When you think of summer, you might imagine barbecues, outdoor festivals, and sunny days spent relaxing by the pool. But the season can also bring added expenses, whether it’s that big trip you’re looking to take or the extra child care you’re paying for while school’s out. In fact, it’s one of the most expensive times of the year, second only to the winter holiday season.Disclosure 1

The good news is that summertime doesn’t have to throw you off track from your financial goals. These summer budgeting tips can help you make the season fun and affordable.

The highlights:

- During the summer, we tend to spend the most on clothes, travel, and entertainment.

- Like “keeping up with the Joneses,” comparing your summer to others can trigger overspending.

- Knowing what you value can make it easier to enjoy summer while staying on budget.

“One way you can stay out of credit card debt is to automatically save $100 eight months out of the year, then pull that $800 out for the summer. You’re spending a little less throughout the year and saving intentionally, so you have a little more to spend come summer.” – Brian Ford, head of financial wellness, Truist

What do we spend money on during the summer?

In a survey, more than three-quarters of respondents said they expected to purchase clothes over the summer months.Disclosure 2 The season ushers in graduation parties, weddings, reunions, and possibly that “I have nothing to wear” feeling.

And of course, if we’re going on a trip, we want to make sure we have a nice outfit or two (or three or four) planned. It’s not surprising that the survey also revealed that about half the respondents planned to spend their summer budget on hotels and other travel costs, along with swimwear and outdoor gear.

For a season that’s often thought of as laid back, summer can also get busy and expensive. Could some of these purchases be a reaction to feeling pressured to have the “Best! Summer! Ever!”? When we see our friends posting their adventures on social media, it’s hard to resist wanting to go on every trip and have every experience.

Fortunately, there are ways to recharge during the summer without draining your bank account, relying heavily on credit cards, or feeling like you’re missing out.

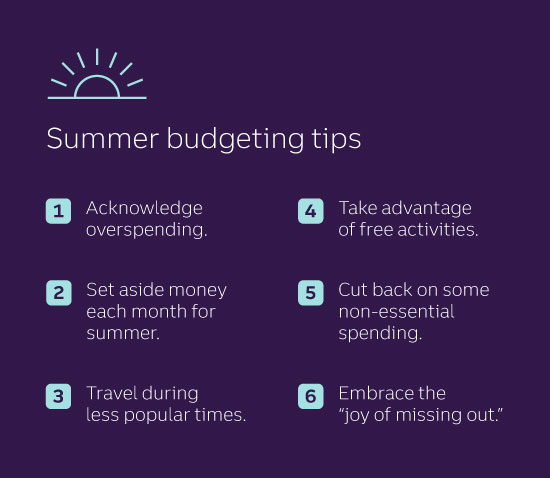

6 tips for crushing your summer budget goals

1. Recognize overspending when it happens. “Just being cognizant of overspending and being aware is a big deal when it comes to your finances,” says Brian Ford, head of financial wellness at Truist. Tracking your spending can help you home in on where your money is going and where you may want to cut back. As they say, when you know better, you do better. This can be especially true during the summer, when we may be more likely to go over our budgets to pay for cool clothes, big trips, or experiences we don’t want to miss out on.

Design a summer budget that lines up with what you value most and takes all your short- and long-term goals into consideration. A values-based budget can help you avoid overspending because it prioritizes the things that will make the biggest difference in your sense of satisfaction and well-being. Maybe this summer it means putting more toward your emergency fund than travel. But that could give you more freedom to spend on experiences next summer.

2. Plan ahead for summer savings. Ford says that creating a savings account ahead of the season and labeling it something like “Summer expenses” or “New clothes for Jo’s wedding,” can encourage you to not only contribute to your savings, but to resist breaking into it before Memorial Day rolls around. Ford also suggests setting up automatic contributions to the account so you don’t have the temptation to skip saving that pay period.

“Maybe it’s $100 a month, to have a little bit more to do in the summer,” he suggests. “One way you can stay out of credit card debt is to automatically save $100 eight months out of the year, then pull that $800 out for the summer. You’re spending a little less throughout the year and saving intentionally so you have a little more to spend come summer.”

3. Look for deals to help you save on travel. When it comes to travel, one of the best tips to help you save money is to travel during nonpeak times. But summer is definitely a peak time for many regions. Still, if warm-weather travel is what brings you joy, keep in mind that flights in the first two weeks of June and the last two weeks of August are usually less expensive than any other time in summer. Flying on Tuesday, Wednesday, or Saturday can potentially save you a bit as well. If you have travel partners, book one seat at a time to get the lowest cost. Often, if you purchase your tickets all at once, you may see increased prices as the airlines may charge more to book seats together.Disclosure 3

You can also save money by booking lodgings that aren’t right in the thick of things, but that have easily accessible public transportation to get you there. Try eating like a local, as well, avoiding touristy restaurants. And if you can find one, a room with a kitchenette could mean saving on food costs.

4. Take advantage of free activities and downtime. This time of year there’s an abundance of things to do outside that shouldn’t dent your entertainment budget. A few ideas include state and national parks, local nature trails, free outdoor concerts, and stargazing. (Pro tip: August is typically a good month for meteor showers).

If you have kids, and worry about them growing bored without expensive trips to the amusement park, Ford reminds us that boredom isn’t always a bad thing. There’s something to be said for those long, slow days.

“It’s not your job to fully entertain your kids all through summer,” he says. “There’s nothing wrong with just having them find friends to play with, and come up with games, and play by themselves every once in a while. Those are all really good things mentally. Not only will you be saving money, but you’ll probably be doing the right thing for your child.”

5. Cut back on non-essential spending. Maybe you have no choice but to spend on trips and celebrations in summer, so do what you can to limit other expenses. Consider putting your streaming services on a break, for example. If you have lots to do, you may not have as much time for watching TV—and you may not even miss it for a couple of months.

Energy costs tend to tick up in the summer, but there are ways you can try to lower your utility bill. Check your filters to make sure they’re in good shape, so your air conditioner won’t have to work as hard. Close blinds against the sun, and keep the house just cool enough to feel comfortable. And speaking of cold, it’s a good time of year to lower your water heater temperature.

6. Embrace the joy of missing out. When you see posts of your former co-worker traipsing across Europe, or front row at what appears to be a great concert, it’s understandable that you might feel a little “Fear of Missing Out,” or FOMO. However, you can shift your mindset to turn FOMO into JOMO—joy of missing out.

Summer may be a good time to avoid social media for a bit so you can refocus. Take time to recognize when you feel like you’re missing out, and then concentrate on what you value, and what brings you joy. Maybe for you, that’s knowing you’re taking care of your well-being by not going into debt. Or maybe it’s spending quality time with your family grilling out in the backyard instead of going to a new restaurant.

If going to concerts or on international vacations is what brings you joy, make it a priority to save for those experiences in advance so you can spend on them without taking on financial stress. The point is to find happiness doing the things that really matter to you, and not feel like you have to do all the things just because everyone else is.

With a little mindful planning, you can have the best summer ever—your way, and within your budget.

Next step suggestions:

- Write down your values and a summer wish list. Create a summer budget that helps you prioritize saving for and spending on the things that are most important to you.

- Start a savings account for your summer spending. If you don’t already have a good place to save, consider opening a Truist One SavingsDisclosure 4 account.

- When you feel FOMO, take a moment to recognize the feeling. Know that it’s OK if you don’t do everything your friends do or what you see on social media.

Truist One Checking accountDisclosure 4

Never wonder if you’re getting the most from your checking account. With all these perks, it’s one simple choice.