The highlights:

- Clearly defining your saving goals—whether for a vacation or emergency savings—can help make them more achievable.

- Starting with a small goal, making small cut backs, and automating saving can help your savings add up quickly.

- Over time and with practice, saving can become second nature, allowing you to expand your goals.

This is an article about saving strategies that can work for you based on your values. Because your savings are all about having money for things you really want, like a house, a vacation—or simply more peace of mind. So, when your financial strategies align to your unique goals, it makes the process of saving easier and more rewarding.

Identify your “why” for saving money.

Saving is as much about your mindset as it is about your money. It’s possible to be motivated—even excited—to save money when you know what you’re saving for. If you think of saving as a chore, you probably aren’t going to be super enthusiastic about it.

So how do you get the motivation to start? Think about what really matters to you. Focusing on things you value most can help you form new habits because you’re highlighting the rewards instead of the obligations.

Think of what you’re passionate about at a high level. Let's use traveling as an example and think of where exactly you want to go. If working out is your thing, is a gym membership or a new treadmill your next investment? If you’re longing for an updated living space, does that mean a new sofa or a whole new apartment? Get as specific as you can—because the more you can pinpoint your goals, the easier it will be to start saving for them.

If you identify something you really want, you’ll likely be more motivated to save because you see that your money is going toward something important—not just being moved aside because that’s what you’re “supposed to do.” Once you can see your priorities clearly laid out in front of you, you’re ready to get started.

The importance of emergency savings

Beyond saving for expected and rewarding life goals, saving for financial emergencies is an effective step to living a happier, more resilient life. This is why we call your emergency savings your “financial confidence account.”

If you don’t have any emergency savings, start with a goal of saving $1,000 in an account that’s separate from your checking but easy to access—like a savings account. When you hit your first savings milestone, keep saving a portion of your income until you have enough to cover three to six months of living expenses.

Over time, your emergency fund can be a crucial fallback in the event of an unexpected financial blow—like being laid off from your job or needing to replace your air conditioning unit in the middle of July. Without an emergency fund, your situation may feel overwhelming, but with one, you can handle life’s unexpected curve balls without taking on debt or additional stress.

To start saving, open a separate no-touch account strictly for one of your goals. Give your new account a name, like “Paris in the spring” or “dream car.” Next, transfer some money into your new account. Start with $20 a week, or $250 a month—or whatever you can afford. A savings calculator can be helpful here so you can see how your money can add up over time—but don’t fixate on your end goal. Just start slow and keep it up.

“I’ve seen hundreds of people go from not being a good saver at all to being total rock-star savers, simply by making the decision to save first and make saving automatic.” — Brian Ford, head of financial wellness at Truist

In short order, you’ll probably be surprised by two things: One, that you don’t really miss the money you’re setting aside. And two, how quickly you reach your goal once you make saving a habit. (If things are going particularly well after the first couple of months, consider increasing your transfers and see what happens.)

6 simple saving principles

After getting the fundamentals down, you can make your money do more with less effort. Here are a few saving tips and tricks to sustain your momentum.

- Save incrementally toward a goal you can visualize. In other words, take baby steps to hit a large goal, saving a little bit at a time. Don’t do the reverse, like charging something big to your credit card and then trying to figure out how to save up to pay it off.

- Pay yourself first. This mantra means when you get your paycheck, automatically move a certain percentage to your savings account and then use the rest for necessities and wants.

- Save for emergencies. Yes, it’s worth saying again. The peace of mind an emergency fund can create is priceless.

- Make small cut backs. If your budget is tight, making small changes like packing lunch or cutting streaming services can be a realistic way to save a little each month.

- Recognize that there will be setbacks. You may lose income, have a sudden rent increase, or need to cover an unexpected cost that throws off your savings plan. It’s OK if you don’t meet your savings goal on the exact schedule you defined. The important thing is to stay the course and keep saving, even if the amount or schedule needs to change.

- Know that change is possible. A saver’s mindset isn’t made overnight. It takes time and effort to achieve the delayed gratification that saving can bring. After you hit your first savings goal, it’s easier to see how your changes paid off—and it will motivate you to keep going.

Next steps:

- Decide what really matters to you and write it down.

- Open one or more savings accounts and name them based on your specific goals.

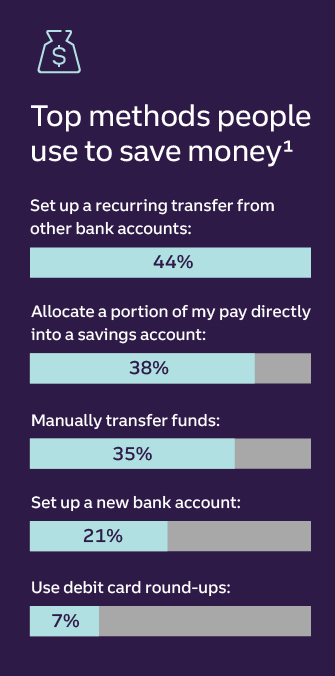

- Automate your saving at the start of every month or pay period by setting up automatic transfers as you get paid. Try depositing money into both your regular savings account and your emergency savings account.