When it comes to renting vs. buying, your housing situation can make a big difference in your financial wellness and overall happiness.

If you’re financially prepared for it, purchasing a home is often considered a smart long-term investment in an asset that can appreciate over time. The U.S. homeownership rate has ticked up over the last several years to almost 66%, powered in part by an increase in the number of younger homebuyers.1, 2 But the reality is that becoming a homeowner is a challenge for many people. Factors like higher interest rates, competing financial priorities, and affordability can contribute to this.

For many, renting is seen as a better solution—one that can potentially help you save money, live with fewer responsibilities, and enjoy more freedom or flexibility. And while experts still suggest that homeownership can be a great goal in your journey toward financial confidence, renting shouldn’t be seen as a waste. It might be what’s right for you right now.

The highlights:

- While buying a home can be a solid investment in your future, there are times when renting may make more financial sense.

- To figure out whether to rent or buy, you should also consider your personal values and decide what kind of lifestyle you want.

- Before buying, talk to homeowners you know about their experiences and research area mortgage rates.

- Keep in mind that if the 20% down payment rates cited as standard seem out of reach, the reliable 8-10% estimates for first time buyer down payments by the National Association of Realtors’ indicate a path to more sensible down payment options.3

3 scenarios when renting makes financial sense

1. You can’t afford to buy a home just yet

Talking with a loan officer in your area, checking current mortgage rates, and calculating your potential mortgage payments can help you figure out how much house may be in your budget. These can be great places to start if you’re deciding whether to rent or buy. But remember that a lot of money goes into homeownership, even beyond the mortgage. Homeowners association (HOA) fees, utilities, unexpected repairs, and more can add up quickly. Don’t overlook the hidden costs associated with homeownership, such as insurance and maintenance.

When you own a home, the cost of any repairs falls on you. If you underestimate those expenses when you buy a house, you may own property—but it could put a strain on your finances. This can make it harder to work toward other important goals such as paying off consumer debt or investing for retirement.

Homeownership isn’t necessarily for everyone, so you should take the time you need to decide if it’s right for you. When Grace and her best-friend-turned-roommate Griffen decided to buy their first house together in their 20s, it took some long conversations to make sure they were prepared and on the same page. “Having these conversations—although tough at times—ultimately made us feel more confident in our decision to purchase together,” she says.

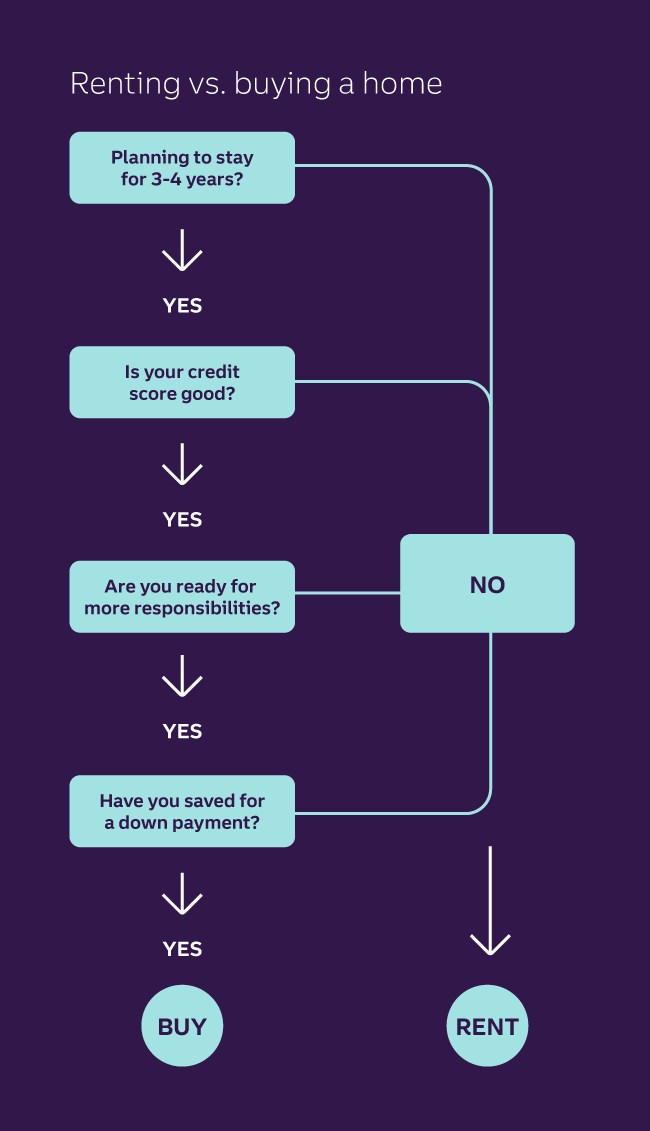

As you’re deciding whether it’s the right time to buy a house, consider asking yourself these questions to determine if you’re financially and mentally ready:

- Will you live in the home for at least three to four years?

