Extra forgiveness

A little overdrawn? It’s all good.

- No monthly overdraft fee.

- $200 Negative Balance Buffer for eligible clients

- Cash Reserve cash advance

Perks Galore

As your Truist total balances increase, so do your benefits.

- Five benefit levels

- Automatic upgrades

- 10%-15% more credit card rewards

Assets

Taxes

Paperwork

Ready to get started?

Let’s locate a Truist professional who can support your financial needs.

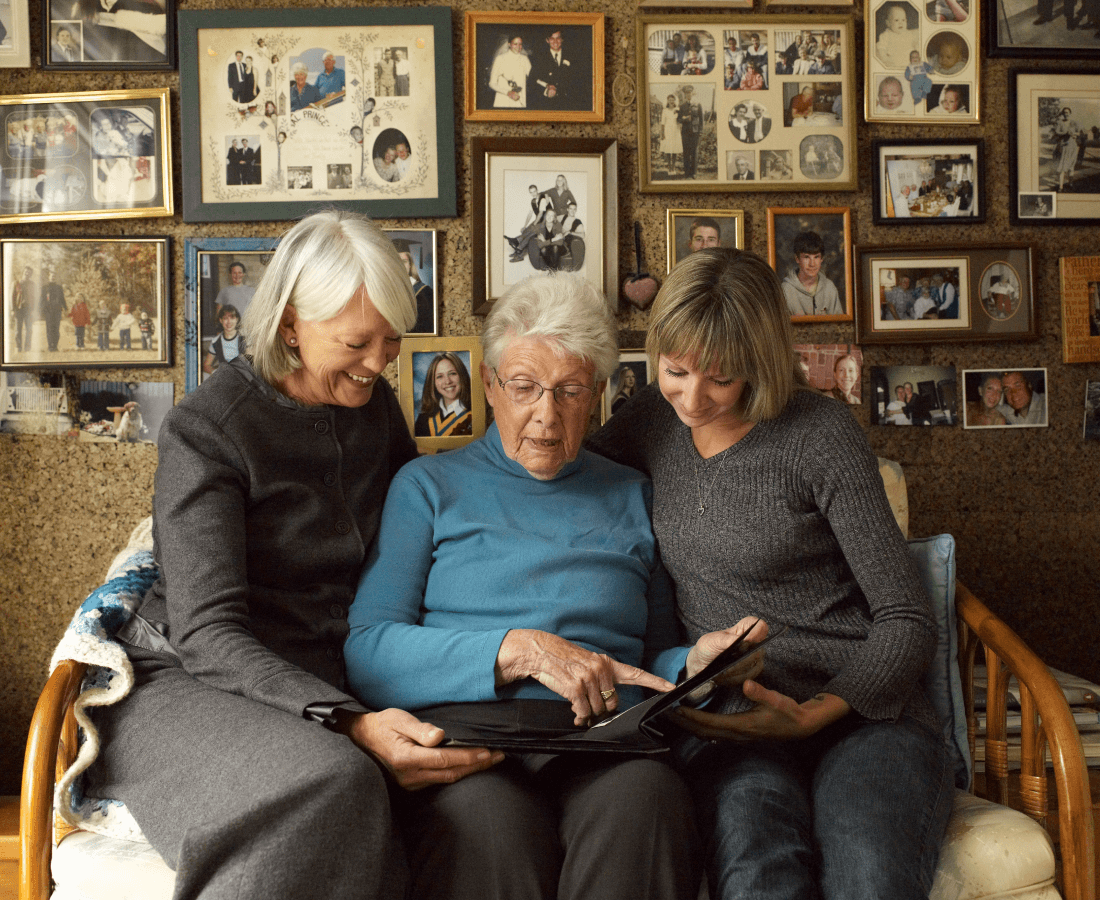

Choosing the right executor for your estate | Truist

Estate planningChoosing the right executor for your estate

The duties of executor can be complex—requiring time, energy, and commitment.

The duties of executor can be complex requiring time, energy, and commitment.

Ways to protect your wealth with insurance

Risk Management Ways to protect your wealth with insurance

As your wealth grows, regularly determine whether you have enough insurance to protect your wealth.

As your wealth grows, you should regularly determine whether you have enough insurance. Here’s how to protect your wealth if the unexpected happens.

Nearing Retirement: Portfolio and Risk Management

Risk Management Nearing Retirement: Portfolio and Risk Management

Determine the asset allocation that works for you today

Now that you’re nearing retirement, keep up your momentum and reduce your investment risk with these strategies.