A guide for investment committees

In a world filled with texts, tweets, emails, blogs, voicemails, and podcasts—not to mention actual in-person meetings—how can your investment committee ensure they’re effectively utilizing these sources of information to improve long-term investment outcomes? The following are some key ways your committee members can better leverage and streamline the information they receive, focus their discussions and decisions, and strive to improve returns in support of your organization’s mission.

“Information is the resolution of uncertainty.”

-Claude Shannon, Information Theorist and MIT Professor

Think long-term

While serving on a panel at the Philadelphia CFA Society Endowment and Foundation Conference, I heard a telling comment from the trustee of a major participating institution. The trustee noted that it was difficult for him to know when, and if, the institution was on track to meet or exceed its long-term investment goals. The number of asset classes, managers, and vehicle types in the portfolio had become so complex that it made him long for the days of a simple stock and bond portfolio. He had the utmost confidence in the diversified portfolio that he and his fellow trustees had created. But the manner in which they reviewed the data, and even the data itself, made it hard for the committee to focus their attention and decision-making.

The investment industry has spent decades improving reporting and communications practices. But these improvements have also led to a litany of statistical data points being made available to investors without focusing in on the additional information’s true value. Reporting packages have taken on a life of their own—with hundreds of pages now available to slice and dice portfolio data. Unfortunately, most committees are now inundated with performance and portfolio allocation information that could constitute a doctoral thesis rather than a foundation or endowment’s investment review.

It’s especially challenging considering that the average investment committee only has a few opportunities to gather each year to review their portfolio and make decisions. Most committee members are busy community leaders, with limited capacity for further engagement on any one board. So it’s critical that this valuable time be used to measure areas of importance.

Michael Mauboussin, in a 2009 report for Legg Mason, referred to this process as focusing on the ‘Important Unknowables.’ In other words, spend the majority of your time on your process and considering the implications of things like portfolio volatility and long-term asset class trends rather than the ‘Unimportant Knowables’ such as whether GDP data for the most recent quarter was revised downward by 0.1%. This concept seems straightforward, but you’d be surprised by the time allocated to the latter in investment committee meetings. Want to develop a better process that still allows the committee to glean investment insights, but doesn’t create information overload?

Don’t set it and forget it

While ‘set it and forget it’ may be a viable approach to cooking a rotisserie chicken, it doesn’t meet best practices of fiduciary behavior for an investment committee. To change the set it and forget it portfolio mindset, your committee needs to set aside greater time to think about prospective returns rather than historical returns. This isn’t to say your committee should simply ignore recent portfolio returns and allocations. Rather, try to allocate a greater percentage of your time to improving the long-term investment strategy of the organization—through developing and reviewing appropriate targets and ranges for the strategic allocations in your investment policy statement.

These targets and ranges will help to better guide the group over time, and allow you to focus more broadly on where the portfolio should be going rather than where it’s been. The review process (coupled with the use of expected return and volatility simulations for the portfolio) will allow you to develop an even greater understanding. In addition, the process gives your investment advisor or consultant the requisite flexibility and accountability to make decisions on the committee’s behalf within specified guidelines.

Accountability

It’s a fundamental aspect of improving outcomes. By clearly defining who’s accountable for specific decisions made in the portfolio, your committee can then consider attribution analysis pertaining to the three elements of return generation: strategic asset allocation, tactical asset allocation, and implementation.

The attribution analysis should include specific information to answer questions such as the following:

Strategic asset allocation—What was the impact when strategic target allocations and ranges to emerging market bonds and hedge funds were added to the portfolio?

Tactical asset allocation—When your advisor lowered exposure to MSCI EAFE two years ago, did it yield a positive or negative portfolio impact?

Implementation—Since hiring XYZ Manager to replace another fixed income manager, has the performance for that mandate improved?

This attribution information will reinforce the value proposition of your advisor or consultant, and allow your committee to stay focused on the broader implications for spending and investment policy.

Primary and secondary benchmarks

The final ingredient in improving investment outcomes is the establishment and monitoring of relevant benchmarks. Typically referred to as primary (or policy) benchmarks and secondary (or relative) benchmarks, they’re critical to understanding performance trends and how your portfolio is tracking to long-term targets. Just as important, they help you avoid focusing too much on the most recent monthly or quarterly data (e.g., spending an entire meeting assessing a small cap value manager that makes up less than 2% of your total portfolio).

