What does our care mean for your small business?

Local expertise and long-term partnership. A shared focus on community impact. Rewards for your loyalty. And big support for your business.

What can we help you with?

Whether you’re just starting out or accelerating growth, we have a checking account that’s perfect for your business.

We meet the evolving needs of your small business with practical advice, full-scale capabilities, and caring partnership, and we’re continually focused on the long-term success of your business.

Big bank solutions—local touch

Zelle® payments mean less time worrying about cash and checks and more time focusing on your business.

Eligible clientsDisclosure 2 can earn a 3.40% annual percentage yield (APY) with a new Truist Business Money Market account.Disclosure 3

Need a cash flow boost? From taking care of bills to taking care of growth—you’re ready for anything with the right credit card.

Online banking that grows with your business

Make plans. Pay bills. Get paid. Take care of everything—wherever life takes you.

- Stay on top of your finances with custom alerts delivered how you want.

- Send and receive money with multiple payment options.

- Deposit checks with just a few taps and snaps.

Open the door to new ideas.

Ready for success? Get tips on everything from getting started to transitioning.

Watch the “Small Business, Big Heart” web series.

See how our clients are going above and beyond to serve our communities.test

Recognizing those who get it done.

May is Small Business Month, and we’re privileged to be partnered with dedicated business owners who inspire those in their communities and ourselves.

Sign up for more information.

Sign up to receive our bimonthly Business Break newsletter and invitations to upcoming webinars.

Contact us

We’re here to hear—and help.

Let’s chat about how we can help you take care of business.

Make an appointment.

Schedule an in-person or virtual appointment.

Model : "disclaimer"

Position : "left"

Business Owner 1 (00:04):

My business has been in our family for years. To build on that legacy, I needed a financial partner to guide us on how to invest in the business and keep it going.

Business Owner 2 (00:14):

My employees depend on me to keep the business financially sound, so I needed a financial partner who could offer tools to manage cash flow, give us more perks as time goes on, and care about my business as much as I do.

Business Owner 3 (00:27):

I put my heart and soul into what I do, and it inspires my customers to tell others about my store. To keep expanding, I needed a financial partner who could understand my goals and help me keep up with the way my customers want to pay. That's why I chose Truist.

Business Owner 2 (00:41):

I like that Truist brings deep knowledge to my business with all the services I need. But even better, it's clear they genuinely care about me and want to see my business succeed.

Business Owner 3 (00:51):

Plus, Truist knows how important my business is to the community because they're a part of the community too. My Truist branch and support team are just down the street. So, whenever I need to see someone face to face, they're right there.

Business Owner 1 (01:03):

And when I'd rather talk over the phone, I can reach a small business specialist who listens to my ideas and offers helpful advice.

Speaker 4 - Narrator (01:12):

As a small business owner who brings big value to your community, you deserve a banking approach that works for you. When you start with care, you get a different kind of bank. See how far your business can go when we work together. To get started, call us, schedule an appointment online, or stop by a nearby branch.

Model : "disclaimer"

Position : "left"

Small Business Bank Accounts, Loans & Credit Cards #1

Your business succeeds because of your effort and drive. And we're here to help you keep the momentum going. We've designed your online experience to meet your unique needs as a business owner.

Here's a look at how it works.

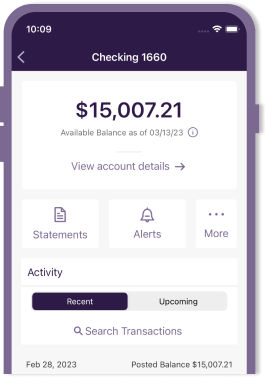

(Visual Description: Truist Online Banking Home screen displays account options.)

The home screen focuses your financial picture into a single, simple view, quickly giving you the information, you need.

You can conveniently see your accounts and details, access recent transactions and history, and review your statements and notifications. Need to send money to a vendor, make loan payments, or send a wire?

Transfer and Pay is your money movement hub.

(Visual Description: Transfer & Pay screen shows multiple options below the section titled, What can we help you with?)

Here, you can pay your bills, make ACH payments, transfer money to other accounts, and use Zelle-- a fast, easy, and safe way to send and receive money. Simply select the payment type that best meets your needs, and we'll help you move money with ease.

Managing your payroll doesn't have to be a hassle. Simplify your process anytime, anywhere with the Online Payroll feature. We give you the flexibility to easily pay your team by check or direct deposit.

(Visual Description: Preview Payroll screen shows options for “What WE Will Do” and “What You Will Do”)

And we do the heavy lifting for you by automatically calculating and filing your federal, state, and local taxes.

You can also use valuable HR tools and resources to help your business stay compliant with labor and hiring laws specific to your state. We know that you're on the go often.

So, we've made most of your online features available in the mobile app.

(Visual Description: Mobile Deposits screen on a smart phone displays options for Deposits and History.)

Take advantage of depositing checks from your phone with mobile check deposits.

And save yourself a trip to the ATM or branch. Want to give your team more autonomy?

(Visual Description: Business admin feature screen displays the section for Profile & Settings, directly under the Business account selection on the tool bar)

Use the Business admin feature to provide account access to other company members, set up specific roles for your employees, customize permissions, and add, edit, or remove users at any time.

(Visual Description: Manage users section shows options to select different users.)

The last thing you want to worry about is potential fraud. So, we've made it easier for you to stay on top of it. Use Fraud inspector to review checks and ACH payments for suspicious activity.

(Visual Description: Monitor accounts screen displays options to Monitor accounts and Manage enrollment.)

And if something doesn't look right, you can request to reverse the transaction.

Online banking with Truist helps you effectively manage your finances in a smart and straightforward way so you can get more done to help your business thrive.

(Visual Description: Truist title and logo)

Disclosure:

Truist Bank. Member FDIC © 2022 Truist Bank Corporation. Truist, the Truist logo and Truist Purple are service marks of Truist Financial Corporation.

Truist Bank Corporation. Truist, the Truist logo and Truist Purple are service marks of Truist Financial Corporation.

For your protection, Zelle® should only be used for sending money to people or businesses you trust.