As a small business owner, your business and personal lives can become so intertwined that it’s hard to see a clear boundary. When it comes to your finances, it’s important to separate your business and personal affairs. Small business owners straddling business and personal concerns have unique risks that few others share.

Take these steps to help safeguard your personal finances by minimizing risk, identifying potential blind spots, and protecting your personal resources.

Keep your business and personal finances separate.

Segregate your transactions, accounts, and recordkeeping, and use tools designed specifically to help manage your business finances like:

- Business checking account, debit, or credit card – Make everyday transactions with business accounts instead of personal ones.

- Business savings or money market account (MMA) – Build a reserve of funds to meet your cash needs when they arise.

- Merchant services account – Accept and track cash coming in from credit card purchases.

- Payroll processing services — Reduce administrative burden and ensure prompt, accurate filing and payment of taxes.

- Business loan or line of credit – Use your business equity to grow your business instead of your personal assets.

- Business insurance – Make sure you’re properly insured with the right business insurance, such as liability, workers compensation, key person coverage, and cyberfraud insurance.

Make a plan to pay yourself and create ongoing business value.

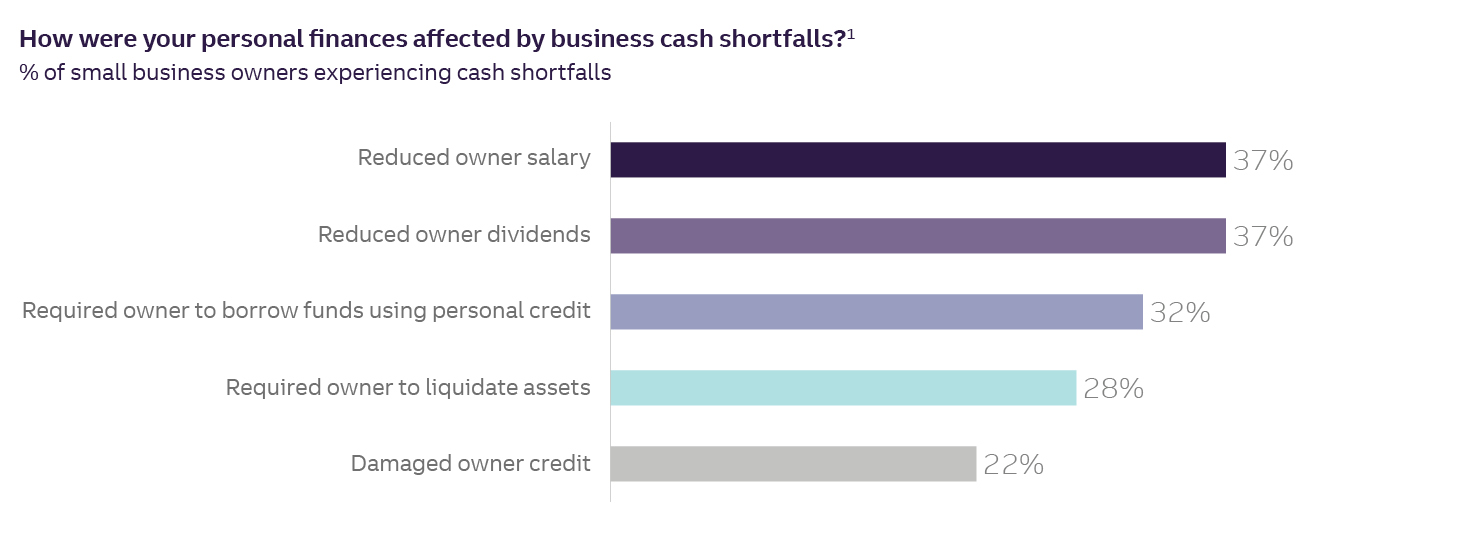

In Truist’s 2021 nationwide survey of small business owners, almost 40% of respondents reported taking a reduction in their salary or distributions when the business needed cash.Disclosure 1 Planning for those shortfalls with the help of outside experts like your CPA, attorney, banker, or business coach can help you avoid taking a financial hit.. They can also help you think objectively about your business plan, take advantage of hidden opportunities, and be more prepared to deal with any setbacks or slowdowns to minimize negative impact on your personal finances. Together, you can come up with a plan for:

- Owner compensation – Simply taking what’s leftover is not a compensation strategy, and it could create stress for you and your family. Creating a consistent payment plan for yourself will help you avoid stress on your personal finances.

- Distribution of profits – Your split between salary, bonus, and distribution affects your Social Security contributions (and could impact your future level of benefits). Many retirement plans base contribution requirements and limits on your salary. Consult with your CPA to set a salary that’s appropriate for you and your business and meets government regulations.

- Rental or lease of owner assets – Could you benefit from owning a property and then renting from yourself? Owning real estate can be a strong diversification strategy with the added benefit of ongoing revenue after leaving the business.

- Retirement planning and asset accumulation – Are you maximizing tax-advantaged accounts? Pausing your retirement contributions to cover business cash flow can leave you shorthanded when it comes time to move on from the business.

- Family member employment – Keep more revenue in the family by hiring relatives—just make sure your family doesn’t become too dependent on the business. Having sources of employment income not related to the business will diversify and protect family income.

- The value of your ownership interest in the company – The value of a small business can vary widely. Some businesses are dependent on the skill, expertise, or reputation of the owner, and no matter how profitable they may be, without the owner, they may have little value to a buyer. Others build a brand and business model that can be transferred to a buyer for some multiple of the cash they generate each year. Some are built to sell, with technology or products designed to attract an acquirer or private equity investor. Be clear on the sources of true value in your business model, including how others define its value, and plan to drive your growth accordingly.

- Know where your business fits and be realistic about its prospects – If you’ve got a “built to sell” business, you might choose to sacrifice compensation and distributions to build the business’s value so that you can be rewarded with an attractive sale of your ownership later. On the other hand, if you don’t have that kind of business, don’t delude yourself into thinking you do. Make sure you’re disciplined about receiving fair compensation and distributions along the way and saving for retirement.

Protect your personal finances.

Focus on protecting areas of your personal finances that are the most critical—and often the most vulnerable—for business owners. Examples include:

- Personal income – Actively manage your dependence on the business for the bulk of your personal income.

- Investments – A diversified investment portfolio helps you avoid concentration risk. As a small business owner, you have special risks, so be careful not to overinvest in the same industry as your business or its customers.

- Succession planning – Have a plan for management of the business once you’ve stepped back or moved on.

- Comprehensive financial planning – Look at your business and personal finances holistically to make sure you aren’t blindsided down the line.

While your business and personal finances will always be linked, taking steps like these ensures that you and your business will be effectively building towards a financially sound future.

Ready to secure your business and personal finances?

Ask your local branch leader how Truist can provide you with advice and solutions to help fund your business smartly, cost-effectively, and in a way that safeguards both your business and personal assets.