Life moment

Borrowing for a big purchase

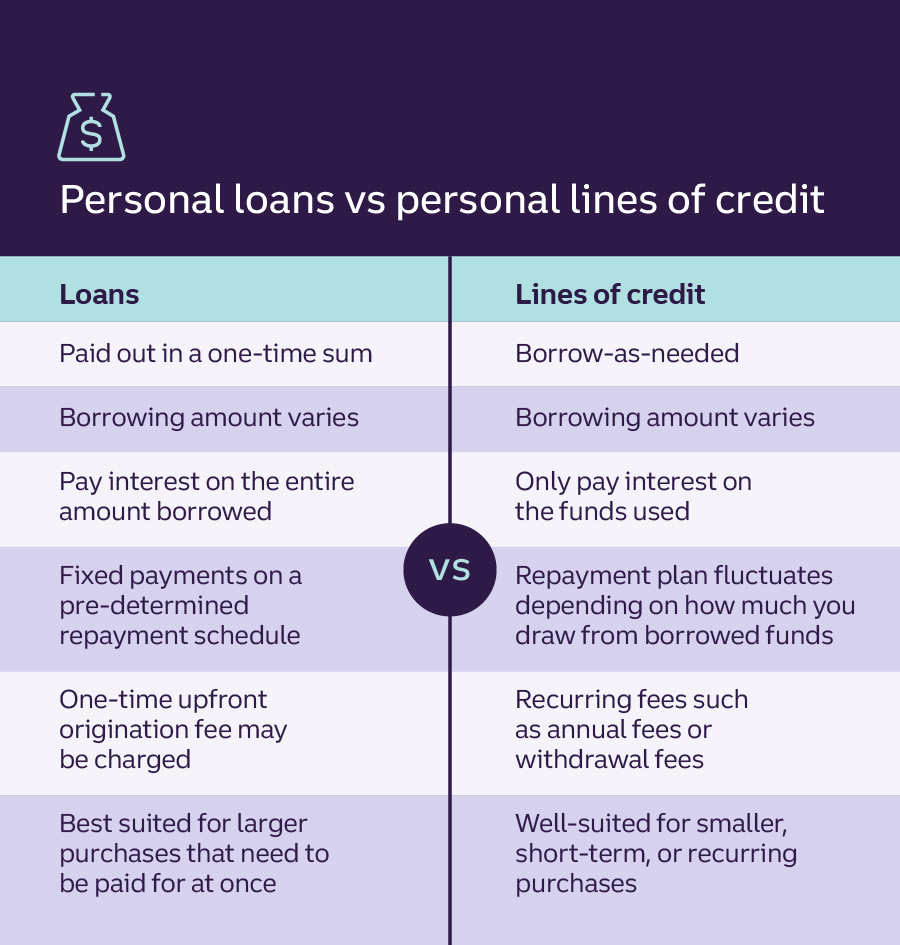

If you have your eyes on a big purchase, like buying a car or starting a home renovation, then you may consider seeking out financing to help your dream become reality. Should you take out a loan or apply for a line of credit? Here’s a high-level breakdown of what each option offers.

A loan is borrowed money you receive as a one-time sum, typically for a specific purchase. The loan will require a predetermined payment schedule, end date, and interest rate. Loans have two types of interest rates: variable and fixed. Variable rates are subject to change. Fixed rates stay constant for the length of the loan term. To determine if you qualify for a personal loan, the bank will typically pull a hard credit check to evaluate your credit score, credit history, income, and debt-to-income ratio.

A common question borrowers ask is, “What credit score do I need to qualify for a personal loan?” In general, you’ll get the best interest rates and terms if you have a credit score of 670 or higher.Disclosure 1

A big life moment is often the reason people take out a loan. For example, student loans can help you reach your degree goals by providing the funds necessary to pay for school, housing, and supplies. Need a new or used car? An auto loan can be the driver you need to fund your purchase.

Looking to move? As home prices continue to riseDisclosure 2, finding the best mortgage rate can help you get in the door. Need a way to help pay off medical expenses, fund home improvement projects, cover major life events, or pay for other discretionary expenses? Consider your personal lending options.

