Many families of wealth struggle with a fundamental question: Can our wealth be sustained across generations and have a positive impact on those who use it?

The Truist Wealth Center for Family Legacy has identified a series of best practices for the successful transfer of multi-generational wealth and believes that families who implement them can increase the odds of maintaining the wealth and reduce the likelihood of succumbing to the global phenomenon of “shirtsleeves-to-shirtsleeves in three generations.”

We have found several factors typically impair the successful transfer of multi-generational wealth. These include: poor communication within the family; lack of an established governance system within the family; failure to properly prepare heirs for the responsibilities of inherited wealth; and the lack of a strategic plan regarding the family’s wealth. Failure to address these common pitfalls often results in complete erosion of the wealth created by the first generation and the resulting requirement of the fourth generation to, once again, roll up their “shirtsleeves” and create material success all over.

The power of communication

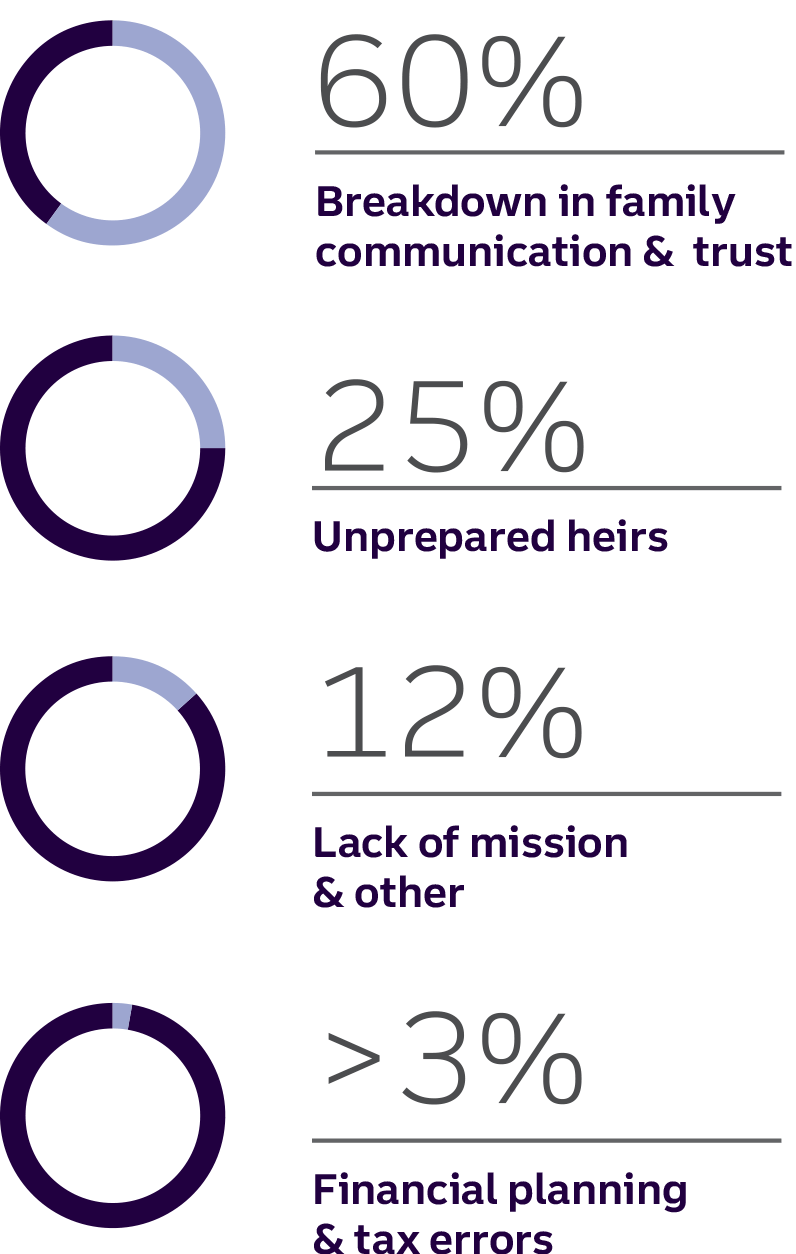

Statistics bear this out. The successful transfer of wealth across generations is as low as 30 percent. Yet, 3 percent of these failures are attributed to tax considerations, legal issues and mission planning, etc. The majority of wealth-transfer failures - 60 percent - is attributed to the breakdown of communication and trust within the family unit.Disclosure 1

