Protecting Your Business Against Social Engineering Fraud | Truist

Fraud How to identify and prevent the most prevalent cyber scam

Preventing social engineering fraud

Article

07/31/2024

Protecting Your Business Against Social Engineering Fraud | Truist

Social engineering involves exploiting a person’s trust to obtain private information or money to commit a crime. Learn how to prevent it here.

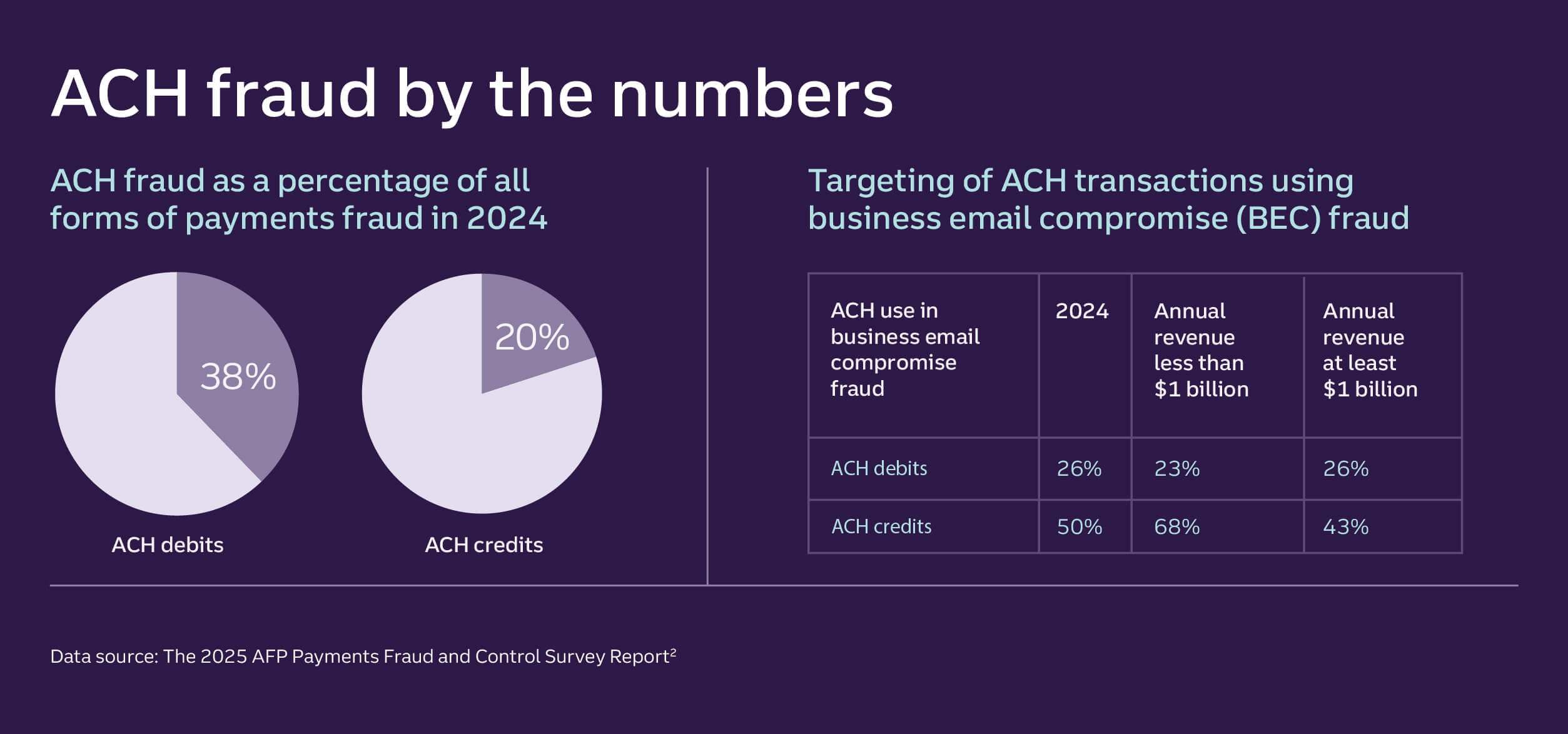

How To Defend Against Business Email Compromise

Fraud How to detect and defend against business email compromise

Article

07/22/2025

How To Defend Against Business Email Compromise

Business email compromise happens when scammers impersonate someone you trust in an attempt to defraud your company. Learn how to spot and prevent BEC.

How to defend your business against password theft

Fraud How to defend your business against password theft

Password theft is a foundational cybercrime hackers rely on to access your company’s computer networks. Learn how to spot and stop these attacks.

Article

09/12/2024

How to defend your business against password theft

Password theft is a foundational cybercrime hackers rely on to access your company’s computer networks. Learn how to spot and stop these attacks.