see opportunities to reduce spending, boost savings, and pay off debt.

If you’re creating a budget for the first time, the 50/30/20 rule that many financial experts recommend can be a good place to start.

- 50% of income goes to needs like housing, food, and utilities

- 30% of income goes to wants like vacations, entertainment, and dining

- 20% of income goes to paying off debt and savings

Don’t forget, your budget should include fixed expenses, variable expenses, and planned one-time expenses. Your one-time expenses can go into an “other” category, but it’s important to account for every dollar. Give yourself flexibility to make changes as new situations arise, and plan regular financial check-ins to stay on track.

Tools and resources

- Budgeting worksheet can help you create a baseline to get started.

- Young adult budgeting spreadsheet is ideal for those new to earning money.

- Reduced income or loss of income spreadsheet can help during times of income change.

- Values-based budgeting can help you align your spending to your interests and passions.

Interested in learning more about budgeting? Read “A guide to budgeting: 6 steps to get started."

Check your retirement savings progress

When it comes to saving for retirement, there are many different types of plans, but across all of them, putting away as much as your income and budget will allow is a smart move that you’ll appreciate later.

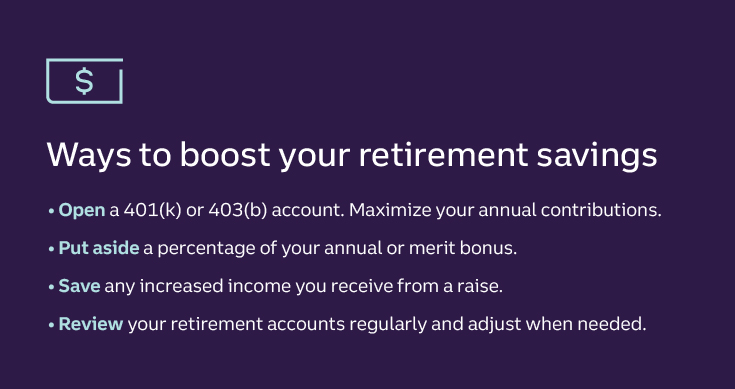

There are distinct benefits to participating in an employer-sponsored plan, such as a 401(k) or 403(b), and there are ways to maximize your savings. Here are four things to consider:

- Lower taxes: By contributing to the 401(k) or 403(b) plan, you’re saving a percentage of your pretax salary and thereby reducing your overall taxable income.

- More money: Many employers match 1% to 3% of the employee’s contribution.

- Growing funds: If you receive a quarterly, semiannual, or annual bonus, consider taking out a percentage and investing it into your 401(k), 403(b), or other retirement savings account.

- Save the raise: Instead of spending the additional income you received from an annual or merit raise, consider putting those additional funds into your retirement account. Your income will stay the same, and you can give yourself a savings advantage.

Types of retirement accounts

Maximizing your contributions before the end of the year will help you take advantage of tax benefits and allow you to continue to grow your retirement fund. Consider these facts about popular retirement saving vehicles:

- 401(k): Employees under the age of 50 who participate in 401(k) plans can contribute up to $23,000 of their pretax salary in 2024. Those 50 years and older can use the catch-up limit and contribute up to $30,500 annually.Disclosure 2 When you contribute to a 401(k), you’re reducing your overall taxable income, and therefore your tax rate. And here’s another bonus: Many employers offer 401(k) matching of up to 3%.

- 403(b): Known as a tax-sheltered annuity plan, a 403(b) plan is designed to assist employees working at a public school or select charitable organizations. The 403(b) plan works the same as a 401(k) plan in that participants can defer a percentage of their pre-tax salary for retirement.

- Individual Retirement Accounts (IRA): There are two types of IRAs: Traditional and Roth. For both IRAs, individuals under 50 years old can contribute $7,000 each year, and those 50 and older can contribute $8,000 each year.Disclosure 3 The deadline for IRA contributions is not measured by the calendar year but by the next year’s Tax Day. For 2024, contributors can apply funds until April 15, 2025. When you contribute to a Traditional IRA, your taxable income is reduced but you pay taxes once you withdraw the money in retirement. With a Roth IRA, the opposite is true: you fund the account with post-tax income but then won’t be taxed when you withdraw the money. Learn more about IRAs.

- Self-employed (SEP) IRA: If you’re a contract worker, small business owner, freelancer, or self-employed, you can contribute 25% of your compensation or net self-employment earnings, or up to $69,000 to an SEP IRA.Disclosure 4

Future planning

Saving for retirement requires dedication and a mindset that the money you’re putting away today will be beneficial for you tomorrow. However, as jobs and situations change—like marriage, children, college, or housing—it’s important to review your accounts and adjust as needed. A professional financial advisor can help you understand all of the savings tools available and provide advice and strategies for optimizing your retirement saving goals.

Tools and resources

- A retirement savings calculator can help you see how much it can take to meet your goal.

- Get inspired by the ways some individuals choose to build generational wealth by investing in real estate.

