High demand for scrap metal has helped deliver strong revenue and boosted profits for metal recyclers in recent years, driving scrap metal prices to a high point in 2023. As a result, many recycling companies have found themselves carrying larger cash balances than usual and are considering their cash management options.

Although the demand for scrap metal remains strong, persistently high inflation, rising interest rates, surging labor costs, and continued geopolitical risk make for an uncertain future. Considering the unsteady state of the global economic environment, it’s especially critical for recyclers to take a deliberate and prudent approach to managing their excess cash.

The plan for managing short-term cash starts with looking at both routine business needs and owner distributions, with these objectives:

- Retaining reserves to cover short-term fluctuations

- Building for longer-term priorities

- Achieving a reasonable return on excess cash, while protecting principal

Questions about the broader economy remain unanswered, so a step-by-step approach can help you build a plan to find the best solutions for managing your short-term liquidity.

Examine cash positions and funding needs.

In a higher-rate environment, where every invested dollar counts, tactical cash management grows in importance. Recyclers maximize their financial resources by actively investing excess cash and taking advantage of targeted short-term investments.

Start by prioritizing business goals for your available cash, including:

- Acquiring scrap yards to grow and expand business

- Purchasing new equipment and vehicles

- Adding skilled labor

- Boosting cash reserves for future capacity expansion

- Accelerating debt repayment

In addition to business needs, you might also consider wealth goals—for yourself and your family—such as education or retirement funding. You may also look at measures to ensure that your family’s future generations can enjoy continued success in the business. Truist’s Business Lifecycle Advisory approach can help you think through your best options—meet the goals you have set for yourself and your family.

Build your investment policy with a focus on capital protection.

Each place you put cash to work carries a unique, purpose-specific time horizon that should inform your investment strategy and allocation of funds. A clearly defined investment policy establishes specific requirements and parameters around asset allocation, relative liquidity, and risk level. It provides a framework to help you strategically assess your options and formulate your response to market shifts and business needs before they occur.

This type of defined policy is a key principle of behavioral finance that helps ensure rational responses to unsettling economic and financial changes. It’s an essential component of risk management for the company’s balance sheet, providing a disciplined method of maximizing yields on reserve cash and strategic investments.

When crafting your investment policy, you’ll want to include:

Objectives – Objectives are a critical component of your policy. By setting your objectives, you frame the basic expectations for your policy’s impact on your investment portfolio.

Asset allocation – Asset allocation sets the groundwork for your investment strategy—it’s the most important set of investment criteria in meeting your financial goals. Review your asset allocation regularly to ensure it has the best odds of meeting your objectives, particularly during prolonged periods of market volatility. Your policy should include periodic rebalance actions that return the portfolio to target allocations.

Sector and credit quality requirements – For the short-term, liquidity-focused portion of your investment policy, you should embrace sector diversity for sound risk management. Further, your policy should provide for investment-grade securities with limited, high-yield exposure. Both these tactics will create the opportunity for the highest possible risk-adjusted return.

A sound investment policy supports the company’s future by ensuring that cash assets are contributing maximally to its long-term success. As shifts take place across our interconnected global economy, it’s important to have investment guidelines that reflect current conditions and minimize capital risk. If your recycling company does not have an investment policy, now is the best time to establish one and start getting more value from your surplus cash.

Put your investment policy into practice.

