The highlights:

- A budget is simply a plan for your money that can help you feel in control of your finances and, in turn, your day-to-day life.

- The best way to start your budget is to track and evaluate all your spending for one month.

- Regularly check in with your budget to adjust based on your values, needs, and future goals.

When it comes to budgeting, there are a couple of basics: Track your spending and don’t spend more than you earn. It takes dedication and practice, but if you can make budgeting a habit, you can boost your financial well-being and get on a path toward reaching your goals. And going beyond these basics can help you accomplish even more.

The benefits of a budget

If the word “budget” makes you cringe, you’re not alone. But changing your mindset to think about budgeting as a helpful tool can be an important step to financial well-being.

In one 2024 poll, 39% of Americans surveyed said they started budgeting because they wanted to increase their savings. In that same poll, 23% said getting out of debt was their motivation for starting a budget. And 87% of those surveyed also said that having a budget helped them stay out of further debt.Disclosure 1

Having a budget can help you feel more confident and prepared when facing uncertainty. Sticking with a budget can also help you hit important life goals. Controlling your spending can help you focus on saving up for a vacation, a backyard renovation, or finally renting that huge summer beach house for your family reunion.

Having a budget is helpful even if your monthly cash flow is good, even if you’re not living paycheck to paycheck or struggling to pay down debt. A budget is just a plan for your money that can be constantly adjusted. You can control your money instead of trying to figure out where it went.

For example, if you decide that you want to start a new $100 per month gym membership, you may be able to easily adjust your budget to accommodate it—maybe by spending less on dinners out or canceling a recurring subscription you no longer need. Instead of just adding on another monthly expense, you’ll be able to absorb the cost without pulling from savings or taking on debt.

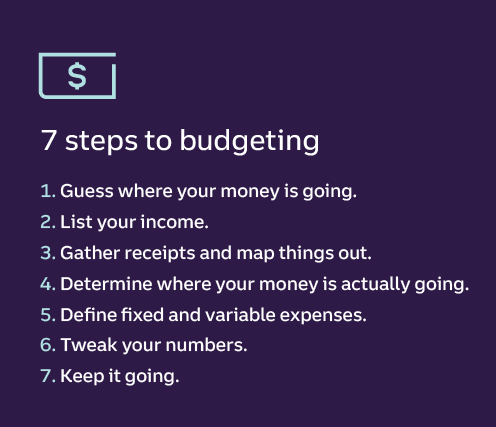

7 steps to start budgeting

So how do you make a budget? Start by putting pen to paper—or fingertips to keyboard. Here’s how to set up a budget.

- Guess where your money goes. Yes, really. Take five minutes and write out how much you think you’re spending each month on rent, food, utilities, entertainment, clothes, transportation? Don’t look anything up—just ballpark it and jot it down.

- Add in your income. On the same document, note all your incoming money for the month: your after-tax income that’s deposited into your account. If your income fluctuates month-to-month, you’ll have to find your monthly average. To do this, just look back over the past six months and determine your average take-home pay.

- Track your spending. Save all your documents for the next month—bills, receipts, recurring payments, and auto-debits—and sit down at a table with a big piece of paper and some markers (color-coding can make it easier to categorize), and track where every dollar went. Or, use a computer and our Super Budget worksheet.

- Compare your guesses to reality. The results will probably be eye-opening and provide good inspiration for how to adjust your budget. Maybe you spent way more than you thought on groceries—or way less than you guessed on gas and car expenses.

This exercise is your first step—and it’s an important step—but it’s all the stuff that follows where things really start to get good.

- Build your budget. That big colorful sheet (or spreadsheet) in front of you will start to provide clarity on what you’re actually spending each month. You can shape this into a realistic budget, with fixed and variable expenses.

Fixed expenses are easy to fill in: car payments, rent, loan payments, recurring subscriptions, etc. Variable expenses will need to be averaged based on your monthly observations: groceries, dining out, beauty services, clothing, entertainment, etc.

