The highlights:

- Consider your values and think about what you want for the future when deciding whether to focus on decreasing your debt or investing in retirement

- Evaluate your debt-to-income ratio and use that as a baseline to help make informed financial decisions.

- You may be able to reduce debt while also investing in your future by adopting a debt payoff strategy and keeping your goals in mind.

You know you should pay off debt, especially those high-interest credit cards and loans. But you’ve also been taught that it’s important to feed your retirement fund. So, which should you tackle first? Here are a few tips to help guide your decision.

Consider your values and mindset.

What are your goals? What lifestyle do you want? Managing your money with purpose gives you an opportunity to experience the kind of life you envision—one with more peace of mind and independence. Gaining clarity on your values and purpose can help guide you toward a more fulfilling life.

Picture yourself 10 years from now. Then imagine yourself 40 years from now. How do you see yourself? Use this vision to help you choose what to do now: eliminate debt, invest for the future—or a mix of both.

Beyond the financial aspects, also consider your peace of mind. When you think about debt and your investments, how do you feel?

No matter whether you decide to focus on debt or investing, feeling anxious or uncertain about financial decisions is a normal, healthy response. Doing something about the source of the anxiety can help calm your emotions. Bright Dickson, Truist’s resident expert in positive psychology, suggests taking action on your debt, your investments, or both.

Read more: Create a spending plan for what matters most

“Ask yourself what is going to bring the most happiness in the long term, and make decisions from that perspective.” — Bright Dickson, Truist’s resident expert in positive psychology

Assess your debt.

Rather than look for a one-size-fits-all answer, it’s better to review your own numbers and decide which action best fits your financial situation.

First, determine if your debt level is manageable. Do you know your debt-to-income ratio? To find it, divide your total monthly debt payments (like your rent or mortgage, credit cards, loans, and car payment) by your monthly gross income (your income before taxes and other deductions).

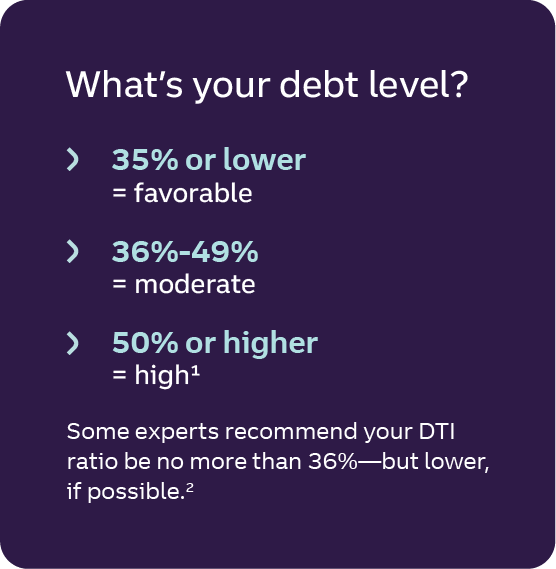

Once you’ve calculated your debt-to-income ratio (DTI), you can identify whether your debt level is considered low, moderate, or high. Your debt level can also help you decide whether you should be paying off your debt or investing in your retirement.

Next, look at the type of debt you have and the interest rates. Is it high-interest or low-interest? Most credit cards fall into the category of high-interest loans. If you have debt with an interest rate that’s greater than the market average, you might want to focus your efforts on whittling that down.

Debt payoff strategies

Remember, interest can cost you a lot over time, so putting your efforts into getting rid of debt with the snowball or avalanche methods could help you save hundreds—even thousands. If you have high-interest credit card debt, this credit card payoff calculator can help you get an idea of how long it’ll take to pay it off.

Debt consolidation—paying off smaller loans or credit card balances with one larger loan—might be another option that can help when paying off debt. When thinking about consolidating, keep in mind:

- Consolidating only makes sense in certain situations, like when you can reduce the interest you’re paying on credit card debt by taking out a personal loan and using those funds to pay your cards off.

- Be careful when consolidating other types of debt, like federal student loans, because you can miss out on potential benefits that are unique to those types of loans.

- The better your credit score and the lower your DTI, the better your interest rate on a debt consolidation or personal loan is likely to be.

- If you want to focus more on investing, consolidating your debt may be able to help you reduce your minimum required debt payments. This could help free up cash flow so you could put more toward investing.

Review your investments.

Once you’ve checked in on your debt, review your investments—focusing on your retirement savings first. Most financial professionals recommend allocating 10% to 15% of your annual pretax income into your retirement account.3 Are you closing in on this goal? If you’re a bit behind, challenge yourself to put a little more toward retirement each month. Even an additional 1% to 2% of each paycheck can make a big difference.

Podcast episode: Listen to “How to invest for retirement at any age” from Money and Mindset With Bright and Brian

If you feel comfortable with your current debt level and like the idea of saving more for an emergency fund and your future, then you may decide to focus more on your investments (while still making your regular debt payments, of course).

Nonretirement investing options

If your debt is low-interest, you’re maximizing your retirement savings, and you have the extra funds to invest, you could look into nonretirement investing, like an S&P 500 index fund. Although the market fluctuates, the S&P 500’s average annual returns with dividends have been around 12.9% for the past 10 years (as of August 2024).4

Investing in nonretirement funds won’t give you the same tax breaks that you would get with a retirement fund (since you have to pay taxes on your gains). But if you can get a return rate from your investments that’s higher than the interest you’re paying on debt, then it may be more logical to prioritize investing. You could even potentially use earnings from your investments to help you pay off your debt.

Keep in mind: Positive returns are never a guarantee when it comes to investing. There’s always a chance your investments could result in a loss. Timing may be a factor, too.

There are other goals that investing in nonretirement accounts can potentially help with—like buying a home or a new car, or even retiring early—since you can withdraw from a brokerage account without the penalties or restrictions that come with withdrawing from your 401(k) or individual retirement account (IRA). You may have to pay taxes on your gains when you sell your investments, however.

Podcast episode: Listen to “How to invest with confidence” from Money and Mindset With Bright and Brian

“Sometimes I hear people say, ‘I just don’t have enough money to invest.’ Well, the truth is, we can invest very little. It doesn’t take a whole lot. So very little upfront, and it should grow over time.” — Brian Ford, Head of Financial Wellness at Truist

Ultimately, you can pay off debt and invest at the same time—but keep your short- and long-term goals in mind as you decide which to prioritize. And no matter which route you go, be sure to budget for your happiness now—like buying things that truly bring you joy and experiences you’ll remember for years to come.

Next steps:

- Pay at least the minimum payments on your debt each month—but more if you can swing it.

- Explore debt refinancing to reduce interest rates, consolidate debts, and free up cash for investing.

- Invest at least as much as your employer matches in your 401(k), if it’s offered. If they match up to 4%, invest at least 4% of each paycheck.

- Make both automatic. Set up automatic monthly bill pay or auto-draft for your debts, and have your employer divert a certain percentage of each paycheck to your retirement account.

Truist One Checking5

Never wonder if you’re getting the most from your checking account. With all these perks, it’s one simple choice.

Get started.