If you’re a homeowner in need of credit, borrowing against your home’s equity can be a great option. A home equity loan and a home equity line of credit (HELOC) are both designed to give you affordable access to credit by tapping into the money you’ve already invested in your home. The possibilities for how to use that equity, however, can extend beyond the home.

The highlights:

- Home equity loans and lines of credit are two ways to use the equity in your home to pay for repairs, renovations, and more.

- Home equity loans and lines of credit typically have lower interest rates than credit cards and personal loans.Disclosure 1

- If you’ve been making on-time payments and your home’s value has been steady or on the rise, then you may have equity in your home that you can use to cover unexpected or planned expenses.

- Some of the best uses for home equity include using it to add value to your property or help you manage debt wisely.

What does it mean to have equity in your home?

Simply put, home equity means your property is worth more than you owe on it. Brian Ford, Head of Financial Wellness at Truist, calls home equity the “magic number.”

“I think home equity is one of the best ways to build wealth,” says Ford. “It happens magically when you make your monthly mortgage payments on time and your home’s value appreciates.”

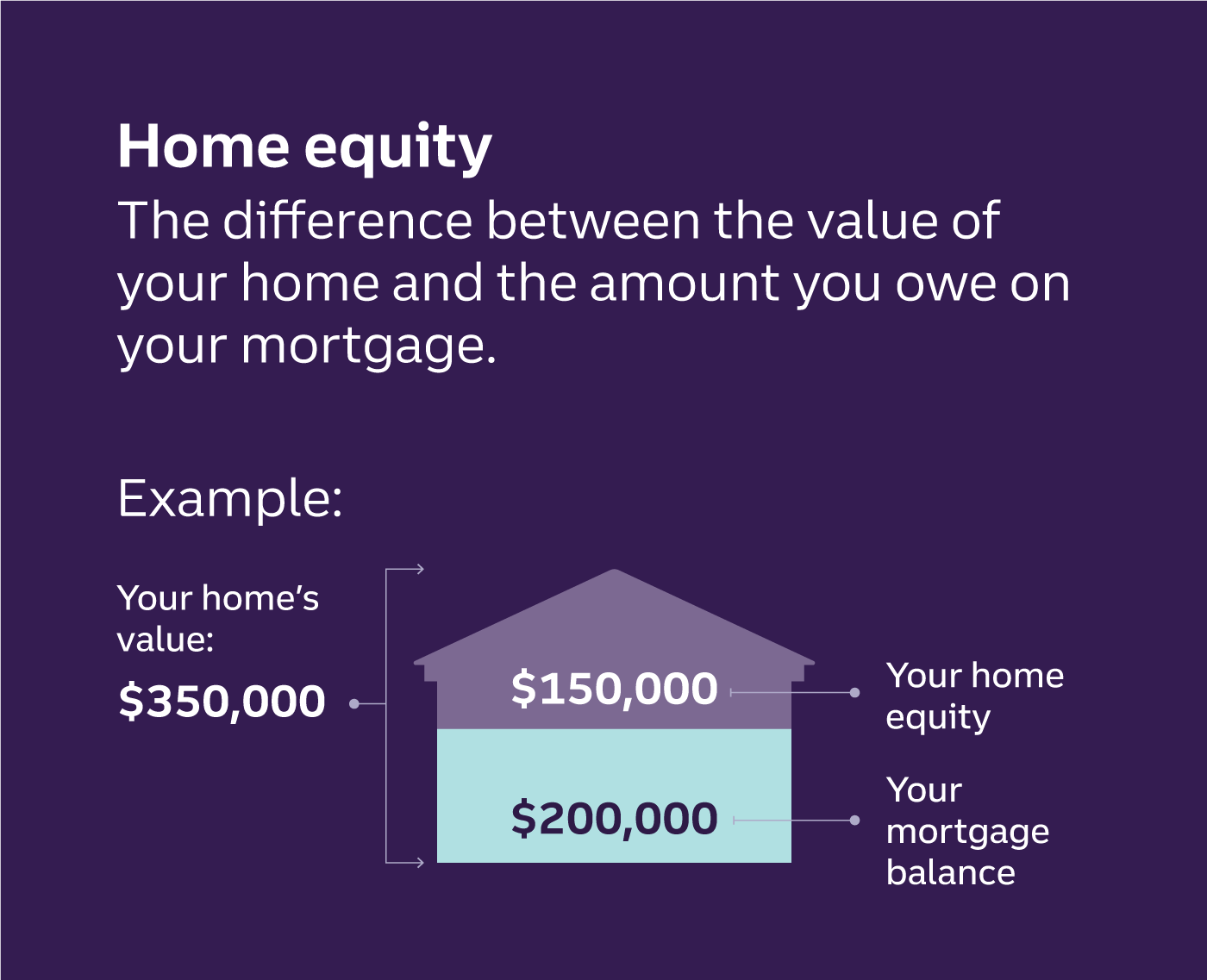

To estimate your home equity, subtract your mortgage balance from your home’s market value—the amount you could sell it for today. If you don’t know your home’s value, you can check out estimates from online realty sources. It won’t be as accurate as a home appraisal, but it’s a good place to start.

