Keys to Finding Funding in the Early Stage

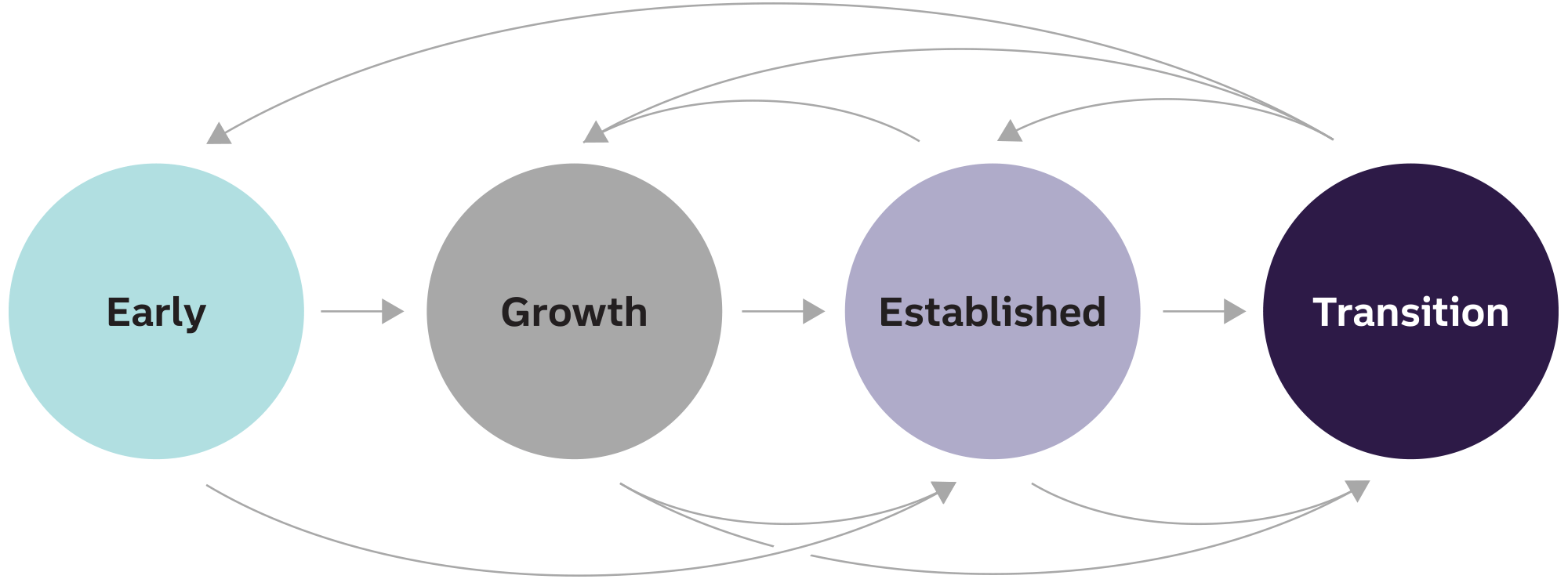

Truist Business Lifecycle Advisory Strategies to access capital in the early stage

Learn what it takes to secure funding before you’ve secured your place in the market.

Article

07/07/2025

Keys to Finding Funding in the Early Stage

Discover essential strategies for securing early-stage funding to fuel your company’s growth and attract investors.

Developing a business roadmap to meet your goals

Strategic Advice The essentials of business roadmaps

Reviewing and refining your business development strategy

Article

06/18/2025

Developing a business roadmap to meet your goals

Learn how refining your company’s vision and goal setting can help drive an effective business development strategy.

Managing business debt during the growth stage

Strategic advice Managing debt in a growing business

Use debt strategically to reach your growth goals.

Article

02/04/2025

Managing business debt during the growth stage

Learn tips to help you think strategically about business debt, optimize your debt structures, and create partnerships to help you meet your growth goals.