Human beings are driven not only by self-preservation, but also by altruism. Compassion is deeply rooted in human nature.i Giving to others can be one of life’s great joys. In fact, our brains are chemically hard-wired to reward us for acts of giving.ii Research shows that the practice of giving is positively related to happiness.iii

This neuro-psychological research combined with two decades of using our non-financial 25 best practices, has led us to discover what many of you already know: A perspective of gratitude and a spirit of generosity play important roles in wealth creation and sustainability over multiple generations. These concepts are so significant to the longevity of a family enterprise that Truist Wealth’s Center for Family Legacy (CFL) lists three philanthropic activities as part of our 25 best practices for multi-generational families.

The practice of philanthropy is one of the most effective ways to define your values and create a legacy. The additional benefit of building empathy, which includes understanding the needs of others, appreciating how different our lives can be, and cultivating gratitude for the ways we are fortunate, may also be a key to wealth creation. As Dr. Jamil Zaki highlights in his book, “The War for Kindness,” the most effective and successful business leaders actually have the highest level of empathy.iv Family philanthropy may be the most ideal place to practice empathy and cultivate the future leaders of your family.

For families of wealth, incorporating the practice of philanthropy within your family structure brings countless benefits, including two key positive impacts:

- It can help to give greater meaning and purpose to your financial wealth

- It can lead to the successful transfer of wealth across multiple generations.

In addition to the positive effect that the practice of philanthropy can have on family relationships, there continues to be a great need world-wide for this practice. Consider the following statistics:

- In the United States, 10.5% of the population—34 million people—live in poverty as of 2019. For an individual in the U.S., the poverty line is $12,880 a year, or about $35.28 per day.v

- As of 2020, 689 million people live in extreme poverty, surviving on less than $1.90 a day. vi

- COVID-19 drove an additional 97 million people into extreme poverty in 2020.vii

Philanthropy is a win-win, for your family and for your community. But this practice involves much more than just writing a check in times of need. In order to receive its benefits, philanthropy must be done authentically and with sincere intention to impact the lives of others.

Understanding the needs of others against your own privilege can be unsettling. Finding a unique place where you and your family can have impact requires strength, courage and a capacity to see where your gifts match the needs of the world. Effective family philanthropy involves deeply understanding your own values and a clear-eyed view of the needs in your community or across the globe.

As with anything truly important, getting started with family philanthropy can be a daunting task. The following information is designed as a blueprint to help you begin this important work.

Getting started: The practical

Let’s take a look at some practices and strategies you can use as you develop and implement your philanthropic goals.

Identifying values and goals; your motivation for giving

In order for your philanthropic efforts to be as efficient and effective as possible, it is important to have a clear vision in place. That starts with identifying, understanding and processing your goals. And to do that, you must first identify and appreciate your values.

Simply put, the question is: What motivates you to give?

Families have different goals when it comes to philanthropy, and the motivations behind giving are myriad and varied. In fact, you may have multiple reasons for giving. Some common drivers include:

- Religious and spiritual beliefs that spark a desire to give

- A feeling of responsibility to give back to your community

- A desire to promote a family or individual legacy

- An appeal for action in a time of crisis or natural disaster

- Tax-related reasons

Your personal and shared values guide your decision-making in all aspects of your life, not just around your giving. For a family interested in giving together, it is vital to explore the many values you share, and how these values might manifest in your charitable giving.

Taking some time to dig into your motivating values will help you identify priorities around giving. It can be beneficial to seek help with this work. At the CFL, we start with a robust values survey based on the research of values theorists Benjamin Hall and Brian Tonna. Each family member takes a proprietary online values assessment that produces a Personal Values Report for each individual and a Shared Values Report for the whole family. Understanding your shared values is foundational to moving forward with your philanthropic goals.

Determining who to include in your philanthropy

It is also important to define who you want to include in executing your philanthropic goals. You may decide to include your spouse, your children, your immediate family and/or your in-laws, your extended family, professionals you work with, and friends. For the purposes of this paper, we assume that you will want to include family members.

Engaging the next generation, even the youngest among them, in decision-making related to giving, administrative responsibilities, and management decisions around investing, truly pays off. This engagement gives them the experience and confidence they will need to be successful stewards of wealth, not just beneficiaries.