For over 30 years, we have been working with individuals and families to help them sustain and enhance their wealth. We have learned that it is essential to recognize the important role the human and intellectual capital of the family plays in successful wealth continuation. The Truist Wealth Center for Family Legacy believes family wealth goes well beyond a family’s financial assets.

Through collaboration with experts, internal research and our hands-on experience working with families of wealth, we have identified six overarching themes and 25 non-financial best practices that we believe enhance a family’s ability to sustain family wealth across generations.Disclosure 2

Family cohesiveness

The family's common bond and desire to work and play together

- Family history & culture

- Teamwork & communication

- Family mission statement

- Family member well-being

- Shared values

Governance

The practice of making informed decisions as a family.

- Family governance

- Family policies

- Succession planning

- Conflict resolution

- Family meetings

Mentoring

Nurture, support, education and collaboration with family members and their advisors.

- Financial education

- Family support network

- Parenting skills

- Support for entrepreneurship

- Money smarts

Philanthropy

Activities and gestures to bring about good or improve quality of life.

- Support for philanthropy

- Shared philanthropy

- Strategic philanthropy

Strategic planning

Developing a roadmap toward long-term family wealth goals.

- Understanding economics

- Wealth objectives

- Planning for major life events

Trusts & estates

Estate planning that aligns with strategic goals and wealth objectives.

- Communicating intentions

- Grantor & beneficiary mentoring

- Selection of trustees & advisors

- Trustee & beneficiary relationships

All in the family

Beating the odds to sustain family wealth for future generations requires a commitment among all the family’s members. The senior generation typically initiates the conversation, and it is often difficult to do. We have found, however, that the manner in which the dialogue begins can have real impact on its ultimate success. For example, we have found that doing so in an interactive family setting can be a positive first step and provide the foundation for ongoing conversation.

In order to promote these conversations, The Truist Wealth Center for Family Legacy created an interactive board game for family members of all ages dedicated to understanding the challenge of perpetuating family wealth across generations. The $hirtsleeves to $hirtsleeves™ board game seeks to explore this dynamic concept through three generations (Gen 1, Gen 2, and Gen 3). The board game includes game cards that correspond to typical issues families might encounter in each generation of wealth. The goal of the game is to get to the end of the board with money – a successful transfer of wealth across the generations.

$hirtsleeves to $hirtsleeves™ is intended to provide our client families with a way to introduce important financial and wealth management terms and topics to their adolescent and young adult children in a non-threatening way through a fun interactive family game. Throughout the game, families have the opportunity to converse about taxes, inflation, debt, insurance, umbrella policies, prenuptial agreements, divorce and many other topics related to living a responsible life with wealth. Industry experts agree that children need to be socialized in these topics prior to being confronted with them. For example, learning about the concept of prenuptial agreements as a wealth preservation strategy provides a family the opportunity to talk about whether such an agreement is or is not in keeping with their family values or way of thinking. Whatever the case, early education is key to preparing future generations to be fiscally responsible inheritors and stewards of wealth.

Conclusion

We have found that families who devote time and effort to the successful adoption of the best practices The Truist Wealth Center for Family Legacy has identified will be better able to anticipate and navigate the many challenges of a successful transfer of multi-generational wealth, and mitigate the risk of the shirtsleeves-to-shirtsleeves paradigm.

Talk to a Truist Wealth advisor or reach out to Truist Wealth’s Center for Family Legacy for more information.