The highlights

- Simplifying your finances starts with a financial check-in, which means finding out where you stand and where you want to be.

- You can further organize your finances by closing old accounts, automating bill payments and savings, and putting important documents in one place.

- Keeping your finances organized can help you grow in confidence while you set clear money goals for your future.

Decluttering has been found to help us feel calmer and reduce feelings of stressDisclosure 1 —and the same can be said for decluttering and organizing your finances.

If you’re in need of a financial fresh start, these five tips can help you get back on top of your money and feel more in control.

Tip #1: Identify where you are and why.

Before you start organizing your personal finances, stop and assess: Where do you actually stand? Are you struggling with paying your monthly bills on time? Or are you so overwhelmed that you can’t bear to face your bank and credit card statements? It can seem daunting, especially if you’ve been avoiding it for a while. But you can manage that anxiety by thinking about your why, says Bright Dickson, Truist’s positive psychology expert and co-host of the podcast Money and Mindset With Bright and Brian.

“The first thing to do to stay in the game is write down your why for getting organized. Why are you doing it? What are you getting out of it?” she says in this episode of the podcast Money and Mindset With Bright and Brian, “How to organize your finances for less stress and more freedom.” “Really answer that question, and literally write out your answer on a piece of paper and put it someplace that you’ll see it through your whole organizing process.”

Doing so will help keep you focused and motivated, she says.

Tip #2: Identify where you want to be.

Now that you have your why, you can start thinking about where you’d like to be financially and how you’re going to get there. If you want to pay down debt, then you can formulate some debt payment strategies to help you get started.

If you want to build your emergency savings fund or put more into your retirement fund, then think about what it would take to do so. Will you need to decrease your debt or reallocate funds in your monthly budget? Is there a big dream vacation you’re hoping to take? What kind of adjustments within your monthly budget will you need to make to book it?

Tip #3: Consolidate and close old accounts.

Unsure about how to even begin cleaning up your finances? There’s a simple solution, says Brian Ford, head of financial wellness at Truist and co-host of Money and Mindset with Bright and Brian.

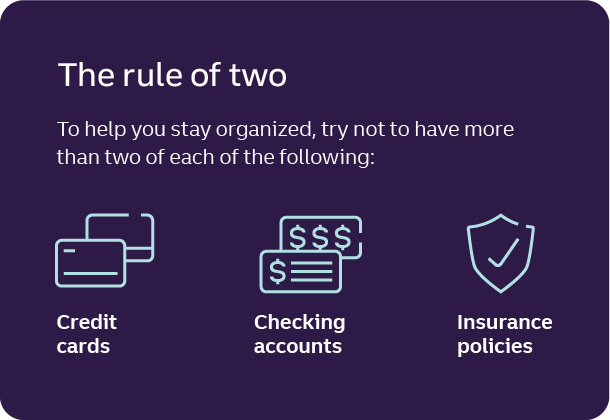

“Don’t have more than one or two insurance companies, credit cards, or checking accounts,” Ford advises. This can minimize the statements you have to look through and policies you have to keep track of. Also look to see if there are other expenses that you can streamline, such as gym memberships, streaming services, or other subscription services.

Next, look at your credit cards. If you have cards you rarely use, you might consider closing one or two of them. (Keep in mind: Closing old credit accounts can bring your average age of accounts down, which can lower your credit score. But as long as you keep some accounts open, over time, your average age of accounts will go back up.) Another alternative is to keep the cards open and only use them for occasional small purchases that you can easily pay off in full.

When it comes to credit card debt, try to pay off the ones with the highest rates and work your way down. It may take some time, but it will be worthwhile in terms of decluttering on every level.

Tip #4: Automate as much as you can.

One of the easiest ways to simplify something is to automate it. Most bill automations allow you to set reminders and confirmations when payments go through to help keep track of finances.

You can automate many areas of your financial life, including:

- Bill and loan payments. Sign up for monthly automated bill payments for everything you can, from cable and internet to electricity and gas. You can even automate monthly loan payment plans through your bank. It’s still a good idea to look over your bills just to make sure there are no mistakes or surprises.

- Your savings. Saving money is tough. By automatically transferring a certain amount of your earnings—even if it’s very small—into a savings account, you are doing yourself a big favor.

- Your investments. Ideally, a portion of your pretax paycheck is already automatically invested in your company’s 401(k). But if you’re an independent contractor, or if you can afford to invest on top of your 401(k), designate a sum from your checking to be invested each month in a separate IRA, Roth IRA, or standard investment account.

Tip #5: Organize your files.

These days, organizing your finances is often done digitally. But sometimes it involves physical tasks, like making sure your files are organized in a way that works for you—whether that’s in a three-ring binder, a file cabinet, or a computer folder.

However you like to keep your documents, the important thing is that you know where they are and how to get them. “If it’s tax time or if I’m applying for a mortgage, knowing where those documents are and being able to access them is well worth the hour or so it may have taken to get them organized,” Ford says.

The satisfaction and peace of mind that comes with decluttering can’t be understated. When you face your financial clutter head-on, there are several possible benefits: fewer accounts to keep track of, a clearer mind, and more financial freedom. You may even be inspired to declutter other areas of your life, too.

Next steps

- Check out this episode of the podcast “Money and Mindset With Bright and Brian” for more tips on organizing your finances.

- Download our guide to budgeting for help keeping tabs on your spending and setting achievable money goals.

- Calculate your net worth by adding up everything you own (including your investments, cash deposits, savings, and any equity you have in a home or car) and then subtracting everything you owe (like student loans or credit card debt). This can give you a better idea of your overall financial picture and serve as a good starting place to get more organized.