Involving the next generation

The practice of involving the next generation provides:

- A means and structure to assist the next generation with building knowledge and experience in philanthropy

- An opportunity to gain leadership experience

- A chance to engage in governance of the family enterprise, and practice shared decision-making

- An opportunity to enhance the connection and relationships between the generations of the family and enjoy time with one another while making a difference

Involving the next generation begins by cultivating a culture of support for philanthropy within the family. Allowing all family members involved to participate in their own philanthropic goals, along with yours, gives them a chance to support what is important to them. It also allows all family members to share and express one another’s values, which can help lead to an engaged and ongoing relationship within the family. It is, in part, this practice of communication that ultimately assists with the successful transfer of wealth through multiple generations of the family.

Allowing for family members’ voices

When involving your family or other individuals in your philanthropic giving, it is important to make sure you have a system in place that will allow for all voices to be heard. In short, if these individuals don’t see themselves represented in the philanthropic process, they may not feel integral to the practice. Holding regular meetings to discuss the family’s philanthropy, with agendas and meeting norms, is a helpful best practice.

Developing your purpose: The philanthropic mission statement

A philanthropic mission statement grounded in your shared values can become a guidepost for future decisions. Questions about whether to support a certain non-profit or engage with a new philanthropic endeavor can be more easily answered when considered through the lens of your philanthropic mission statement. Moreover, turning to your mission statement to explain what you do not support is of equal importance.

Before drafting a philanthropic mission statement, first explore your philanthropic values. Then, decide where you want to focus your giving. If you cast too wide a net, it will become hard to make decisions, hard to say “no” when asked, and harder to make a real impact. If your focus is too narrow, you risk alienating family members who aren’t as passionate about that specific area of giving.

While there are many ways to draft a philanthropic mission statement, we do not recommend that you do it alone. At the CFL, we begin this process with the shared values exercise described earlier. Then, a CFL advisor facilitates a family meeting and works with the family to develop a philanthropic mission statement based on these values. Families consistently find it fun and rewarding work. Time and again, we see the reward of starting with values.

Consider a donor intent statement

A donor intent statement might be important if you have very strong feelings about how you want this money to be used, or how you don’t want it to be used by future generations.

In a donor intent statement, you can describe your giving/charitable principles, interests, and goals so that future givers may understand your vision. You may wish to include a statement regarding where you would like the giving to be focused, and you can also make clear what activities/organizations should not be supported and the reasons why.

Keep in mind, that if you want your philanthropic legacy to continue into perpetuity, it is critical to build in flexibility for future generations. A donor intent statement that is too prescriptive can limit the effectiveness of your giving as the world and your family evolve.

One strategy we have seen that effectively codifies donor intent while striking a balance between the generations, is the sharing of important and pivotal personal and family stories, which shape and give context to your vision.

At the CFL, we believe an effective donor intent statement allows for a balance between current and future generations.

Next steps: The technical

Since the early 2000s, there have been a number of studies looking at donor satisfaction, and the findings may shock you. Many donors who gave significant amounts to their charities of choice came away dissatisfied with their gifts. This failure for a donor to have a successful, positive feeling about his philanthropy left many business-minded people looking for answers. Some of the leading philanthropic consultants found that a key reason was unclear expectations and/or unrealistic goals.

The field of philanthropy had been driven by well-meaning intentions and high emotional intelligence, but not always a disciplined approach to metrics and results. The last 20 years have seen an increased focus on defining goals with precision and setting metrics that can be measured.

The clearer philanthropists are about their goals and the more effective they are at communicating those goals with the organizations they support, the more likely they are to feel their resources are achieving impact. Additionally, when you work with this level of clarity it becomes easy to say no to requests outside your scope.

Though this requires some work, it ends up saving time and money, and results in much higher satisfaction for the donor and the recipients of the generosity.

Putting your philanthropic goals into action

After you have identified and clarified your values and vision, the next step focuses on how to achieve your goals. These preferences will help shape your overall strategy.

In order to be most effective with your family philanthropy, you need to understand how and when you want to give:

- Do you want to put a mechanism in place for ongoing giving, or do you want your giving to be done on a case-by-case basis?

- Do you want to handle all the administrative tasks involved, or would you prefer to put this into the hands of others?

- Do you want to give during your life, or would you like to leave a philanthropic legacy that continues after you pass?

Your answers to these questions will help to determine the most appropriate approach.

