How To Defend Against Business Email Compromise

Fraud How to detect and defend against business email compromise

Article

07/22/2025

How To Defend Against Business Email Compromise

Business email compromise happens when scammers impersonate someone you trust in an attempt to defraud your company. Learn how to spot and prevent BEC.

How to defend against corporate phishing attacks

Fraud How to defend against corporate phishing attacks

Learn tips and tactics for preventing fraud.

Article

09/08/2024

How to defend against corporate phishing attacks

Arming your employees with the knowledge and tools needed to protect your business from phishing attacks is vital.

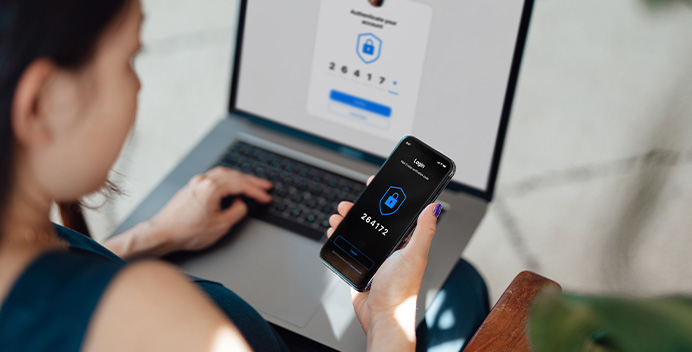

How to defend your business against password theft

Fraud How to defend your business against password theft

Password theft is a foundational cybercrime hackers rely on to access your company’s computer networks. Learn how to spot and stop these attacks.

Article

09/12/2024

How to defend your business against password theft

Password theft is a foundational cybercrime hackers rely on to access your company’s computer networks. Learn how to spot and stop these attacks.