Inflation can erode business profits and reduce the value of your business. If you’re paying more for labor, supplies, rent, and utilities, you’ll need a strategic approach to pricing your products and services to combat the effects of inflation and protect your profits.

What is your pricing strategy?

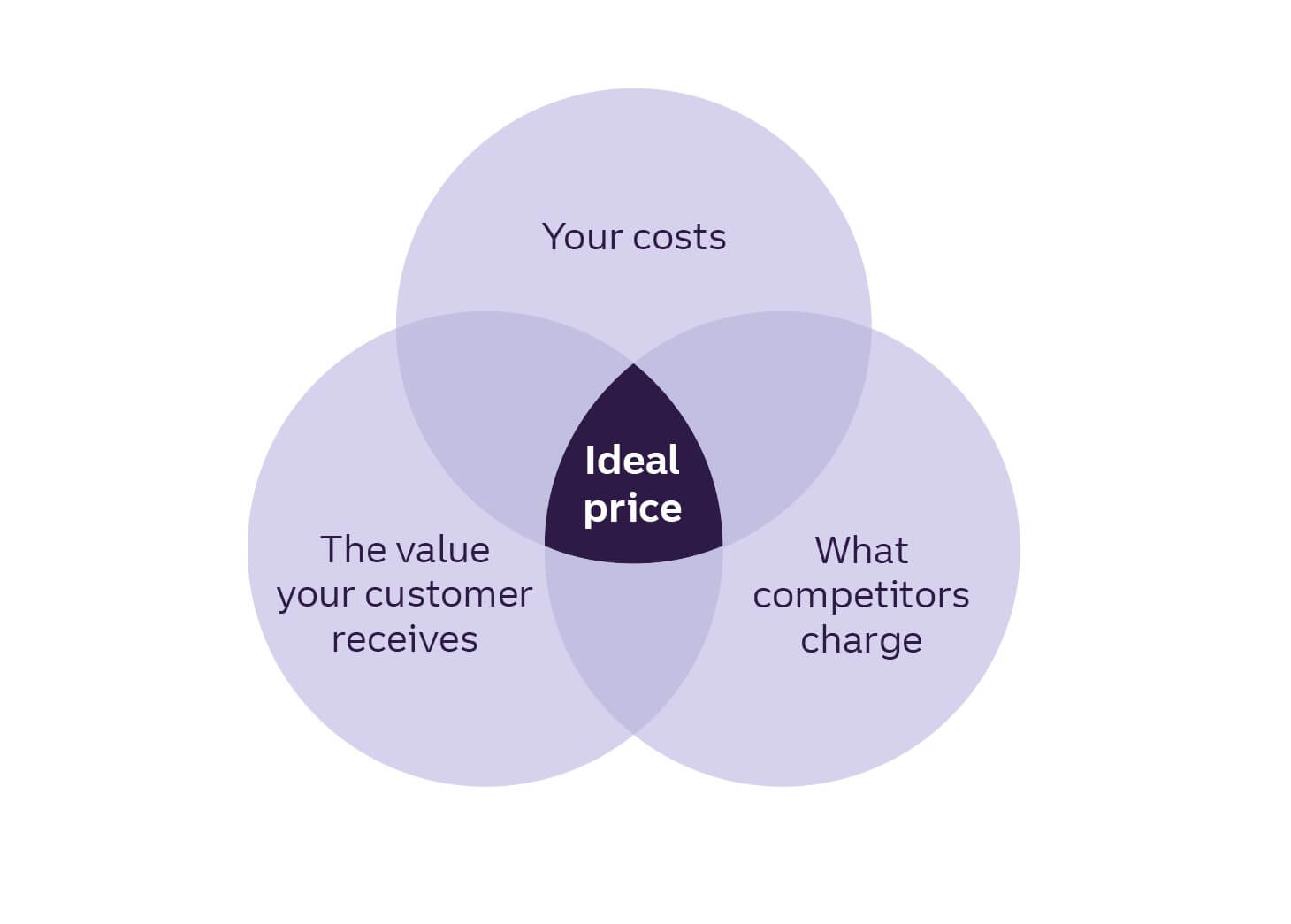

To find the ideal price for your products or services, consider your costs and what your competitors charge, along with what your customers value most.

Your ideal price considers:

Step 1: Your cost

Pricing is based on how much it costs you to deliver your product or service. Use actual costs as your floor for pricing to keep your business profitable.

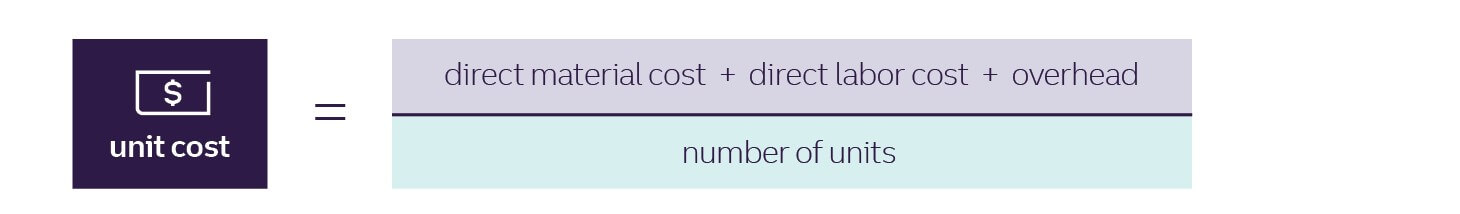

You want to understand your total cost per unit that you deliver, whether it’s a product or a service.