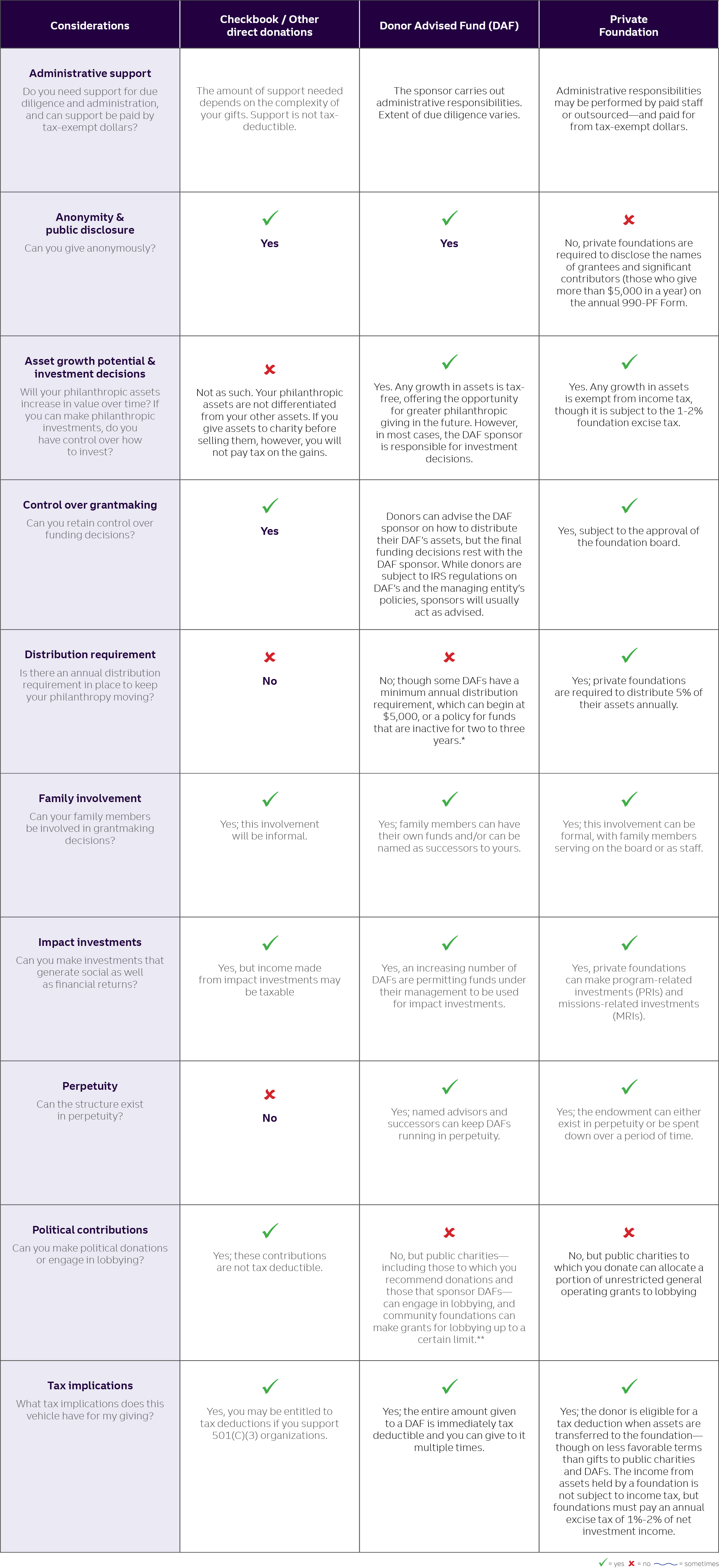

When it comes to philanthropic planning strategies, there are many options to choose from. There are positive characteristics and potential drawbacks to each of the following methods and entities:

- Direct Giving: Simply put, direct giving involves writing a check or giving funds directly to the charity of your choice. This allows for flexibility because there is significant opportunity and no formal structure to follow. However, this approach does not allow the opportunity for planned ongoing giving, nor will this method continue past your lifetime.

- Donor Advised Funds: A Donor Advised Fund (DAF) is an individual account set up with a public charity, such as a community foundation. Contributed assets are managed and administered within the DAF. Donors recommend eligible charitable recipients, but final granting authority and investment control reside with the DAF’s directors. A DAF has no minimum annual giving amount required.