Once you have an idea of how much equity you may have, you can decide if it could be enough to cover your needs. Keep in mind, though, that most lenders only allow you to borrow up to 80% of your home equityDisclosure 2.

What can you use a home equity loan or HELOC for?

Here are three common reasons homeowners get a home equity loan or line of credit:

- Necessary or unexpected home repairs: If your HVAC system breaks down in the heat of summer or dead of winter, you’ll likely want to replace or repair it right away. And if you have plenty of home equity but not much cash, a home equity loan or HELOC can be a good option to cover the cost. You can also use them to pay for major repairs you can see coming, such as replacing an aging roof, swapping out damaged or worn siding, or repainting.

- Home renovations that will increase your home’s value: Certain upgrades will boost your home’s value more than others. Kitchen and bath remodels may provide a consistently high return on investment. But keep it modest: Renovations that don’t require changing the room’s layout or adding high-end finishes typically give you the most bang for your buck. Upgrading your HVAC system to a more energy-efficient model or replacing old, drafty windows are two more examples of changes that can increase your home’s value.

- Paying off or consolidating higher-interest loans: Replacing high-interest debt with a lower-interest home equity loan or HELOC can save you money and help you pay off the balance faster—and lowering your debt-to-income ratio can also help boost your credit score and your financial confidence.

“Improving your home can improve your everyday life and standard of living, while also increasing the value of your property. I love anything that we can get value out of that benefits our lifestyles at the same time.” —Brian Ford, head of Financial Wellness, Truist

What’s the difference between a home equity loan and a HELOC?

- Home equity loan: A one-time loan that’s dependent on the amount of equity you have in your home. It usually comes with set monthly payments and a specific payoff date.

- Home equity line of credit (HELOC): A revolving line of credit, also dependent on the amount of equity you have in your home, that functions more like a credit card.

How does a home equity loan work? Homeowners often use one-time home equity loans to finance planned expenses. Similar to a personal loan, you could borrow a lump sum with a fixed interest rate, fixed monthly payments, and a scheduled pay-off date. Often called a second mortgage, a home equity loan won’t remove your first mortgage—it stays in place, and you’ll make payments on both loans. A home equity loan is a good choice if you know exactly how much you need to borrow.

How does a HELOC work? Because a HELOC is a line of credit, you’ll have more flexibility around how much credit you use and when you use it. Like a credit card, your available credit will replenish up to the original credit limit as you repay what you’ve borrowed. HELOCs often come with variable interest rates, so your payment could go up or down based on your rate and how much credit you’ve used.

It’s important to be careful not to misuse the line of credit, just like with a credit card. Manage a HELOC responsibly to ensure it serves you in a way that improves your financial confidence and well-being.

How to decide if using home equity is right for you

If you’ve built up enough equity in your home to borrow against it, that’s a financial milestone worth celebrating. But just because you can do something doesn’t necessarily mean you should. Since these forms of credit are backed by the money you’ve invested in your home, it’s generally best to stay away from tapping your home equity for one-time events like weddings, vacations, or items that depreciate in value.

If you’re considering using home equity for anything other than home repairs, improvements, or consolidating higher-interest debt, take some time to reflect to decide if what you’re borrowing for is really worth it. And if you do decide to borrow, be sure to budget for your monthly payments and have a payoff plan in place first.

“It’s a matter of balancing what you value against the numbers and the risks,” says Bright Dickson, co-host of the Money and Mindset podcast. This home equity repayment calculator can help you begin planning.

How do you get a home equity loan or line of credit?

The application process will be similar for both a home equity loan and HELOC. You’ll likely need to provide the lender with bank account statements, proof of income, tax statements, and permission to check your credit history and credit score. A home appraisal or valuation may also be required. Both types of credit may come with closing costs, too.

Interest rates and terms will vary based on your situation and credit history. To improve your chances of being approved and getting favorable terms—which will effectively lower the cost of borrowing—pay attention to these stats.

- Your credit score: A good credit score will usually provide you with the best results. If yours isn’t quite there, making consistent on-time mortgage payments is one way to raise it.

- Your current loan-to-value (LTV) ratio: Be sure you’ve built enough equity in your home. Requirements vary, but you’ll likely want this ratio comparing your first mortgage balance to your home’s value to be 80% or less.

- Your debt-to-income (DTI) ratio: Having too much debt compared to your income can work against you. If the ratio is high, consider ways you can pay down some of your existing debt before borrowing against your home equity. You can use an online calculator to estimate how long it can take to pay off debt.

How your home equity grows

The principal you owe on your mortgage goes down. Simply making your monthly mortgage payment will make this happen. If it’s in your budget to pay a little extra toward your principal each month, your loan balance will fall faster.

Home values go up. Barring any major economic downturns, the market value of your home may naturally increase over time. The good news if you’ve been a homeowner for a while: Home values have been on the upswing. In fact, the Federal Housing Finance Agency says the percentage of homes with 30% equity or higher (what the agency considers “high equity”) reached a 10-year high of 83.3% in Q1 2023.Disclosure 3

Next step suggestions:

- Learn more about HELOCS and calculate how much you could borrow.

- Check your latest mortgage statements and do some research online to get an idea of how much equity you may have in your home.

- Explore more of our tips on homeownership so you can make your living space a worthy and joyful investment.