- Direct materials are the materials your small business uses each time it manufactures a product or delivers a service. Direct material costs are usually a sizable part of the cost to create each unit in a product-based business.

- Direct labor costs are the total costs for the workers that directly assemble or manufacture your products or deliver your services. These costs include wages, payroll taxes, pension contributions, and expenses for life, health, and worker’s compensation insurance. Direct labor costs are higher typically a major part of the costs in service-based businesses.

- Overhead costs are the costs that can’t directly attributed to a specific product or service. Examples include indirect materials, such as packing tape or printer ink, and indirect labor costs, such as the costs to employ a maintenance worker. Examples of other overhead costs are telephone expenses, rent, utilities, stationery, furniture, equipment, and software. Add together all the overhead costs you incurred during the month to find total overhead costs.

- Once you know your costs for a month or year of operation, you’ll add them together and then divide them by the number of units produced during the same period to get your total cost/unit. You should do this for each product or service you offer by allocating your overhead using the % of each product or service line.

- Some service businesses choose to sell their time by the hour. Calculate your unit costs using the right intervals (minutes, hours, days) that fit your business.

Step 2: What competitors charge

Now that you understand your costs, look at what a variety of competitors are charging:

- Direct competitors are businesses offering comparable products or services sold to similar customers. FedEx and UPS are direct competitors.

- Indirect competitors are businesses in the same industry that sell different solutions to solve the same customer problem. For example, in tax preparation, you can use Intuit’s TurboTax solutions to prepare returns yourself, you can go to a tax preparation business like H&R Block, or you can give your documentation to your CPA firm and let them handle it all.

- Replacement competitors are businesses in different industries that solve the same customer problem in a different way. If you want to drink filtered water, you can buy a Brita water filter to store in your refrigerator, or you can buy a built-in water filter at a home improvement store, or you can arrange a water delivery service.

Step 3: The value your customer receives

Look at the value your customer receives from your product or service. Unlike the cost and competitive approaches, you won’t be able to calculate an exact number for customer value. But trying to understand your value in the eyes of the customer allows you to get closer to charging what your product or service is worth to them.

The value received includes both direct, measurable benefits and more indirect, secondary ones as well. The mix of direct and indirect varies across industries and varies between products and services within them. The following questions can guide you through thinking about value.

Direct value

- Can you help your customer generate more revenue or get more money?

- Will you save your customer time or make them more efficient?

- Does your product protect the customer’s assets or reduce the risk of loss?

- Will you save the customer hassle (search costs, learning costs, switching costs)?

- Is your product less expensive or will it save them money in some way?

Indirect value

- Do you have an attractive brand or reputation that customers want to associate with?

- Is your investment in knowing your customers and building relationships a reason to do business with your company?

- Do you provide environmentally or ethically responsible solutions that connect with customers’ principles?

Step 4: Adjust your pricing

Now that you’ve looked at your costs, competition, and customers, you can find your ideal price. You can also seek out customers willing to pay more versus those that are price sensitive and adjust your marketing and sales tactics to target the most profitable segments.

Step 5: Communicate your pricing changes

While inflation has already led to price increases in many sectors, price makes a powerful statement to customers and is always a critical factor in purchase decisions. The standard for communication with your customers and potential customers about price changes could not be higher.

Should you communicate directly about pricing changes? Many businesses don’t—they simply adjust the price—and believe that it’s best not to focus customers’ attention on a price increase, particularly in an inflationary environment where price increases are common. Businesses built on customer relationships or partnerships or those with repeat customers who will recognize the price change should consider communicating more directly about the price increase. There are two basic steps to communicating pricing changes:

1. State a rationale. This should be clear, succinct, and with an underlying empathy for what it means for your customer. Keep it brief, avoid apologies or defensiveness, and acknowledge that it will allow you to continue to deliver the value your customers expect.

2. Make it about the value you deliver. Remind customers of the value you deliver and why they buy from you—that helps take the sting out of any pricing changes. As you talk about value, it can be more compelling to focus on the emotional value of what you do rather than restating features and functions of your offering. It never hurts to go beyond discussing the value and work on convincing customers to pay for what you bring.

While inflation may be today’s driver to evaluate pricing, a regular review of pricing from top to bottom can make sure you’re staying aligned with your customers and receiving a fair return for what you do.

How do I learn more about inflationary pricing?

To learn more about pricing during inflationary times, call a Small Business Banker at 877-279-3083, or schedule time for a local branch or virtual appointment.