- Private Foundation: A private foundation is a not-for-profit legal entity established by a person, family, or business that is organized exclusively for charitable, educational, religious, scientific and literary purposes. Donors may contribute a wide range of assets and retain full control over those assets, including control over investment decisions and grant-making.

Foundations tend to be multi-generational and last in perpetuity. They are wonderful vehicles for family involvement and maintaining control. Keep in mind that foundations are strictly regulated and are required to file annual tax returns and make annual minimum distributions in order to avoid tax penalties.

A note about community foundations

Community Foundations are grant-making public charities that are dedicated to improving the lives of people in a defined local geographic area.

They are tax-exempt charitable organizations that provide support from funds they maintain and administer on behalf of multiple donors. They seek support from the general public, but they also provide grants to other charitable organizations.

Many community foundations manage and/or administer donor-advised funds, scholarship funds, and technical assistance and training programs for nonprofits.

Charitable Trusts

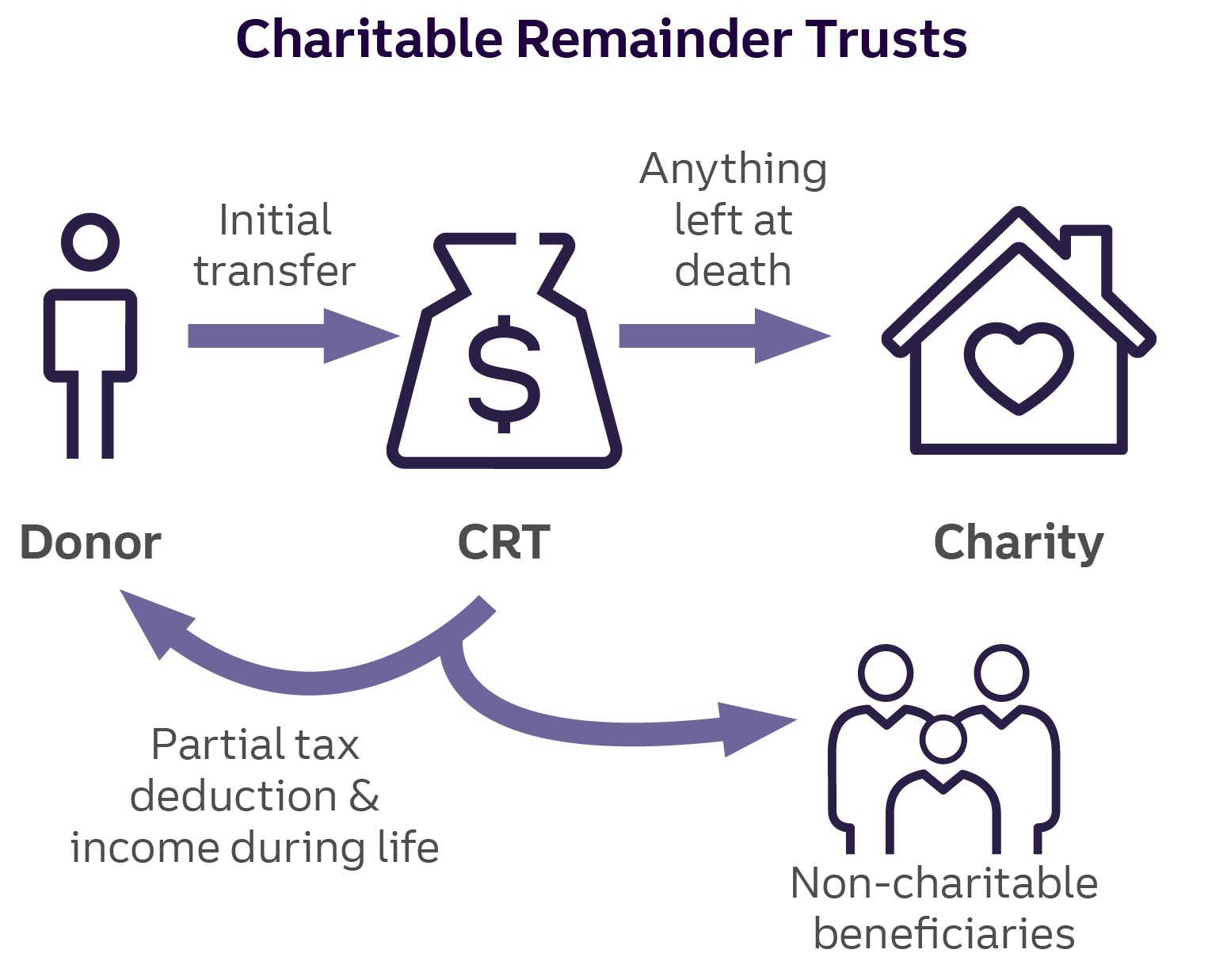

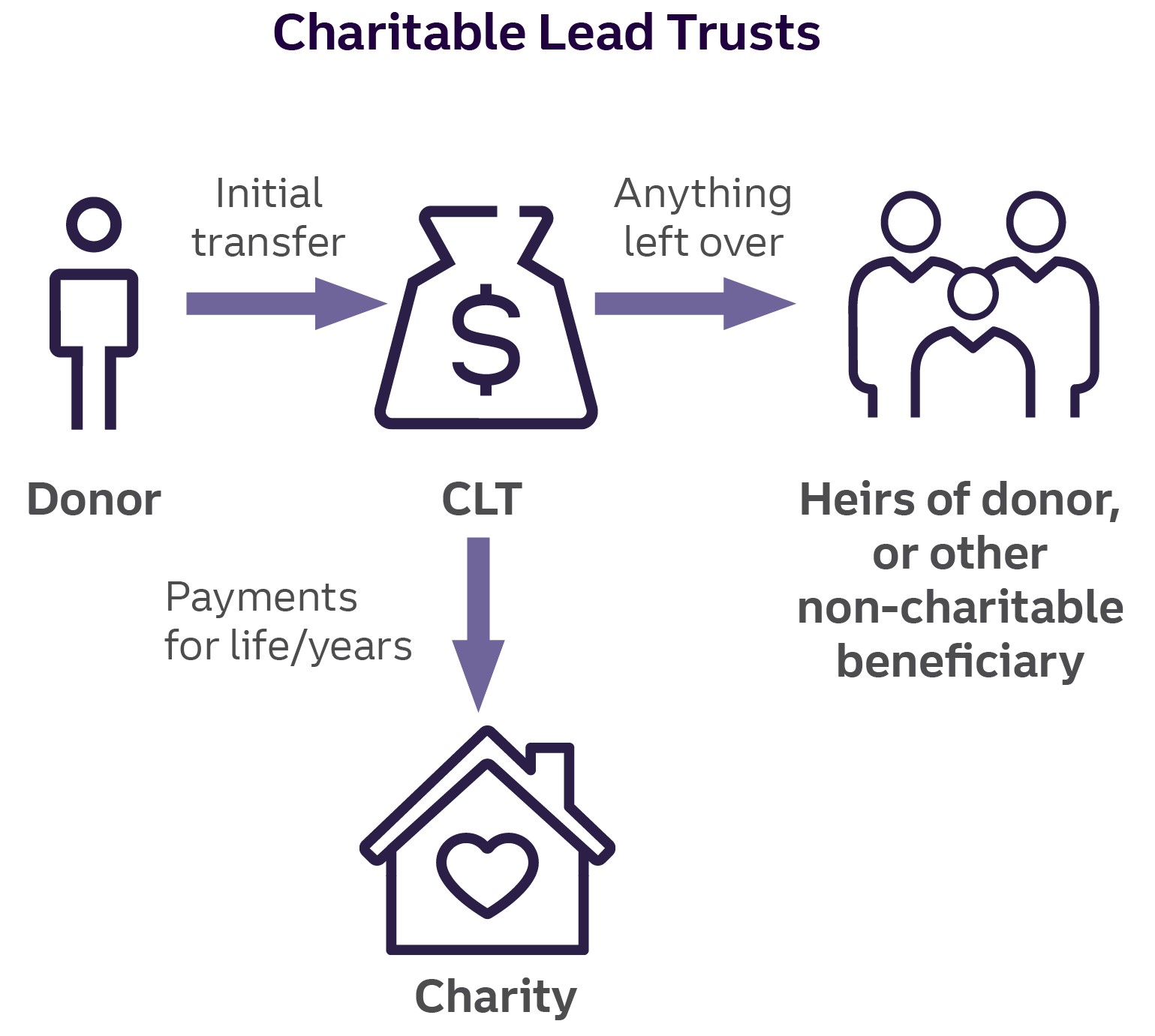

A charitable trust is a trust created for a set period of time. A donor receives a tax deduction and the assets are held and managed in a charitable trust for a specific amount of time.