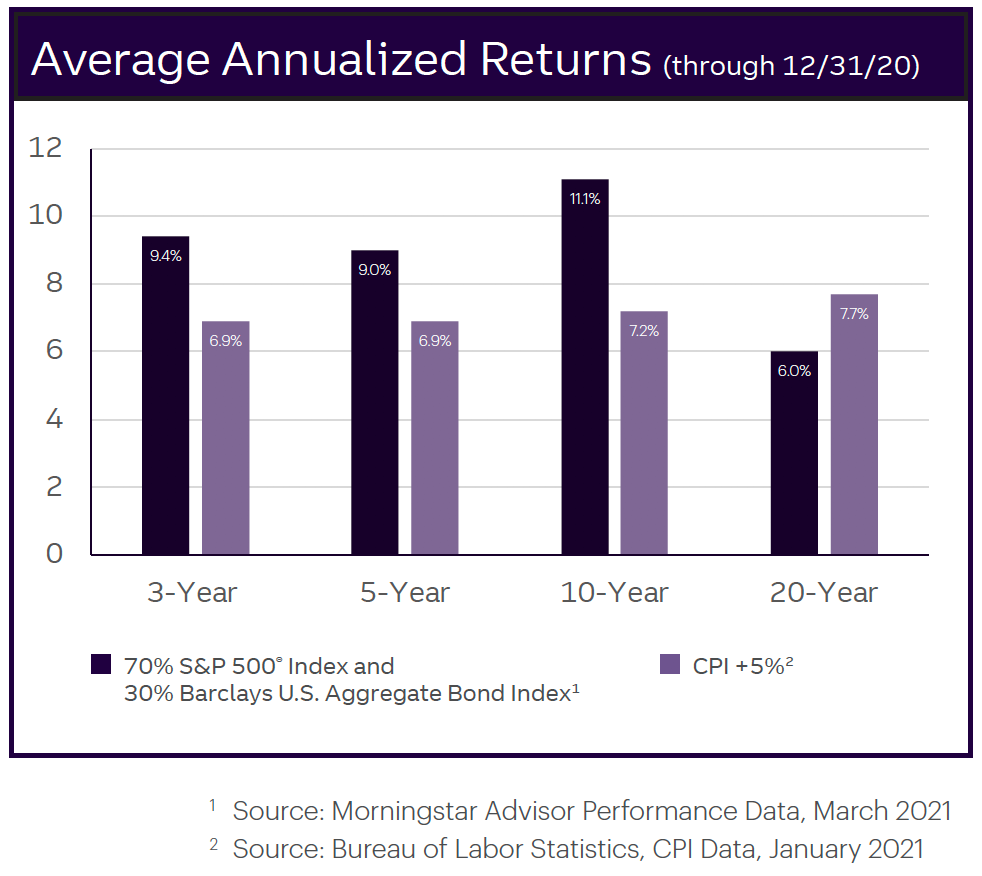

Look no further than the performance of a simple absolute return portfolio (70% tracking the S&P 500® Index and 30% tracking the Barclays U.S. Aggregate Index). As the following graphic shows, depending on the timeframe you focus on, the portfolio’s performance vs a typical foundation and endowment benchmark of CPI+5% might look like either a winning strategy or an underperforming one. Therefore, make sure your investment committee considers these factors as part of their overall investment performance analysis.

Additional best practices

- Spend less time with your advisor reviewing economic information you can readily access online, and instead focus your time on the range of possible outcomes based on your current asset allocation and active vs passive manager lineup.

- Closely monitor costs to ensure you know exactly how much you’re paying to your advisor, underlying managers, and administrator/custodian

Conclusion

Looking ahead to a market environment where no easy solutions are apparent, now more than ever investment committees need to rely on process to ensure the long-term success of their investment programs—finding ways to improve your processes and outcomes by focusing on the long-term. As the protagonist (Jesse Livermore) states in Edwin Lefèvre’s classic investment novel, Reminiscences of a Stock Operator, “Throughout all my years of investing, I’ve found that the big money was never made in the buying or the selling. The big money was always made in the waiting.”

About Truist’s Foundations and Endowments Specialty Practice

Truist has more than a century of experience working with not-for-profit organizations. Fiduciary stewardship is the heart of our culture. We’re not just a provider, but an invested partner—sharing responsibility for prudent management of not-for-profit assets. Our client commitment, not-for-profit experience, and fiduciary culture are significant advantages for our clients and set us apart. The Foundations and Endowments Specialty Practice works exclusively with not-for- profit organizations. Our institutional teams include professionals with extensive not-for-profit expertise. These professionals are actively engaged in the not-for profit community and are able to share best practices that are meaningful to their clients. Team members offer guidance and advice tailored to the various subsets of the not-for-profit community, including trade associations and membership organizations. Our Practice delivers comprehensive investment advisory, administration, planned giving, custody, trust and fiduciary services to trade associations, educational institutions, foundations, endowments and other not-for profit clients across the country.

Have a specific question about the structure or performance of your investment portfolio?

Contact your Truist relationship manager or investment advisor or call us at 866-223-1499.