When it comes to planning how to pay for long-term care (LTC), people tend to fall into two groups. The first group is people who have had to arrange, implement, and pay for months or years of assisted or nursing care for a loved one.

The second group is the people who haven’t. Neither is the right or wrong group to be in, but the one you’re in will change your perspective on this facet of your wealth plan.

Jennifer Ritorto, a financial advisor with Truist Wealth, explains why. “If somebody has experienced a long-term care event with their parents or their grandparents, then they’ve seen firsthand how expensive long-term care can be and the impact it has on the family,” she says. “They’re much more inclined to want to have the conversation with us around how they can protect themselves and their kids and not put their loved ones through that same sort of pain or stress.”

The group that hasn’t had firsthand experience acknowledges they may have to spend some portion of their net worth on long-term care costs, explains Mark Grow, insurance specialist with Truist Life Insurance Services. But specifically selecting an insurance plan isn’t their preference.

“They might tell us, ‘I’d rather invest and figure out a way to pay for long-term care costs when the time comes,’” Grow says. “We can say, ‘All right, that’s totally fair. But why not allocate and leverage a small portion of your assets and offload that risk to an insurance company?’”

Starting with education

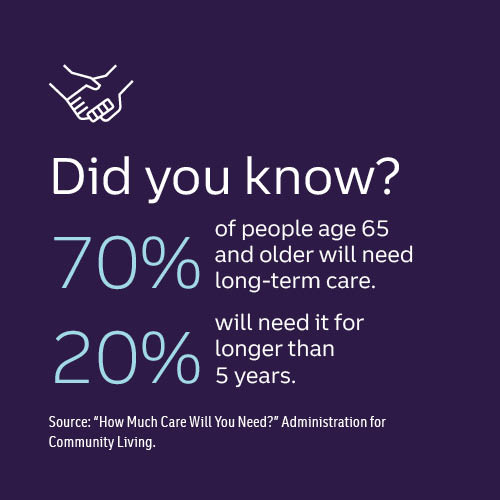

Ritorto and Grow’s path to alleviating stress and preserving wealth starts with dispelling myths about long-term care costs. A few key points:

- Most older Americans will need LTC in the last chapters of their lives. The average cost of LTC in the United States is $6,163 per month for part-time care at home.Disclosure 1

- In most cases, general health insurance only provides limited coverage of a person’s long-term care needs. Government health insurance programs, such as Medicare or Veterans Affairs benefits, may also fall short of expectations. “Coverage is not as much as you think and there’s a lot more red tape,” Grow says.

- Medicaid has dramatic draw-down requirements to meet the income qualifications for coverage. “It’s basically all of your assets minus the essentials, so that’s a shocker,” Ritorto says.

- Liquidating parts of your portfolio or selling real estate to pay for care can be messy, especially if the need for LTC arises suddenly. “You or your loved ones are scrambling for money. You can’t wait. You may create a taxable event having to sell your investments or pull funds out of a qualified account like a retirement fund,” Ritorto says.

Three types of LTC insurance

The long-term care insurance landscape has changed a lot in the past 10 years, offering products and approaches that better meet policyholders’ needs. There are now three main forms of coverage:

1. Traditional long-term care insurance reimburses a policyholder when they need to fund care costs. If they die without needing LTC, their benefit amount is $0. “That’s a use-it-or-lose-it scenario,” Grow says.

2. Hybrid life insurance with a long-term care component works like traditional long-term care insurance in the policyholder’s lifetime to reimburse or pay cash for care costs. The policy will also pay a death benefit, which will adjust depending on how much was claimed for LTC care in the policyholder’s lifetime. If LTC claims weren’t needed at all, the policy pays 100% of the possible death benefit.

3. Universal life insurance with a long-term care rider is similar to hybrid life insurance but offers added features. Heirs receive a high death benefit if the LTC coverage isn’t used in the policyholder’s lifetime, and the policyholder has the option to accumulate cash in the policy through premium payments.

Start early, stay flexible

A key advantage of the hybrid or universal policies is that you can incorporate them into your wealth plan well before retirement age, Ritorto says.

“The younger you are, the better the chances to lock in your insurability,” she explains. “We all age. The older we get, the higher potential for additional health risks, which may reduce insurability or increase the cost to protect yourself.”

This can be particularly appealing to people who have had the experience of arranging LTC for a family member and want to take action now. “I underwrote a 40-year-old whose father had early onset dementia,” Grow says. “He told us, ‘I’m planning for this now because in 20 years it could happen to me.’ He has three kids and a wife, and he’s the primary breadwinner.”

Not only did this 40-year-old lock in his insurability at a young age, but he also established guaranteed LTC benefits for his family that will inflate tax-free and be easily accessible in case care is needed.

Will his family use it? What kind of care will be right for him if he needs it? He doesn’t know today, and he and his family don’t need to decide. “You may not know exactly what you want right now—in-home care, assisted living—but you want the ability to have options,” Ritorto says.

Questions to ask your advisory team about different long-term care insurance policies

What kind of care does this policy cover?

Some plans will cover only formal care—delivered by nurses, therapists, and other professionals. Other plans will incorporate informal care, Grow explains. “In some cases, a friend or family member could provide care, and if he or she is taking time away from work, you could potentially supplement their income loss with these funds.”

How will benefits be paid?

Reimbursement for qualified expenses (think filing receipts) is common. Some plans may also pay a cash benefit (think direct funds to you) as requested or on a schedule.

Does this policy adjust for inflation?

There are two reasons this is important: to determine if your premium costs are fixed or may rise, and to determine if your benefit amounts are fixed or may rise.

Will paying for long-term care insurance hurt my ability to do the other things I want to do in retirement?

Ritorto says this is one of the most important matters to discuss with your Wealth team. “When you go through the planning process, we can look at our analysis and we can show the impact on your finances if you didn’t have long-term care insurance and you needed the care. We can also show if you had insurance protection, how that would change the picture.”

Ready to discuss your long-term care plan?

Talk to a Truist Wealth advisor.