Typical examples include charitable remainder trusts and charitable lead trusts.

Charitable remainder trusts allow the donor or other non-charitable beneficiary to benefit immediately from the trust for a specified period of time (the life of the beneficiary, for example,) after which the assets are transferred outright or in trust to a charitable beneficiary. These trusts are helpful when a donor wishes to provide income to a non-charitable beneficiary but also has charitable goals.

Conversely, a charitable lead trust benefits a named charitable beneficiary for a set period of time, after which the assets are transferred in trust or outright to a non-charitable beneficiary. They can also be helpful to allow a charity to benefit from a donor’s assets for a set period of time, while also ensuring that a non-charitable beneficiary will ultimately benefit from those assets.

Keep in mind that charitable trusts require formality. They necessitate the engagement and ongoing involvement of trustees, file their own tax returns, and must meet fiduciary standards and laws applicable to irrevocable trusts.

A further note on social impact

It is important to note that, in addition to the above vehicles there are a number of approaches to social and environmental impact that have become popular in recent years outside of the non-profit sector. These include for-profit, or quasi-for-profit entities designed and administered with a fundamental social, political, or environmental conscious approach or mission. These include the use of LLCs, certified B corporations, and benefit corporations. Additionally, an increasing number of families of wealth are including impact investing, investing in environmentally and socially conscious or motivated securities and businesses in their overall plan. Note that, as explained earlier, these areas are not specifically detailed in this whitepaper as the focus here is the traditional approach to philanthropy.

Keep in mind that many charitable strategies require an annual tax return to be filed, and in some cases, certain annual registration and certification criteria will need to be met. Some entities also require the ongoing engagement of trustees who serve in a particular fiduciary role. It may be helpful to note that there are many third-party agents, including attorneys, CPAs, and financial institutions (including Truist) who are uniquely qualified in and experienced with this work.

Regardless of whom you choose to include in your giving and among your advisors, you need to be sure to include people you trust and who are qualified to manage and run your philanthropic entity. You will need an individual(s) who are willing and able to manage the resources earmarked for giving and make important decisions around the giving and management of the enterprise.

Other practical concerns

Ultimately, you will need to consider what and how much of your resources you wish to dedicate to your philanthropic goals. This will help to identify the resources and investments to be used, along with any tax implications you will need to take into consideration.

You will be best suited to make these decisions by engaging your advisors to help you. These may include your investment advisors, your attorney, a CPA, and other trusted advisors.

It can also be very advantageous to develop a clear system for how decision-making will be made, and to employ the practice of allowing all family members involved to be heard. The CFL team has deep resources to offer as you plan for this future.

Conclusion

Family philanthropy can be extremely rewarding in bringing family members together and deepening relationships within the family through a common cause. It is also, of course, extremely beneficial to the causes you care about.

Before you begin a philanthropic practice, it is important to have a thoughtful plan in place, and include your family members in key decisions. Truist Wealth’s Center for Family Legacy advisors are here to help you and your family understand your personal and shared values, codify your goals, and work together to develop a plan. Together, we’ll create a plan that, over time, will greatly assist in the successful transition of your family’s wealth across multiple generations and leave a philanthropic legacy of which the family will be truly proud.

Talk to a Truist Wealth advisor or reach out to Truist Wealth’s Center for Family Legacy for more information.

A note about social impact

It is important to mention a rising movement in the United States and worldwide to advance social and environmental justice, that can feel and look differently from traditional philanthropy. This movement is being inspired and led by millennials and Generation Z (those born between 1996 and 2014). Important characteristics of individuals in Generation Z include their independence, self-confidence and autonomy.8

“Generation Z is the youngest, largest, and most ethnically diverse generation in American history,” writes Rachel Premack.9

The activism of these generations and their focus on impact is changing the landscape of philanthropy, social entrepreneurship and even how traditional business and investing are done. Their interest in the social and environmental impact that all of our daily behaviors, vocations, wealth, and actions have, is changing the traditional philanthropic landscape in a number of ways. This perspective carries with it the power to permanently change how our culture approaches executing on our values. For more information, look for the second paper in this series, soon to be published, or speak with your Wealth Advisor.