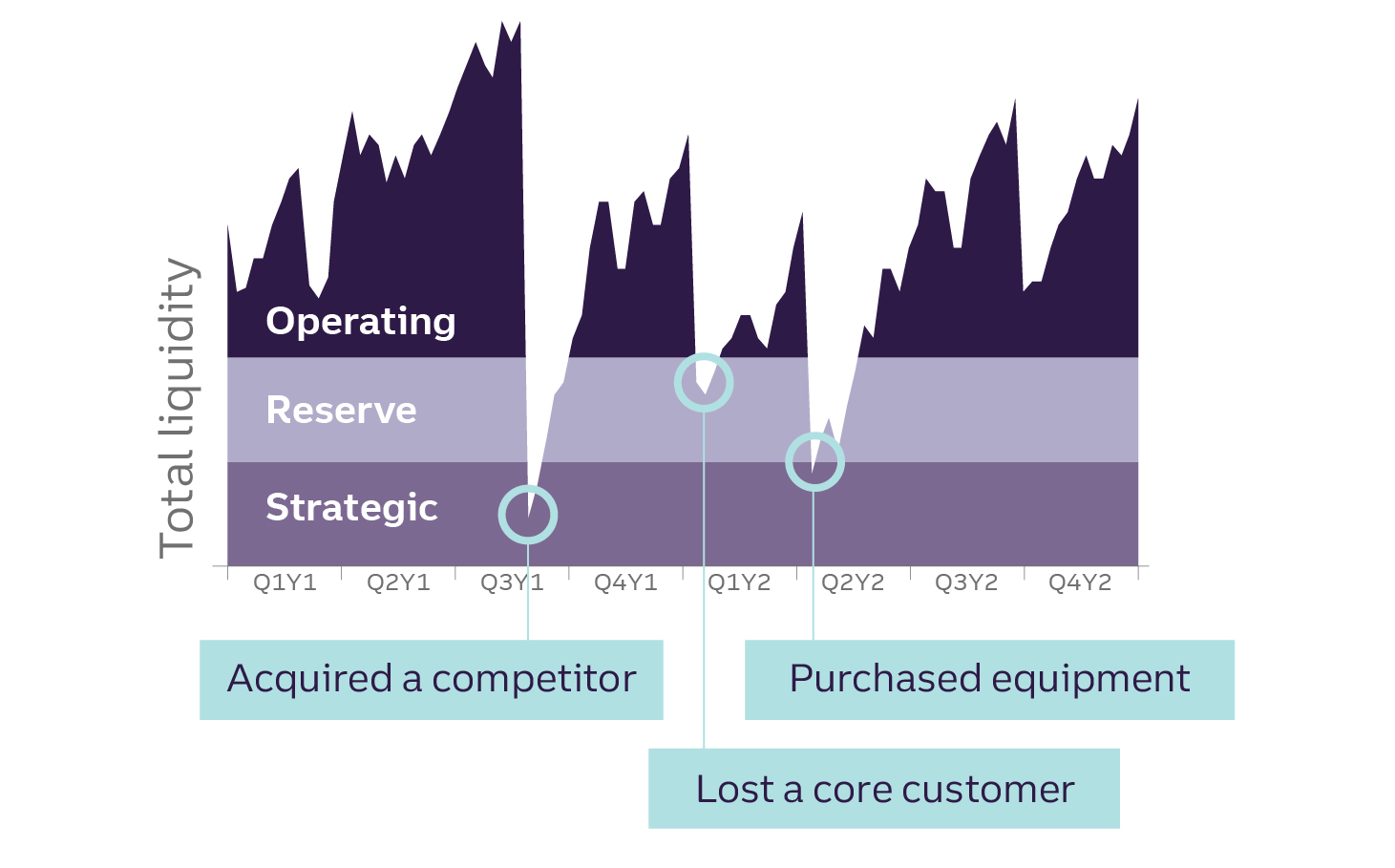

You can meet your short- and long-term liquidity needs and optimize returns by segmenting your cash. Based on your business’s operating patterns, you can calculate the percentage of cash you need to meet your daily operating needs. You can also determine the percentage you need for longer-term uses, an amount not typically devoted to operational expenses. Then, you can segment the available cash by liquidity needs and risk tolerance, thinking in terms of three separate buckets:

- Operating cash for day-to-day needs

- Reserve cash for needs that will occur 6 to 12 months down the road

- Strategic cash for needs a year or more out on the horizon

Breaking down total liquidity by time horizon and purpose

Use cash segmentation to guide your investment approach.

Your cash is the product of the sweat equity you’ve invested in your business, so protecting principal by minimizing risk on all your short-term investments is imperative. By customizing investment strategies for each segment, you can maximize the value of your cash assets while keeping a low-risk exposure.

Operating cash: These funds are best invested through FDIC-insured bank deposits, insured cash sweep vehicles, and certain types of treasury securities to ensure full liquidity and completely risk-free protection of principal.

Reserve cash: Liquidity is less urgent for these funds, however, protecting principal is still a top priority. That makes enhanced cash-management solutions the ideal fit for reserve cash—think about short-term certificates of deposit (CDs), treasuries, and money market funds.

Strategic cash: You can look a bit further beyond treasuries and bank deposits for cash that has a longer investment horizon. These strategic cash assets enjoy enough flexibility to allow investment through low-risk, marketable securities—consider treasuries, commercial paper, and investment-grade corporate bonds.

| Operating cash | Reserve cash | Strategic cash |

|---|---|---|

| Liquidity is a priority for meeting day-to-day business operating needs. | Principal protection and short-term liquidity with enhanced returns are priorities. | Yield and total returns are a priority with investment horizons that can exceed a year. |

| Maturity range: 0-15 months

Avg. credit quality: A-AAA |

Maturity range: 0-3 years

Avg. credit quality: BBB-AAA |

Maturity range: 0-5 years

Avg. credit quality: BBB-AAA |

| Objective: Cash management | Objective: Enhanced cash management | Objective: Short term fixed income |

A cash-segmentation strategy needs to address both liquidity needs, as well as risk tolerance. What percentage of cash flow should be immediately available and how much should be protected? How much surplus cash do you need without missing investment opportunities? By thinking about each individual component, you can achieve a more nuanced approach to investing and, in turn, find the financial returns you’re looking for.

Consider time horizons as you map your cash needs. The technical work of analyzing your cash flow, yield curve, duration, and credit, informs your policy’s implementation. Your cash forecasting and investment strategy are impacted by both planned events—such as seasonal demand spikes and budgeted expenses—and unexpected events—like pandemics and geopolitical unrest. With proper planning, you can take advantage of investment opportunities to yield greater returns.

Use your short-term investment strategy to keep your cash as productive as possible.

Take a thoughtful and well-reasoned approach to investing cash while managing risks. Your Truist relationship manager can review your approach to investing short-term reserves and share recommendations to put your cash to work.