John Lynch is Education Industry Manager for Truist, Max Anthony is Head of Institutional Client Strategy for Sterling Capital Management, and Corey Byrd is Senior Client Strategist – Education Specialty for Sterling Capital Management.

With a rising rate cycle, public and private higher education institutions are seeing a core component of financial discipline—their short-term investment strategy—rise in importance. Now, getting your short-term investment strategy right has an even greater impact on your financial returns, not to mention its effect on your ability to manage liquidity, address your cash flow cycle, and deliver on your organization’s mission.

As a steward of your assets, you must ensure your teams and your external advisors are handling your reserves as effectively as possible, adhering to your investment policy, keeping your investments in line with regulatory parameters, and actively managing risk while also optimizing short-term returns.

Whether you’re a larger school with more staff and an adequate line of sight on your cash cycles, or a smaller school with more limited resources and investment management tools, today’s rate environment signals the right time to reevaluate your approach to managing short-term assets.

Start with your investment policy.

By tying your financial strategy to concrete goals, specific tactics, and operating guardrails, your investment policy forms your financial foundation. It gives you an accessible framework for managing seasonal and event-based ebbs and flows and provides a disciplined way to target higher yields and risk-adjusted returns on reserves and strategic balance sheet cash. It’s also essential to risk management.

Investment policies are prescriptive by design and usually state investment objectives and goals, define specific investment strategies and asset allocations, and outline permitted exposures and constraints to provide clear guidance to investment managers and standards to monitor policy compliance.

Whether your institution is subject to investment statutes or not, investment policies are a best practice and key to sound governance. Operating without one can create unintended financial risk, liquidity issues, and undue financial strain.

If you don’t have an investment policy, creating one is a great first step. If you have one that’s outdated, make it a priority to refresh it and set a plan for annual reviews.

There’s a substantial body of expertise that you can access to help you with your investment policy. The investment policies used by higher education institutions contain common elements that you can adapt for your own policy. Non-profit hospitals and corporations deal with similar cash flow, investment options, governance, and overall responsibility issues that can also be applied.

Whether you’re creating your first policy or refreshing one that’s outdated, you’ll want to ask: Does it fit your current standards for prudence? Is it too open-ended? Or is it too restrictive? Does it consider the investment instruments available today and the rate environment that we’re entering? Does it call for a level of Environmental, Social, Governance (ESG) goals that follows your institution’s principles?

Wherever you are with your investment policy, fiduciaries or other financial advisors should be able to offer guidance. Whoever you turn to and however you build your policy, take the opportunity to incorporate standards to measure your level of risk and financial progress.

Putting policy into practice with reserves and liquidity

Cash forecasting and management become more challenging when you need to meet liquidity and reserve requirements to account for planned events (such as seasonal tuition revenues and planned expenses) as well as unexpected events. In addition, public institutions may need to adhere to statutory limitations, requiring the use of certain securities, durations, and curve exposures. Private institutions may have inherently greater flexibility and more opportunities to find higher yields and greater returns.

| Operating Cash | Reserve Cash | Strategic Cash | |

|---|---|---|---|

| Liquidity Needs | Cash required for operations. Principal protection and liquidity are priorities. | Longer-term investment horizon. Principal protection is a priority, but same-day liquidity may not be necessary. | Principal and liquidity are prioritized with the corresponding liability. Investment horizons can exceed a year with yield and total returns a priority. |

| Maturity & Quality Ranges |

|

|

|

| Objective | Cash Management | Enhanced Cash Management | Short Term Fixed Income |

What’s your framework for thinking about the various elements of liquidity? You may have unrestricted liquidity (your operating reserves, strategic cash), board-designated liquidity (like capital expenditure reserves), restricted liquidity, or all of these. By thinking about each of them individually, you can get to a more nuanced approach with your investments and in turn, enhance performance.

Modeling behind investment strategy

Many institutions have felt the pressure from multiple demands over the past two years and have put short-term investments on autopilot, given reduced potential for incremental yield and returns in a low-rate environment. Institutions with smaller treasury teams or lower levels of support from their advisors may not have had the depth to manage the modeling needed to implement investment policy as thoroughly as they would like.

