Business transitions, like the sale of a company, an acquisition, a restructuring, or a CEO change, are common in the middle market with 77% of businesses having experienced a transition in the past five years or expecting one in the next five.Disclosure 1 Transitions often provide the spark for improvement and innovation that keep a middle-market business moving forward.

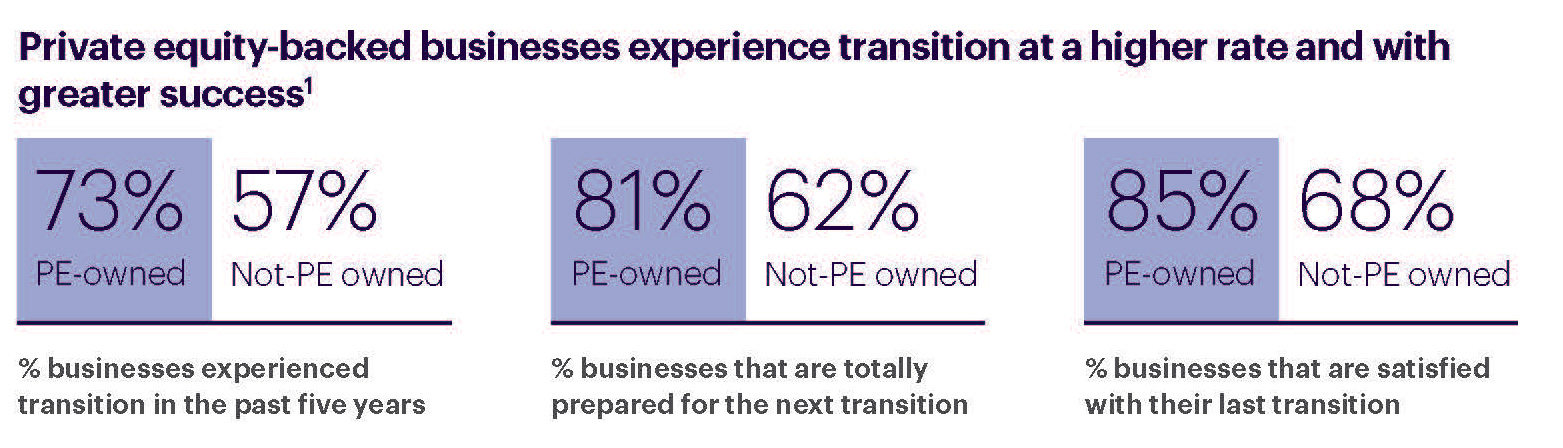

Private equity firms depend on business transitions to create value in their portfolio companies. Compared to other firms, companies backed by private equity engage in business transitions more frequently, are better prepared for them and see better results.Disclosure 1 They hold a distinct advantage over businesses not backed by private equity in being able to use business transitions to create value.

“Private equity investors place a higher priority on transition, including planning and readiness, than companies that don’t have an outside investor,” says George Calfo,Managing Director, Mergers and Acquisitions at Truist Securities*. “Transition is higher on the priority list, and those businesses that are experiencing transitions are more successful and find better outcomes.”

The COVID-19 pandemic and the business disruptions following in its wake didn’t spare private equity. With the uncertainty and slowdown in the early stages of the pandemic, private equity firms turned back to care for their portfolio companies, making sure they had access to capital, support in taking action through the downturn, and help seizing growth opportunities. In short order, activity rebounded with company solicitations back to normal or elevated levels and deals flowing. Overall valuations may be off a notch, but private equity is willing to put its long-term capital to work and pay up for companies that are performing during the pandemic.

Appreciating the private equity model

Learning transition lessons from private equity firms starts by appreciating the private equity model. Private equity has grown tremendously—60% of companies surveyed had a private equity investmentDisclosure 1 — but it doesn’t always enjoy the best reputation. Russell Sanders, managing director, Business Transition Advisory Group at Truist Wealth says, “Private equity is not about stripping value, it’s about creating value. They’re not the wolves of Wall Street.” Sanders adds, “Private equity does a fantastic job of getting money to owners, redefining leadership roles, focusing the business, and fulfilling obligations to employees. And that doesn’t even count the benefits it can provide in growth capital and expertise.”