- Understanding the difference between traditional and Roth IRAs can help you make the right choice for your budget.

Plan for tax season

The Internal Revenue Service (IRS) goes into overdrive during tax season, which officially begins in January when the first returns are processed. This means hundreds of millions of taxpayers are gathering W2s, 1099s, K-1 Schedules, and more—all of which leads to billions of dollars in refunds. As of April 2024, the average refund was $3,011, which was up from $2,878 in 2023.Disclosure 5

These are some of the key dates throughout the year when organizing and filing tax-related documents should be top of mind.

- Income tax returns: Individuals are required to file their returns by April 15.

- Tax filing extension: Those who need more time beyond the April 15 deadline can file a Form 4868 to request the filing deadline be extended to October 15.

- Quarterly tax due dates: Salaried professionals typically pay taxes once a year. However, sole proprietors, partners, and S corporation shareholders are required to pay estimated taxes every quarter. The due dates are April 15, June 15, September 15, and January 15 (of the new year).

Common tax deductions and credits

The government greenlights certain activities and expenses for tax deduction and tax credit. Avoid a rush at tax time and get a head start on gathering documentation for these expenses. Here’s what you need to know.

Charitable contributions

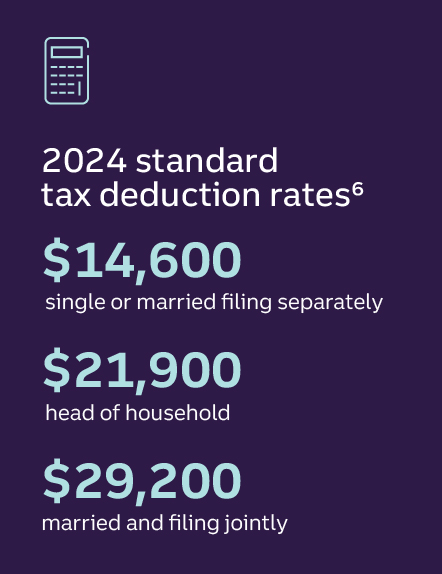

At tax time, your charitable donations can make a difference if you’re itemizing your deductions and they exceed the standard deduction rate. (For 2024, the standard deduction is $14,600 for those who are single or married but filing separately, $21,900 for the head of household, and $29,200 for those who are married and filing jointly.)Disclosure 6

As a general rule of thumb, you can donate between 20% and 60% of your adjusted gross income to charitable donations. How do you know if your donation can be tax deductible?Disclosure 7 Ensure you’re donating to a qualifying organization (such as a nonprofit or religious organization). It’s also important to keep track of your donations with a bank statement, credit card statement, receipt, or written letter from the organization. Your financial advisor can help you determine if any additional forms or paperwork are required, such as a Form 8283, which is used for non-cash donations.

Medical expenses

The IRS says that if your medical and dental expenses exceed 7.5% of your adjusted gross income for the year, you may be able to deduct them for yourself and your family. These expenses are deducted on IRS Schedule A (Form 1040, used for itemized deductions) and may include doctor, dentist, or surgeon fees; inpatient hospital care; prescription drug fees; and more. Self-employed individuals may also qualify for a health insurance deduction.

Education-related deductions

There are two main education-related tax credits available for qualifying taxpayers. The first is the American Opportunity Tax Credit (AOTC), which offers a maximum of $2,500 per qualifying student. The second is the lifetime learning credit (LLC), which can provide $2,000 per tax return for qualifying students.8 Visit the IRS website or reach out to a tax professional or financial advisor for greater details about qualifications for education-related deductions.

Tools and resources

- Learn more about tax tips for charitable donations.

- Get tips for maximizing your charitable giving impact.

- Explore empowering ways to spend your tax return.

Use any remaining FSA funds

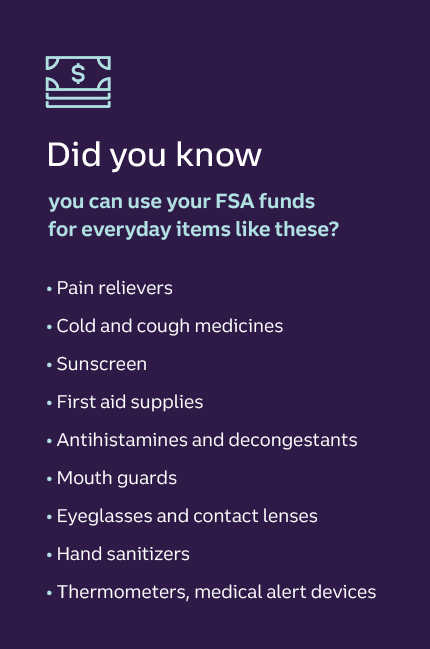

A flexible savings account (FSA) allows employees to contribute a set amount through payroll deductions to be used for healthcare costs. For 2024, the FSA limit for the year was $3,200 per employee.