- Is your credit score high enough to get a competitive interest rate?

- Can you easily afford the total monthly payment in addition to any other debts you may have, like an auto loan?

- In addition to your monthly principal and interest payment, have you factored in the cost of insurance, utilities, maintenance, private mortgage insurance (PMI), and any HOA fees?

- Are you confident that your job and current income are stable?

- If you lost your job, could you continue to make your mortgage payment for a minimum of three to four months?

- Do you have at least 10% of the total cost of the home saved for a down payment?

- Besides money for the down payment, do you have additional funds to cover the closing costs, which you pay at the time of purchase?

- Are you free of excessive credit card or other high-interest debt?

If you answered “no” to any of these questions, renting may be the best route for you right now. And that’s nothing to be ashamed of—you’ll likely be better off renting than jumping into the significant responsibilities of homeownership before you’re ready.

2. You’re focusing on other financial goals

After serving in the U.S. Navy, Erwin and his wife bought their first home, a triplex. They lived in one unit and rented out the other two with the goal of launching careers in property investment. “We’ve created new careers and generated this passive income while building something we believe in to support our family,” he says.

But before Erwin was ready to invest in real estate, he had to accomplish some other goals first—starting with building up his credit. Whatever your situation may be, some financial goals should always come before buying a home, like improving your credit score and setting up an emergency fund. Without emergency savings to fall back on, you may lack the financial security you need. Aim to save enough to cover three to six months’ worth of living expenses.

Even with good credit and a proper emergency fund in place, you may have other goals you want to achieve before buying a house. Paying off debt—even if it’s “good debt” like student loans—is a common goal, and it can be a significant hurdle to overcome in your journey toward homeownership. Depending on your values and priorities, you may also simply want to focus on other things, like spending more on experiences and travel.

3. You’re not ready to settle down

There are many non-financial reasons why you may prefer renting over buying right now. Maybe the idea of being a homeowner just doesn’t excite you at all—especially if you consider yourself more of a free-spirited, go-wherever-the-wind-takes-you sort of person. Or maybe you’re focused on your work and know that a job change or career leap might take you to a new place.

Where you live can also have a major impact on your decision to rent vs. buy. If you work from home and enjoy having a little space, buying a roomy house in a suburb with a relatively low cost of living may be right for you. But if you work downtown, value a short commute, and thrive amid the bustle of a major city, it might be better—and more cost-effective—to rent closer to your job. Plus, apartment living can come with its own perks, like a gym, pool, or other communal spaces that you may value.

For some, renting may make it easier to live the way you want, which could help you increase your happiness and boost your mental well-being.

“If you can afford homeownership, but your values point you in the direction of renting, that’s OK. Just know you may want to find other ways to build your net worth,” says Truist head of financial wellness Brian Ford. “Picture yourself 10 years from now. If you realize your friends who bought homes have built up anywhere from $100,000–$200,000 in home equity, will you be OK with not having that yourself?”

So if you plan to rent long-term, Ford suggests coming up with a savings plan and investing so you can continue building your net worth. The longer you rent, the more you should consider increasing your savings as a way to build wealth and financial confidence.

Opening the door to homeownership

If you’re excited by the thought of owning a home, it’s probably a sign you’re mentally ready to buy a house. But make sure your financial situation backs up your mental readiness.

Bright Dickson, co-host of “Money and Mindset With Bright and Brian,” shared her thoughts on steps to take before buying a home: “Talking to people who are homeowners about their experience is probably a really good way to go. Choose people whose lifestyle is similar to yours, because they’re going to be able to tell you what they’ve encountered. That can help you decide if you’re ready or not.”

In line with the National Association of Realtor’s estimates of first-time home down payments averaging at roughly 9%, Ford’s advice is to have at least 10% saved for a down payment He even prefers a more traditional 20% down payment, which is the minimum required to avoid paying private mortgage insurance—an extra monthly cost that would otherwise be tacked onto your mortgage.

Ford also recommends not buying unless your job is stable and your emergency fund is healthy. And if your credit score isn’t stellar, look for ways to improve that, too, which can help you get a lower mortgage interest rate.

When your money habits match up with your mindset, you’ll know that regardless of whether you’re a renter or a homeowner, you’re doing what’s right for you. There are many ways to build financial confidence aside from becoming a homeowner, so don’t let FOMO or comparing your situation to others get you down. Having confidence in your plan, whatever that may be, will pay off in the long run.

Next step suggestions:

- Talk with friends or family members who have bought a home within the last few years. What did they learn from their experience?

- Look up real estate listings in your area and check current mortgage rates. Then you can use the rent vs. buy calculator on this page to see what may fit your budget.

- Connect with a mortgage professional to find out whether you qualify for any home down payment grants or assistance.