Private equity firms use transition events to deliver what owners want: increases in revenue, more efficiencies, additional capital, and a strategic path to creating new value. Finding and shepherding new sources of innovation, whether in product development or technology-driven processes, is the key to the competitive advantage and the higher potential returns private equity offers. Calfo notes, “Where private equity brings experience tends to be in implementing new systems, augmenting management, sourcing new talent, completing an acquisition strategy, or outsourcing part of their manufacturing base. They have a perspective on what needs to be done to exit with an attractive return, and they’re disciplined in their pursuit of that path. I don’t always see that same discipline across the board for businesses without external capital.”

Private equity firm and portfolio business compatibility begins with similar values, comparable management styles, and relevant industry/sector experience. Doug Speegle, group head, Financial Sponsors Group at Truist Securities, says, “Success starts with your fit with a private equity firm, as you work to get a common goal around strategy and deal structure along with partial liquidity for those who want to stay involved in the business. It’s how the whole transaction comes together such that everyone gets what they want. That’s more important than a single-point estimate of value that you receive.”

The private equity approach to transitions

Business transitions are a core component of the private equity model, so it’s no surprise that private equity firms manage them well. There are three components that illuminate the private equity performance advantage with business transitions:

- Transitions are at the core of the private equity model. Most private equity funds typically raise and close funds within 10-years. Portfolio company investments will usually be made and closed within that same timeframe, so there’s at least one assumed transition for every investment. Private equity firms build the expertise to plan for and execute on transitions. “Private equity is designed to rollover every five or so years, so of course they place a high priority on transition planning, and they prepare the company for transition,” says Calfo. “Begin with the end in mind. Private equity rarely goes into an investment without thinking about what their exit looks like.”

- The private equity model depends on meaningful improvement in portfolio businesses, and transitions play a vital role. Transitions are important catalysts to put the right leadership in place, achieve scale, and organize the business in the most effective way, all critical to private equity success and returns. Speegle says, “First and foremost, private equity firms are focused on increasing the value of the equity of the business, and ultimately, increasing the value of their share.” Calfo adds, “Private equity is operating as a fiduciary for their investors. They go in with a very disciplined approach of which steps drive the return dynamics they want. Those might include management change or augmenting management together with adding geographic or product growth, either organically or by acquisition. Whatever the strategies it uses, private equity goes in with a plan for an exit.”

- Setting up the second bite of the apple. Many owners’ primary asset is their stake in the business. They’re often torn between holding out for the business’s value to grow and cashing out to remove the risk of the value going down. One way to carry out both objectives is to use private equity for partial liquidity while holding a smaller stake for the “second bite of the apple.” The second bite of the apple allows owners to benefit from the value the private equity firm will generate using strategic shifts, growth capital, acquisitions/divestitures, and fresh leadership.

For owners staying with the business after transition, a private equity investment usually allows for some owner liquidity from the sale, while also reducing concentration of assets in the company and allowing for a stake in the company going forward. Speegle adds, “Private equity provides an opportunity for owners to transition in stages. To the degree that you’re the CEO or owner-operator, private equity firms provide a very good transition in that they would be willing to invest in the business today, even if you’re not interested in being the CEO in three to five years. There are a lot of businesses where somebody keeps a substantial minority stake, and that stake winds up being more valuable in three to five years than when they took it off the table initially. It all depends on how you can partner with the private equity firm to unlock that value.”

Tapping into transition expertise

While transitions may be common, almost 40% of businesses had little transition experience within the past five years.1 A private equity investment is one way to embrace business transition and make it a core capability. “With private equity, you’re taking on a partner and a boss. That’s a big move and one you should take seriously,” says Sanders. Choosing the right private equity partner can get you “transition-ready.”

Truist Wealth, works with advisors, consultants, and other service providers to help owners map their personal and business transition. Through its extensive work with private equity firms, we can support private equity-backed businesses in all transition matters. Preparation needs to begin at least two to three years in advance to put transitions to work building value for a business and its owners.

Private equity considerations

The risk profile of private equity investment is higher than that of other asset classes and is not suitable for all investors. There are inherent risks in investing in private equity companies, which encompass financial institutions or vehicles whose principal business is to invest in and lend capital to privately held companies. These risks include a long term investment horizon, rigid liquidity restraints, and high bankruptcy rates among portfolio companies. Generally, little public information exists for private and thinly traded companies and there is a risk that investors may not be able to make a fully informed investment decision.

Use business transitions to build value.

Talk to your relationship manager or Truist wealth advisor to learn more.