FSA contributions lower your taxable income—but they are usually “use it or lose it” funds, which means it’s important to use your FSA funds each year. Some employers may allow up to $640 of unused funds to be rolled over for the next year. Other employers may provide a grace period of up to two and a half months past the end of the plan year.

You can use your FSA funds for:

- Eligible medical expenses that include doctor visits, co-payments, hospital fees, surgical fees, prescription drugs, and testing and diagnostic services

- Purchasing health-related items such as wellness products, over-the-counter medications, and medical equipment such as crutches and bandages

To estimate what FSA funds you may need for the upcoming year, consider your medical, dental, vision, and medication expenses, including copays, regular office visits, and other healthcare needs.

Assess your emergency fund

When an unexpected event occurs, having the means to cover expenses is vital to protecting your finances—and your peace of mind. This is exactly the rationale behind having an emergency savings fund. When you put money aside for the unforeseen costs, you can cover expenses and financial emergencies without adding more stress to the situation.

Where should you start? You can open a savings account specifically for your emergency fund and start making small deposits. Aim to save $1,000 but keep the momentum going until you eventually have three to six months of living expenses in your fund. You can determine the deposits and cadence based on your budget and goals, but making regular contributions to plan for the future will go a long way in helping you feel confident to handle emergencies.

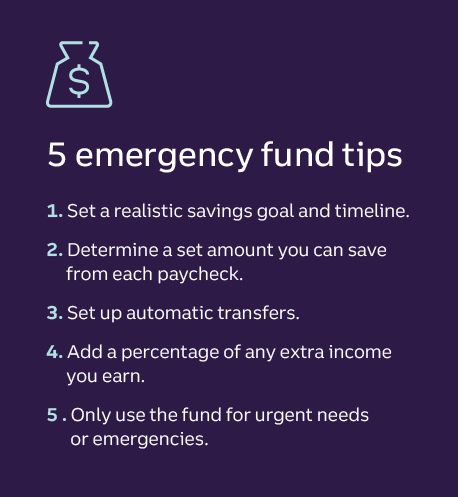

Tips for establishing and replenishing your emergency fund

- Set a realistic savings goal and timeline.

- Determine a set amount you can save from each paycheck to contribute to the fund.

- Set up automatic transfers so the money goes into the fund each time.

- Add a percentage of any extra income you earn, such as a bonus, raise, or gift.

- Don’t use the fund for anything that isn’t an emergency or urgent need.

Tools and resources

- Learn how to prepare for the unexpected with an emergency fund.

- Use the emergency savings calculator to estimate how much you should put away each month.

- Get tips for building an emergency fund while paying down debt.

- Follow these tips to know when it’s okay to dip into your emergency fund.

Schedule and automate your savings

A savings plan can help you reach a goal, like taking a dream vacation, starting that home improvement project, or having enough saved for school or for a down payment to purchase a new home.

Tips for a successful savings plan:

- Set a goal. Do you want to save for a particular item (remodeling the bathroom) or event (dream vacation)? Or are you determined to grow your account to a specific amount?

- Determine a realistic saving schedule. How much do you want to save each month? You’re looking for a reasonable amount, but not one that will cause you budgetary stress. Consider factors like recurring expenses and planned events, as well as forecasting for the unexpected (rising daycare costs, increases in groceries, etc.)

- Set up an account and automatic transfers. It’s important to have a dedicated savings account so you can watch your money grow. And by setting up automatic transfers, you can be sure to pay yourself first every month before other expenses get in the way.

- Boost your efforts. There are plenty of ways to save a little extra every month. Consider cash-back programs, reward programs, discount apps, and other opportunities where you earn and save.

Your savings goal can start small and grow over time as your income and needs change. Evaluate your goals at the end of the year so you can plan for the next 12 months with confidence.

Tools and resources

- Use the savings goal calculator to estimate how much you’ll need.

- Consider boosting your savings with a no-spend challenge.

- Try these five strategies for saving on a schedule.

Lean on your financial team of experts and champions

As you go through this checklist, you can also lean on the expertise of financial professionals—your accountant, financial advisor, insurance agent, and attorney— who can help guide your journey with advice and direction.

- Accountant: As you start prepping for tax season, an accountant can help you navigate more complex situations.

- Financial advisor: When you’re reviewing your retirement savings progress, a financial advisor can be a great source for guidance.

- Insurance agent: When you’re creating or adjusting your budget, are your insurance payments aligned? If you’re over- or under-insured, a trusted agent can help you make the necessary adjustments.

- Attorney: An attorney can be crucial as you go through major life events like buying a home or executing a will. An attorney can also be great to have if you’re a small business owner.

Your financial team can also include trusted family or friends who will help you stay accountable for your goals—and will be there to cheer on your success.

Next steps:

- Schedule recurring sessions with yourself to work through this end-of-year checklist.

- Create a budget, start a savings plan, and open an emergency fund.

- Meet with a financial advisor to review the past year and prepare for the next one.