- Refine or make adjustments. To optimize your budget, you can compare and adjust your spending plan to what the experts suggest, or try using the 50-30-20 rule: 50% of income spent on needs, 30% spent on wants, and 20% put in savings.Disclosure 2

- Keep the budget going. You’ve done the hard work, so now it’s a matter of sticking to what you started. Now you know where your money is going each month, and where you want it to go. Check in with yourself and your budget on a regular basis and move forward with confidence.

Pro tip: Get an accountability partner.

Partner up with a friend or family member who can go through the budgeting process with you. Whether it's someone who's already great at budgeting and can offer you guidance, or someone who's going through this experience for the first time with you, having a partner to hold you accountable can help you be successful.

Adjust your budget to work for you.

So, you made a budget and you’re trying to stick to it, but you want to improve or refine it to better align with your needs. Try this: Make three columns and start categorizing your expenses:

- Love: Areas where you’re already spending money on what you love.

- Tolerate: Areas where you’re spending money but not reaping meaningful rewards.

- Wish: Areas for new spending that will bring you joy.

You may be thinking, where do I put must-haves like housing and food? Well, you put them wherever they belong depending on what you value. If you pay more than the recommended 30% of your gross income in rent but adore your apartment and spend a lot of time there, then that goes in column one. It’s worth it. If, however, you’re spending a lot on rent, but you don’t exactly love your apartment, then that goes in column two—and maybe you need to consider moving to save money. And finally, if every morning since you watched that ocean documentary you’ve woken up wishing you could scuba dive, research how much a certification course would cost and put that in the “wish” column.

“Sitting down and going through your expenses can give you a massive sense of self-efficacy. Building that skill of understanding where your money is going builds confidence.” —Bright Dickson, resident positive psychology specialist at Truist

Tools to support your unique budgeting needs

Of course, your budget is unique to your life, but there may be some instances where you need more specific budgeting guidance:

- Young adult budgeting spreadsheet. If a young adult in your life is just starting to earn an income for the first time (or if this describes you), this budget template can be a great tool. It’s a simplified version of our Super Budget worksheet but it can still help you set a plan for your spending and saving so you can reach your future goals easier.

- Reduced income or loss of income spreadsheet. When you have to manage living with less or no income, planning ahead can make a world of difference. Whether you hit a bump in your financial journey or are simply taking time off from work for personal reasons, this budget worksheet offers an adjusted template and tips to help your dollars go further until your income is flowing again.

- Understand values-based budgeting. When your spending aligns with your unique values, it can empower you and provide a greater sense of satisfaction in life. Dig deeper into the concept of values-based budgeting to make your budget even more powerful by personalizing it to your unique interests or passions.

Beyond the budget: What to do next

Once you’ve honed your budget, the next step is to start saving. You’ve probably identified areas of real (or at least potential) extra money each month and can start channeling that extra cash into one or more savings accounts. Soon, you’ll start seeing real change, hitting goals, and feeling financially confident.

Try this: Use this Savings Goal calculator to help determine your savings based on the numbers that work for you.

Remember, your budget is for you. Nobody is going to evaluate it, grade it, or compare it to their own. So, don’t be afraid to get things wrong or try new approaches.

Creating and keeping a budget may provide you with more freedom than living without one. A budget can help you get to a better place financially, and you may also see the positive impact in other areas of your life that you never thought a budget could affect.

Next steps:

- Start saving your receipts. Craft your budget using the seven steps outlined above.

- Note how it feels to live by the guidelines of your budget for a month or two, and then adjust where necessary. From there, you can outline or adjust your long-term goals.

- Start reaping the benefits of budgeting: Notice how managing your money allows you to enjoy more of what you like while cutting out expenses that aren’t contributing to your happiness.

Saving made simple.

Stick to your budget and build toward your financial goals. Start saving today with a Truist One Savings account.