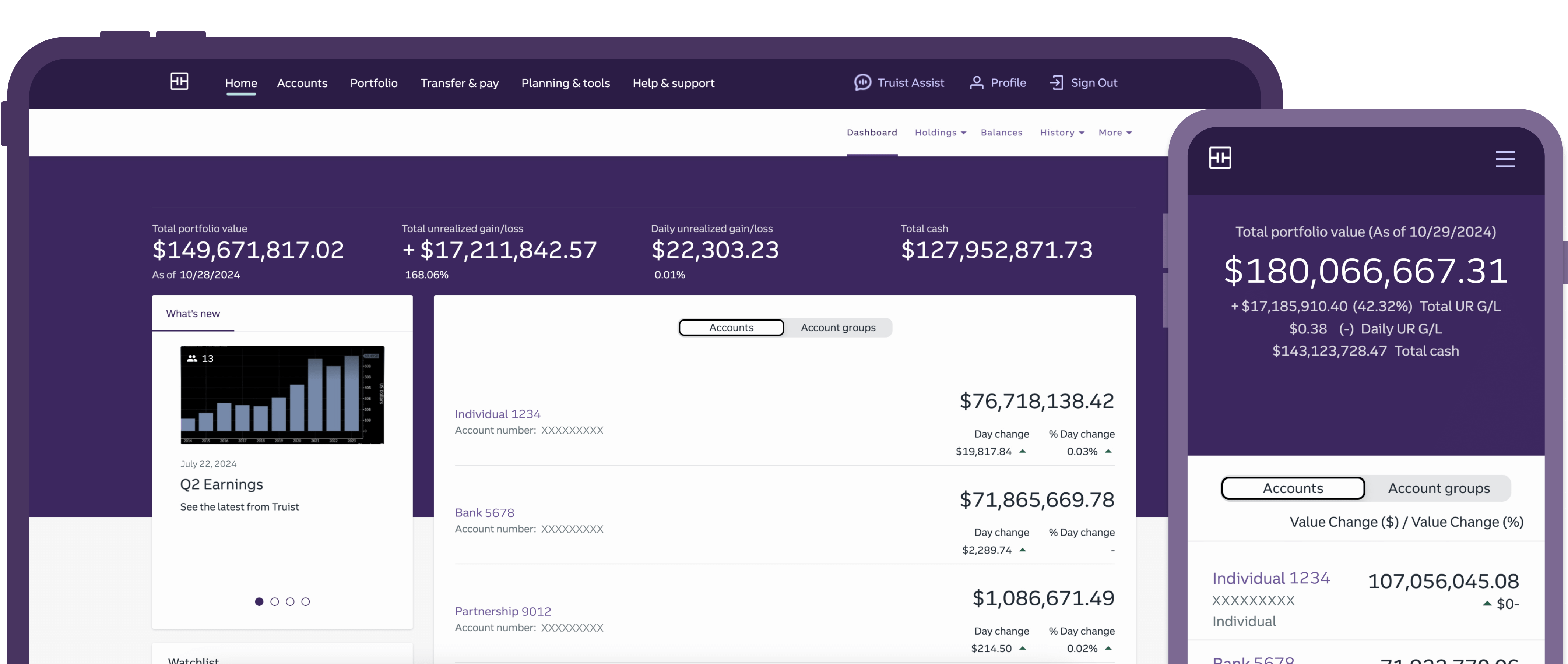

Join nearly 5 million clients using our mobile app.Disclosure 3

Get fast access to your accounts and insights into your spending with the Truist mobile app.