Finally, if you have multiple forms of debt, such as credit cards and medical bills, consolidating your debt into one personal loan can provide you with one monthly payment and often a more favorable interest rate.

Also known as revolving credit, a line of credit is a set amount of money you can borrow against. With a line of credit, you can borrow repeatedly, as long as you pay back what you owe. For example, if you use $5,000 of a $10,000 line of credit for car repairs, and then pay off your full balance, typically you can borrow the full $10,000 again without the need to reapply.

Applying for a line of credit follows a similar process as applying for a personal loan or credit card. You may be able to apply online, in person, or over the phone. To qualify, lenders will pull a hard credit check to assess your credit score; payment history, including number of timely, late, or missed payments; credit utilization; income; and recent credit inquiries. To qualify for a personal line of credit with the best rates, lenders often require a minimum credit score of 690.Disclosure 3

There are two common types of credit lines: personal lines of credit and home equity lines of credit.

A personal line of credit (PLOC) can be used to consolidate debt, finance a home renovation, pay for a wedding or big event, and more. Unlike a personal loan where you receive a one-time sum, PLOCs offer a credit limit that can range from a few hundred dollars to $50,000. You can borrow as much as your limit will allow and only pay interest on what you use.

Home equity line of credit (HELOC) lets you tap into the equity in your home and borrow against it for things like home improvements, consolidating debts, or other major expenses. Use our HELOC calculator to learn how much you may be able to borrow.

Credit cards are the most common example of a line of credit, but while cards can be great for day-to-day expenses, they typically come with higher interest rates than other types of loans.Disclosure 4 A personal line of credit, a home equity line of credit, or even a business line of credit may offer better rates for funding larger goals—like renovating your home or upgrading your business equipment.

Deciding between a personal loan and personal line of credit depends on your financial situation and savings goals. Credit cards can be great for earning rewards, such as cash back on purchases or earning points for dollars spent, but should be paid off in full each month because interest rates can be high. By contrast, personal loans typically have lower interest rates, which can make them better for longer-term and more expensive needs, such as buying a car.

The better your credit score, the better chance you have for getting approved for a line of credit. To help you secure your personal loan or line of credit, start by building your credit. Credit history and payment history are important factors for many lenders. If you don’t own a credit card, or need to build up more credit, consider applying for a new card, such as the Truist Enjoy Cash Secured Credit Card. Use your credit card responsibly and be sure to pay the balance in full each month to help build credit history.

If you already have credit cards and other loans, focus on paying down the existing debt. Some experts recommend maintaining a credit utilization of 30% or below.Disclosure 5

Lastly, if you have a family member or close friend with a strong credit score, history, and income, asking them to co-sign the loan can help you qualify and maybe even get a lower interest rate.

This content does not constitute legal, tax, accounting, financial, investment, or mental health advice. You are encouraged to consult with competent legal, tax, accounting, financial, investment, or mental health professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

This overview is not intended to be all-inclusive but is for illustrative purposes only. Individual results will vary based on client usage. For additional information, please refer to the Personal Deposit Accounts Fee Schedule.

This calculator is made available by one or more third party service providers. It is not intended to be an advertisement for a product or service at any of the terms used herein. It is not intended to offer any tax, legal, financial or investment advice. All examples are hypothetical and are for illustrative purposes. Truist Financial Corporation ("Truist") and its affiliates do not provide legal or tax advice. Truist cannot guarantee that the information provided is accurate, complete, or timely. Federal and state laws and regulations are complex and are subject to change. Changes in such laws and regulations may have a material impact on pre- and/or after-tax investment results. Truist makes no warranties with regard to this calculator or the results obtained by its use. Truist disclaims any liability arising out of your use of, or any tax position taken in reliance on, this calculator. Always consult an attorney or tax professional regarding your specific legal or tax situation.

A Truist Personal Loan can be great for consolidating high-interest debt to save money—and boost your financial confidence as you pay it down.

Tell us a little about yourself and we’ll show you options based on your needs.

Choose an option with the rate that suits your needs and a term you can be comfortable with.

Both are common types of loans, but there’s one key difference: collateral.

Debt consolidation may help reduce the burden of debt, and it might even save you money.

Your FICO® credit score is one of the most common ratings used to determine your creditworthiness.

{3}