Change the beneficiary of your 401(k) when you get married. Update your will when you have your first child. Talk about insurance coverage levels when your wealth increases significantly. Fund the revocable living trust you created.

Are any of these or other common financial tasks on your checklist, but you just haven’t gotten around to doing them? If so, you’re in good company. Oscarlyn Elder, co-chief investment officer at Truist Wealth, has had updating the revocable trust in her estate plan on her list for a while. Then she had an “aha” moment where she determined what to ask for when she met with an attorney.

What helped her identify the need to update her trust and keep making progress was knowing her purpose: “to live in peace and joy and to create better futures,” she explains on our podcast “I’ve Been Meaning To Do That.” She says her purpose gives her “an aspirational sense of creating and moving toward something.”

Connect purpose and values to action

Purpose is your reason for being—it’s the driving force behind what you hope to achieve in life. It’s different from your passions. You might feel passionate about music, for example, but your purpose would involve what you hope to achieve with that passion. Maybe your purpose is to help people express their creativity through music. Then, to live out your purpose, you might start a nonprofit organization that provides funds for music lessons in your local community.

Values, meanwhile, are the foundation of your purpose. They’re the driving force behind your behavior and decisions.

When you understand your values and purpose, you’re more likely to stay on track with your financial plan. It helps you maintain a long-term focus on your wealth objectives when unexpected world events or bear markets occur.Disclosure 1

And when you’re finding it difficult to make progress on those financial to-do’s, knowing your values and purpose can help you work down the list.

Focus on family

A common value for clients is family, says Judy Ravenna, senior managing director and wealth advisor for Truist Wealth. “We try to help them think about what some of their more meaningful experiences have been over the past month, year, and five years,” she says. “And it usually all relates to the time they’re spending with their families.”

With family members in mind, clients work toward their wealth objectives of making sure they’re happy, healthy, and safe. Other objectives might expand on that value to helping others. “But that’s where it usually starts—the focus on the family,” she says.

Revisit your financial plan

After you’ve worked to develop your purpose, one item that could always be on your checklist is aligning your purpose with your financial plan. If elements of your financial plan were already in place, you might need to revisit them to make sure they’re connected to your aspirations.

For example, one family working with Truist Wealth’s Center for Family Legacy on governance issues needed to revisit their financial plan. “The matriarch and patriarch of the family had already done some extensive estate planning,” says Tom Lasley, senior vice president and wealth strategist for Truist Wealth. “But there was a big gap between what they had done over the years in terms of their estate and business succession planning and the governance conversations about the true goals and purposes of the family.”

Sometimes a little help holding yourself accountable can spur action. In this case, Lasley helped the family understand that they needed to start making changes to the estate plan.

Learn more: Read our Truist Purple PaperSM “The impact of purpose” for a deeper understanding of this topic.

Job 1: Sound financial practices

So far we’ve discussed how to take action on your purpose with assets you’ve already accumulated. But it can work the other way, too. A desire to live your purpose can spur you to begin saving and investing early in your career.

Emily Haenselman, director of family education at the Center for Family Legacy, says younger people today are especially interested in their impact. “There’s a sense of urgency about making an impact that we haven’t seen before,” she says.

But before young adults try to live out their purpose, building sound financial practices should be the first order of business. Chris Trokey, managing director of the Sports & Entertainment Specialty Group, works with athletes whose career paths tend to earn them more money when they’re younger and less, as the saying goes, when “the ball stops bouncing.” Trokey’s message to these clients is to make good money choices when they’re younger, because those choices will have long-lasting effects when they’re older.

To help spur these clients to take action, Trokey introduces the idea of knowing their purpose. “A lot of times, purpose is discussed upfront,” he says. “It’s what motivates action, such as good habits.”

“If we can help the client define their purpose, then we can ask, ‘Well, what’s it going to take to get there?’ Now we’re into a long-term budgeting conversation. And then the habits will fall in line in order to meet that purpose.”

Work with a team

Even though your values and purpose are unique to you, it’s wise to explore them with people you trust. A financial advisor who’s good at listening and asking questions can help you hone your purpose and build a team for developing a financial plan that’s consistent with your aspirations.

Your financial advisor can also be there to remind you of your purpose and to keep you moving toward your aspirations. And when life events change your perspective, they can help you revisit your purpose, realign your financial plan, and begin acting on it.

First steps to purpose: Explore your values

If purpose is the “why” of your life, values are the “why” of your behavior and decisions. Those values form the foundation of your purpose—when you know your values, you can fully explore your purpose. There are a lot of values; the number varies among experts. Researchers Brian Hall and Benjamin Tonna identified 125 of them.Disclosure 2

Listen to Episode 2 of our podcast (“How to explore your purpose”) and download the worksheet to start exploring your purpose.

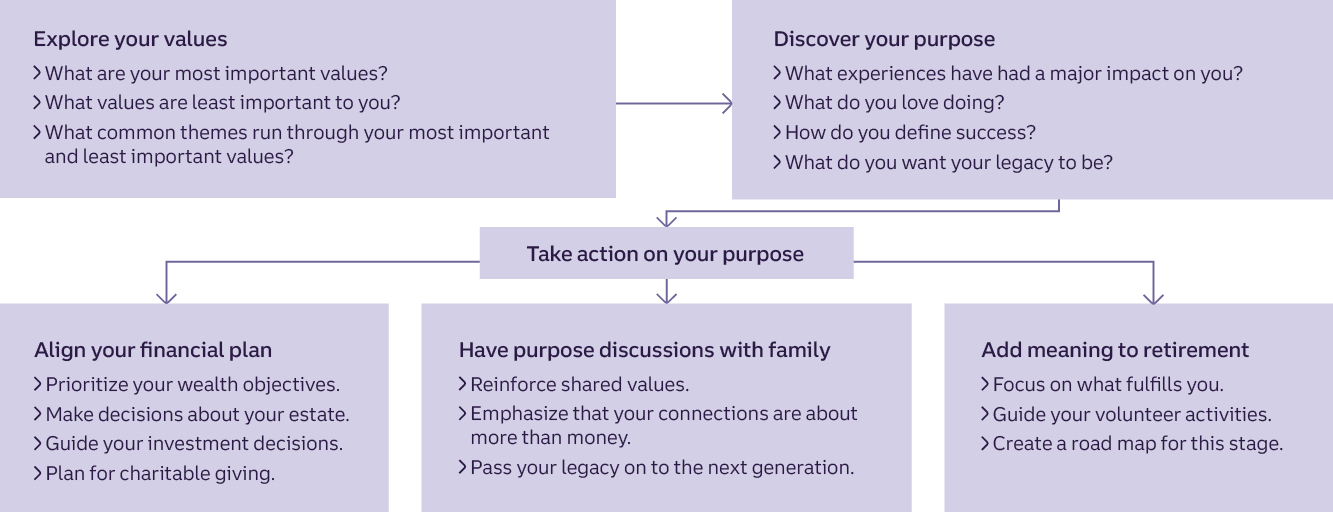

The path to purpose—and taking action

Your purpose can help guide you in making decisions about your financial plan, the legacy you want, and other important parts of your life. Here are the steps you can take to understand your purpose, the questions you can ask yourself, and how knowing your purpose can influence your life. An advisor or someone else who’s good at listening can help you along the way.

Get help taking action on your financial plan.

Talk to a Truist Wealth advisor.