Truist mobile app

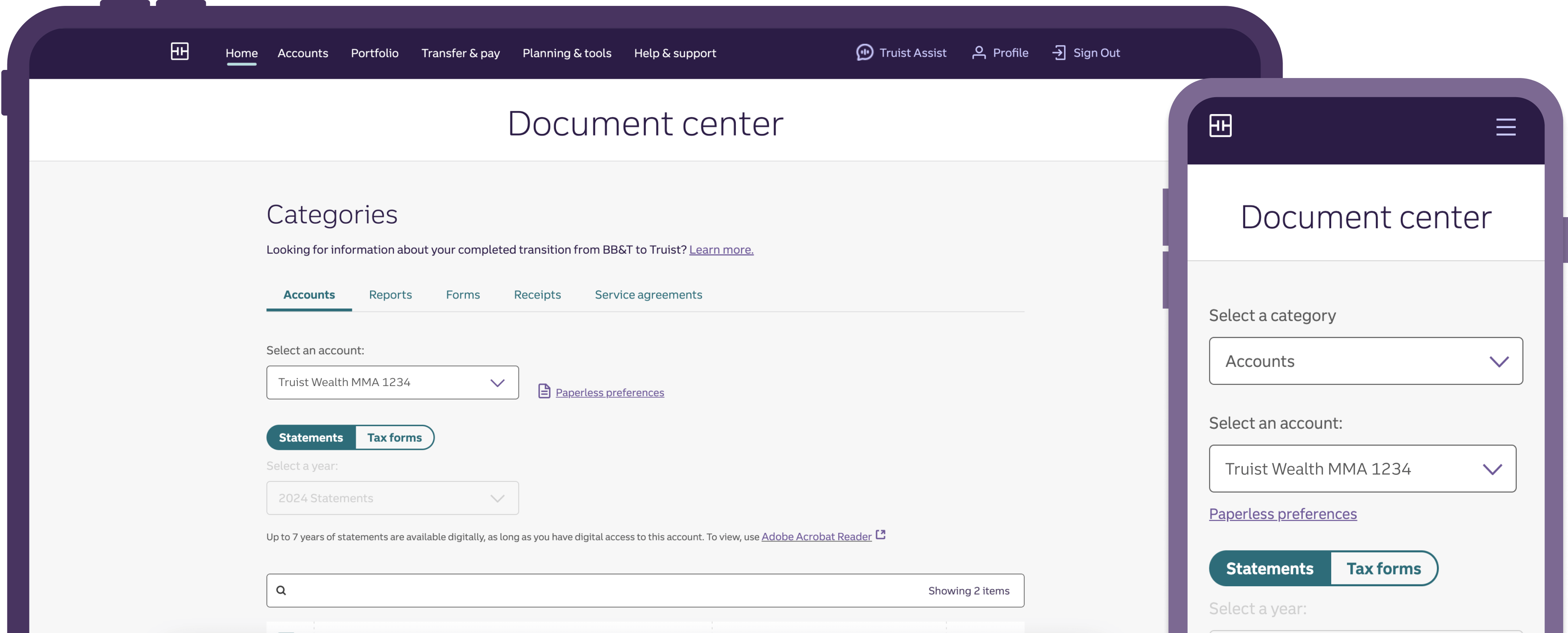

Bill pay and eBills

View, manage, and pay bills securely in one place, with one simple sign-in. With bill pay and eBills, you can view electronic versions of paper bills, track due dates, set up email reminders, and choose your payment frequency. And going paperlessDisclosure 4 helps protect you from mail theft—it’s a win-win.

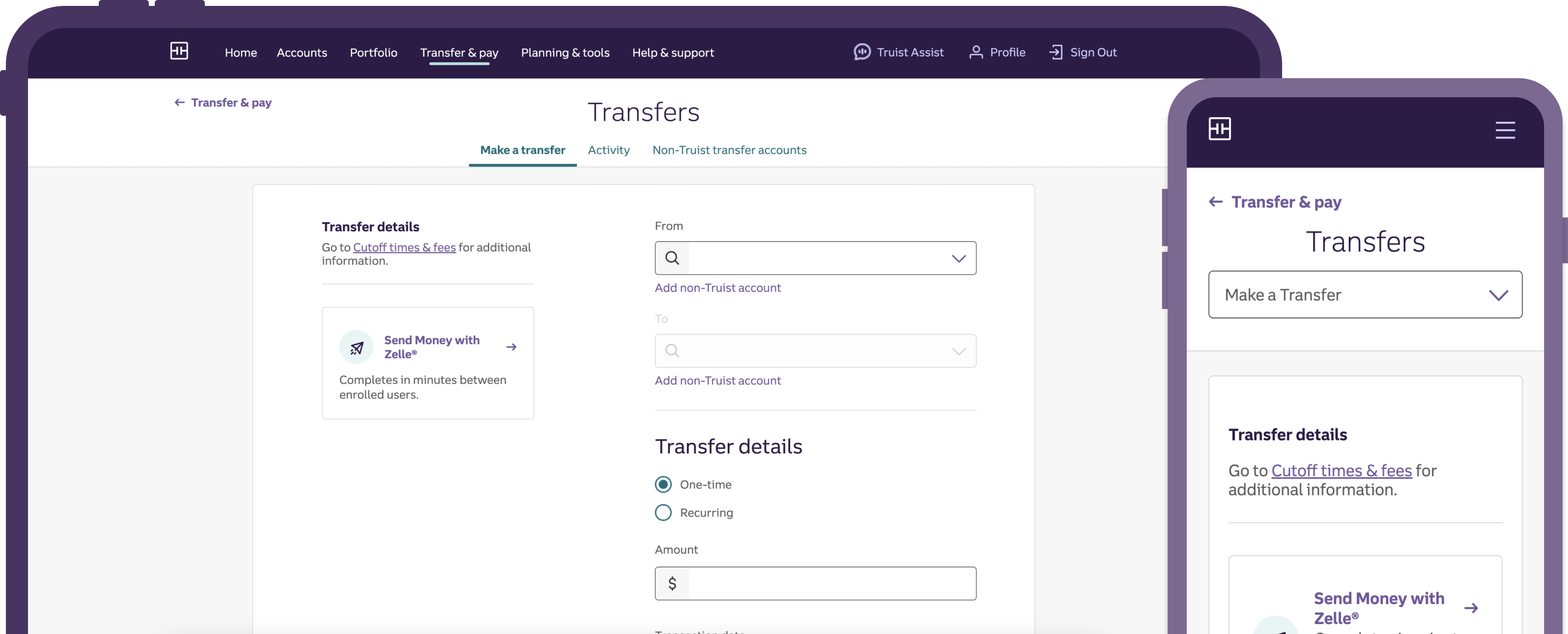

Send money with Zelle®Disclosure 5

Get money payments sent directly to your checking or savings account from trusted friends and family—without sharing your account number. All you need is a Truist checking or savings account and a U.S. mobile number or email.

Self-directed trading

Take greater control of your retirement savings and get in-depth market insights with self-directed online trading through Truist Trade.

Automated investing + help when you need it

Truist Invest is a powerful automated investing platform—driven by technology and backed by human advice.

Work with an advisor

Starting at $1,000,000 to invest, you’ll get one-on-one guidance from a Truist advisor focused on helping you grow your retirement savings.