Grow Your Business

Tap into guidance from coaches and consultants to help you run your business.

Protect Your Assets

Accounting and financial business software

Protect your assets

Online banking helps you see the big picture - from almost anywhere.

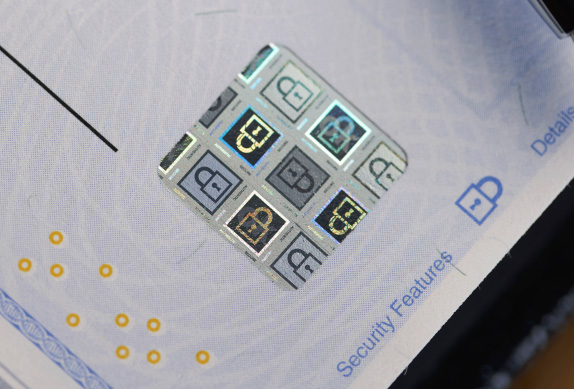

Help protect your small business from check washing fraud

Protect what matters Help protect your small business from check washing fraud

Check washing is one of many threats that require vigilance from small businesses.

Small businesses owners can be vigilant against check fraud scams with prevention techniques and secure payment systems to mitigate financial fraud risks.

Resources to support your multicultural business

Managing your business Resources to support your multicultural business

Resources & Tools For Women Business Owners | Truist

Managing your business Finding the resources to support your woman-owned business

To help women owners address the issues that concern them most, we’ve identified resources for women business owners.

Discover invaluable resources for women entrepreneurs. From networking to capital access, Truist offers insights and tools for women business owners.

Fight Back Against Fraud | Truist

Protect your assets Fight back against fraud

The rise in cyberfraud has small businesses looking for effective defenses to avoid the costs and distractions of an attack. Follow these six steps to help protect your business from fraud.

Be Fraud Aware | Truist

Protect your assets Be fraud aware

Know the sources of today’s business fraud.

Cyber fraud has been on the rise, and small businesses are prime targets for costly attacks. Understand the sources of fraud and be alert to the latest schemes to prevent your company from becoming a victim.

Getting A Business Loan Doesn’t Have to Be Hard | Truist

Control cash flow Borrowing tips for your business

Businesses often want to know whether they’ll be able to borrow the funds they need.

You can improve your chances of getting approved for a small business loan by focusing on the 5 Cs of Credit that lenders often use to evaluate loan applications.