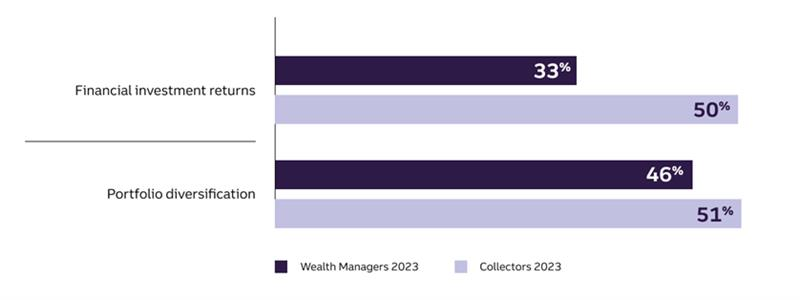

Investing in Wine & Wineries: Grow Wealth Through Passion

Lifestyle Invest in your passions: Wine and wineries

A case for fine wine investment

Article

10/13/2025

Article

Discover how investing in wine and wineries can diversify your portfolio and fuel your passion. Explore wealth strategies with Truist.

Make Buying or Building Your Dream Vacation Home a Reality

Lifestyle What makes the perfect vacation home?

Your Truist Wealth advisor can help make your dream second home into a reality.

Article

05/19/2025

Article

Learn three areas to consider when planning to finance a second home and how a Truist advisor can help you get one step closer to meeting your goals.

Luxury Travel Planning Tips To Capitalize on Market Growth

Lifestyle The new era of luxury travel

Growth in the luxury travel sector gives you new opportunities for unique getaways.

Article

05/12/2025

Article

Learn how a wealth advisor can help you take advantage of recent growth in the luxury travel sector, and find opportunities for unique getaways.