Is a spinoff right for your company?

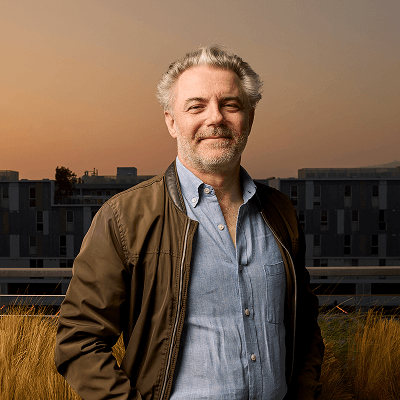

Strategic advice Is a spinoff right for your company?

What to consider before deciding to divest

Article

11/19/2024

Is a spinoff right for your company?

Learn strategies and see examples of successful spinoffs to help you decide whether this business divestiture is right for your company.

4 Effective Strategies to Grow Your Customer Base

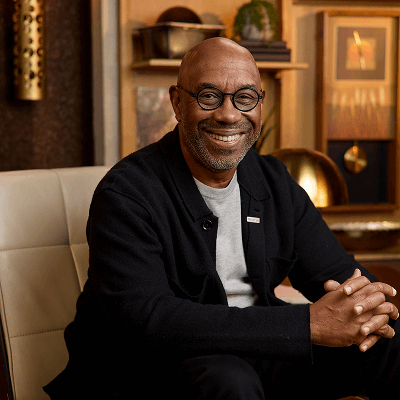

Strategic advice 4 effective ways to grow your customer base

Smart strategies to expand your customer base and drive business forward.

Article

11/18/2024

4 Effective Strategies to Grow Your Customer Base

Learn business growth tips to help you expand your customer base, drive acquisition, build trust, and generate customer retention.

Two steps to help you improve operational efficiency

Strategic advice Minimize complexity while embracing growth

Minimize complexity while embracing growth

Article

10/31/2024

Two steps to help you improve operational efficiency

Learn fundamental revenue management tips to help you minimize complexity, embrace growth, and achieve operational efficiency for your company.