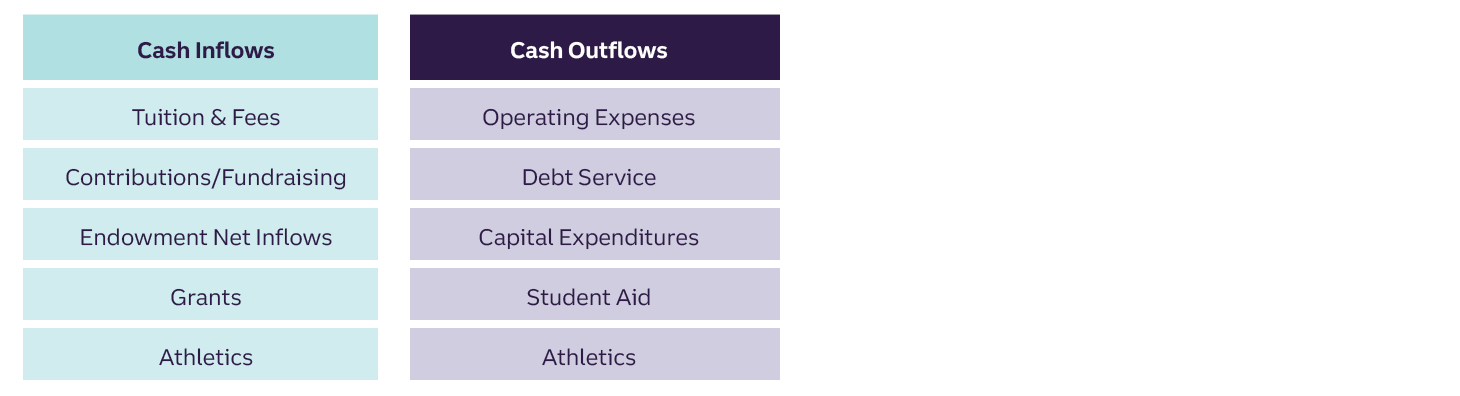

Drivers of Cash Flow in Higher Education

Modeling to support your investment strategy starts by separating your cash flow by time horizon into immediate, short, intermediate, and long-term portfolios, including accounting for any date-certain cash flows or more prescribed time horizons. The technical financial work of cash flow analysis, yield curve analysis, duration analysis, and—if credit is permissible—credit analysis, forms the foundation of your policy parameters.

Your modeling provides your investment advisors with the requirements for your investments, duration, and quantifiable risk necessary to put your portfolio strategy in motion.

Additional questions to consider

As you think about your approach to short-term investments, these questions can provide helpful prompts for conversations with your team and your professional advisors:

- Do you have a policy? If so, how is it structured to address your liquidity requirements or your risk tolerance? What are the parameters of your policy? When was your investment policy last updated?

- Do you have liquidity constraints which might affect the duration-related contours of your portfolio?

- How have you typically managed your cash pool?

- What are your intended uses for your excess cash?

- Have you explored separate accounts for different allocations of cash?

- Once you get beyond the reserves you need for Earning Credit Rate (ECR) and essential operating needs, are you truly maximizing your use of cash?

- What’s your approach to ESG and is it right sized within your overall investment strategy?

Why these questions matter now

As rates rise and you look to mitigate interest expense, don’t overlook the yield on your balance sheet cash. You may have significant amounts of excess cash that ¾with more attention and the clarity provided by a current investment policy¾ could be invested more effectively and enhance results at a time when you need returns most.

Now is the right time to explore opportunities to improve the performance of your investments while also optimizing cash flows and actively managing risk. Your Truist relationship manager can look at your short-term reserves investment approach and share recommendations for how you could tune your strategy and improve your overall financial performance as you work to satisfy your stakeholders and contribute to your institution’s educational mission.

Use your short-term investment strategy to get ahead of rising rates.

Talk to your Truist relationship manager about how you can optimize your financial performance by tightly managing your short-term cash reserves.